Updated February 18, 2026

What’s Driving Growth, Innovation, and Industry Change This Year

Digital marketing has become a powerful force in the global economy. In 2024, global ad spend reached $1.1 trillion, with more than two-thirds of that total going to digital formats for the first time. That level of spending now accounts for about 1% of global GDP (and nearly 1.5% in the U.S.), highlighting the industry’s growing economic weight.

This article offers a full view of where digital marketing stands now and where it’s headed next. Drawing on new data from Clutch and trusted industry sources, it covers everything from AI’s growing impact to privacy regulations, platform consolidation, and global market trends. If you work in strategy, operations, or marketing leadership, this piece is designed to serve as a go-to reference point for planning in 2025 and beyond.

Looking for a Digital Marketing agency?

Compare our list of top Digital Marketing companies near you

The last few years have brought key shifts that have caused greater transformation than the digital marketing industry has seen in over a decade:

Together, these developments tell a story of an industry that’s leveling up, both in scale and sophistication. What follows is a detailed look at where we are now, what’s gaining traction, and how smart companies are planning for what’s next.

The digital marketing industry continues to evolve rapidly, driven by a combination of global economic pressure, platform innovation, and shifting audience behaviors. While much of the momentum began post-pandemic, the past few years have brought pivotal growth and structural change across the industry.

Here’s where the market stands today, including total valuation, key growth metrics, and how each segment of digital marketing is performing in 2025.

Digital marketing diversified, expanded, and outpaced expectations in several key areas. Depending on how you break it down, the global market was worth somewhere between $598.58 billion and $667 billion, a difference largely driven by whether adjacent advertising categories are included in the total.

As of 2025, total ad spend across both online and offline channels in the U.S. is $426 billion, reflecting a year-over-year increase of nearly 8%, or $30.9 billion. North America as a whole represented 39% of global digital marketing activity, fueled by both enterprise adoption and a robust ecosystem of platforms and tools. Programmatic formats captured 82% of total ad spend last year.

Growth projections remain strong, if varied. Analysts project a compound annual growth rate (CAGR) of over 9% through 2034, though some models, especially those focused on digital-first firms. Expect the industry to grow at a rate closer to 11% annually over the next eight years.

If we zoom in on specific channels, a few stand out:

Digital marketing in 2025 reflects both deep specialization and massive audience reach, with adoption patterns that vary widely between B2B and B2C sectors.

"B2B marketing requires a longer sales cycle, trust-building content, and account-based strategies. That’s why we focus on assets like whitepapers, blog series, case studies, and LinkedIn thought leadership, rather than B2C-style high-frequency content," said Lufti Aydeniz, CEO of fascinatid.

While both groups continue to invest heavily, the ways they engage, especially when it comes to content consumption and purchase decision-making, are diverging in meaningful ways.

Aydeniz continues, "for B2C clients, we emphasize emotion-driven storytelling, social commerce integration, and visual platforms like Instagram or YouTube to drive quick conversions."

Aydeniz also references that their company has continued expansion in AI-driven services due to the demand for educational content surrounding digital transformation topics.

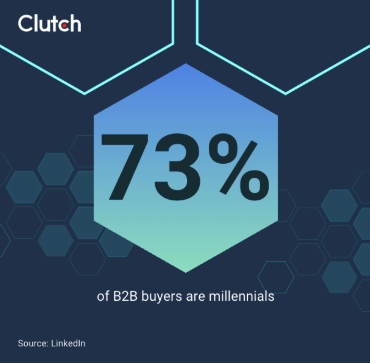

On the B2B side, millennials now make up the majority of decision-makers. In fact, 73% of B2B buyers are millennials, and they’re reshaping what a typical buying journey looks like.

These buyers tend to take in a lot of information before making a move. B2B content strategies in 2025 prioritize video and webinars, with short-form video like TikTok and Instagram reels delivering the highest ROI.

Lead generation strategies are also shifting. There’s a noticeable return to brand-led marketing: 38% of marketers now focus on shaping the customer experience around their brand identity, while another 28.78% are producing content that reflects their core values. Results are showing up across the funnel. In recent surveys, 74% of marketers said content marketing helped them generate leads, while 62% credited it with nurturing audiences, and nearly half said it led directly to sales or revenue.

B2C marketing, meanwhile, is being heavily shaped by digital behavior. In the U.S., social media penetration has reached 68%, with Gen Z leading growth across Meta-owned platforms. Content is going mobile-first, too: 69% of consumers say smartphones are their primary device for watching videos. On search, Google controls 94% of the global mobile market. And when it comes to product research, 82% of buyers use social platforms to help inform their decisions.

Globally, adoption trends reflect regional strengths. North America continues to lead in ad spend relative to GDP, with over 1% of total output going toward marketing. But other regions are growing quickly. In APAC, the Middle East, and Africa, over 1.2 billion people were online in 2023, many accessing the internet primarily through mobile. Latin America also shows strong momentum, with more than 450 million internet users and mobile usage exceeding 70% of the population. Brazil alone is on track to spend nearly $9 billion on digital ads by 2025.

The digital marketing ecosystem in 2025 is defined by two contrasting forces: market concentration at the top and fragmentation everywhere else. While major players continue to dominate in revenue and reach, smaller firms are either merging, repositioning, or carving out hyper-specific niches to compete.

Let’s start with the numbers. A handful of platforms account for the lion’s share of global ad revenue, and their lead is growing. By 2026:

Behind those headline figures lies a much more fluid landscape. In 2024, mergers and acquisitions (M&A) hit a five-year high across martech, ad tech, and digital content. According to eMarketer, the volume of deals reflects growing demand for full-service capabilities and data-rich platforms. Private equity firms have also stepped into the mix, driving what SI Partners calls a sustained acceleration in M&A heading into 2025.

Among strategic buyers, Accenture led the charge with 39 acquisitions in a single year — evidence of the firm’s commitment to building a full-stack marketing and tech service portfolio. But not everyone is scaling with ease. Large legacy agency groups like WPP are under pressure to match the integration success of Publicis Sapient.

If 2024 was a year of investment, 2025 is the year digital marketing gets more intelligent, more regulated, and more community-powered. Across industries, marketing teams are rethinking how they collect data, communicate value, and meet customers where they are, often with the help of increasingly sophisticated AI tools or creator-led commerce channels.

Here are the three defining trends shaping the landscape this year:

AI has officially moved past the experimental phase. What began with chatbots and basic automation has evolved into a marketing engine that learns, adapts, and acts in real time. 62% of companies now say AI has directly improved their customer experience, primarily through better personalization.

The broader AI marketing industry is also scaling quickly. It’s worth $47.32 billion in 2025 and is expected to grow at a staggering 37% CAGR, hitting $107.5 billion by 2028. Much of that growth is driven by advances in predictive analytics: tools that can deliver up to 30% more accurate personalization while respecting data privacy.

Nike, for example, used a real-time personalization strategy to boost e-commerce conversion rates by 35%, showcasing how AI can drive measurable results at scale.

Marketers are now deploying AI across nearly every stage of the funnel:

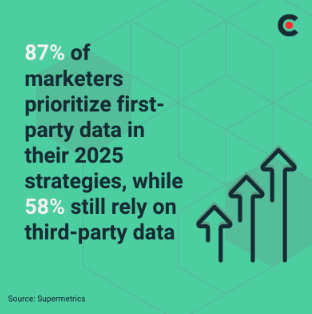

If AI is changing how brands operate, data privacy is reshaping what they’re allowed to do. With tightening privacy regulations like GDPR and the California Consumer Privacy Act, and the decline of third‑party cookies, brands are doubling down on collecting first‑party data (from owned channels) and zero‑party data, which refers to willingly provided customer preferences and insights. These strategies support more trustworthy, personalized marketing while respecting privacy boundaries.

In response, companies are making major shifts:

Privacy-first marketing in 2025 isn’t just about compliance—it’s also a strategic lever for ROI, retention, and consumer trust.

According to research from Forrester, incorporating first-party customer data has a positive impact on key metrics such as customer acquisition costs, customer satisfaction, brand awareness, conversion rates, and ROI.

"While Google continues to delay the full deprecation of third-party cookies, it still feels inevitable; especially as platforms like Firefox phased them out years ago. For us, the solution lies in converting third-party problems into first-party strategies, as that’s the only logical way forward," said Jack Oddy, Managing Director of Soap Media.

Beyond technical setup, their team also encourages clients to revisit the value of the first-party data they already have.

"We also don't have a budget reserved for privacy and data infrastructure. Instead, it’s embedded into how we work," said Foster.

Social media has become a full-fledged commerce platform, with creators serving as both influencers and transaction drivers. Brands that invest in these ecosystems are seeing big returns, especially in high-growth markets.

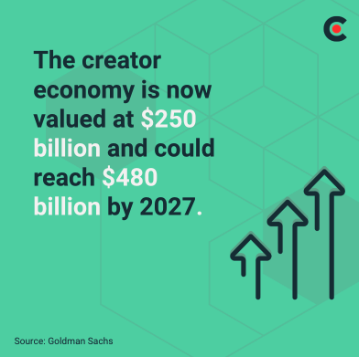

The creator economy is now valued at $250 billion and could reach $480 billion by 2027. Platforms like TikTok are leading the way, having posted a 200% increase in ad revenue in just the last year. As partnerships grow more sophisticated, brands are spending more on creators than ever. Why? Because it works. In the U.S., creator-led content outperforms traditional brand content in distinctiveness by a factor of 4.85x.

We’re also seeing social commerce evolve into richer, more immersive formats:

While digital marketing continues to scale, 2025 has brought a new set of headwinds. From shifting privacy laws to tightening budgets and talent shortages, marketing leaders are rethinking how to grow and how to stay operationally resilient. These are the three major marketing challenges most teams are navigating this year:

Data privacy regulations are getting sharper, and enforcement is following suit. In 2023, only 20% of large companies were using AI to support compliance. This year, that number has tripled to 60%, as brands race to keep up with GDPR and similar laws. It’s a challenge on both the legal and technical fronts. New rules now require companies to manage cookie consent, regulate direct marketing, and tighten digital security standards, often across multiple jurisdictions.

At the same time, antitrust scrutiny is increasing. Google currently controls nearly 90 % of the global search engine market, raising concerns around monopolistic behavior. Its recent $32 billion acquisition of Wiz has caught the attention of U.S. regulators and the Department of Justice, which is now reviewing the deal for potential antitrust violations.

Budget flexibility isn’t what it used to be. In 2024, marketing budgets for North American and European companies dipped to roughly 8% of total revenue, the lowest level recorded since 2021. That said, many brands still increased spend: between 2023 and 2024, digital marketing budgets grew at a 10% clip, reflecting a gap between top-line investment and margin pressures.

"...budgets are tighter, but demand hasn’t dropped, it’s just shifted. Clients are more focused on measurable channels: Google Ads, LinkedIn, SEO, email. Content and strategy still matter, but they have to tie directly to pipeline or conversion metrics," said Adam Yaeger, Founder & CEO of Llama Lead Gen

Outside the budget line, technical infrastructure is under strain. As Google phases out third-party cookies, marketers are being forced to rebuild their data ecosystems – a costly, time-intensive shift. Adding to the complexity, over half of marketing teams now rely on analytics and productivity tools before reaching $1 million in annual revenue, increasing their dependency on tech even at early stages of growth.

In 2025, the marketing industry is experiencing a pronounced skills gap that is affecting both strategic and tactical effectiveness. Over 60% of marketers report a deficiency in core marketing effectiveness skills—the highest of any category—indicating that many teams struggle to link marketing efforts to measurable business outcomes.

A critical area of concern is data and analytics, with 37% of brand-side marketers identifying this as the top individual skills gap. This shortfall not only hinders the ability to measure ROI but also undermines personalization, segmentation, and customer journey mapping. According to the American Marketing Association, the largest current competency gaps are in digital marketing, data and analytics, proving ROI and data privacy and compliance.

In parallel, the rapid evolution of AI and marketing technology (martech) is widening the divide. 43% of respondents in the AMA’s research agreed that Generative AI is the most important skill for the future.

"..AI is an assistant, not a replacement. Maybe 10–20% of our service delivery is AI-assisted at this point, especially in research, reporting, and early-stage creative," said Yaeger. "The ROI comes when we combine AI speed with strategic human oversight, especially for B2B SaaS clients where nuance matters."

This echoes Clutch’s research on the top roles in demand at large, which found that nearly half (48%) of companies say AI development and implementation roles will grow in the next two to three years, with digital marketing coming in second place at 27%.

Digital marketing is still in the middle of major changes. AI is coming in faster than a lot of teams can integrate, regulations are shifting across regions, and audience behaviors keep evolving. If 2024 felt like a sprint, 2025 and 2026 are shaping up to be the years teams catch their breath, retool, and build smarter.

Let’s talk numbers first. By 2026, the digital marketing market could hit $786.2 billion. AI is a huge part of that momentum. Around 75% of B2B leaders say they’re likely to bring generative AI into marketing. This is already reshaping how teams handle creative, testing, and campaign development.

Meanwhile, good old email is still going strong. It’s expected to hit $17.9 billion in revenue by 2027, with 4.73 billion users globally by 2026. The channel’s still valuable, especially as privacy concerns push people back toward owned media.

And then there’s the creator economy. It’s been around for a while, but now it’s being treated like a core growth strategy. Projections say it’ll grow to $480 billion by 2027, as brands lean more into partnerships, content licensing, and live social selling.

Inside marketing organizations, things are changing too. More teams are ditching piecemeal tools and adopting AI as part of broader workflows. These shifts are shaping hiring fast. Demand for marketers is expected to grow 8% through 2033, which is faster than average compared to most other roles, according to the Bureau of Labor Statistics.

The runway for digital marketing is long. Some reports say the industry will grow to $1.19 trillion by 2033, others suggest it’ll pass $1.44 trillion by 2034. Either way, it’s not slowing down.

Spending will follow suit. Total ad spend across formats is expected to top $800 billion by 2027. That includes paid search, programmatic, and social, all of which are still growing.

As privacy becomes a bigger differentiator, the Privacy-as-a-Service market is getting more attention. It’s projected to grow from $3.69 billion to $4.19 billion in a single year, which tells you where companies are putting their money.

And in terms of geography, it’s not just about the U.S. anymore. Central and Eastern Europe are becoming hotspots for mergers, tech partnerships, and service expansion. Lower costs and strong tech talent are making them attractive to global buyers.

There’s no shortage of advice floating around in 2025, but if you’re operating inside the digital marketing ecosystem, you’re likely looking for grounded direction. Whether you’re running a boutique agency, building marketing software, or leading a brand team, the pressure to adapt is real. Below are some practical starting points based on where the industry is going:

If you haven’t made AI part of your day-to-day operations yet, now’s the time to stop waiting. Nearly half of U.S. businesses say AI development roles will grow in strategic importance over the next two to three years, according to Clutch’s 2025 survey of 1,000 business decision-makers. That shift is already influencing hiring and outsourcing plans, with digital marketing ranking as the second-highest priority area after AI. Agencies that can integrate AI into client strategies, analytics, and creative workflows are better positioned to meet growing demand.

Privacy, too, is no longer something you delegate to the legal department. With stricter enforcement already happening in 2025 and regulators issuing high-profile fines, agencies should consider standing up teams or functions focused on privacy and data compliance. Clients will start asking for it, if they haven’t already.

And if you’ve been eyeing the market and thinking this could be a year for growth via partnership or acquisition? You’re not alone. Reports show that M&A activity is accelerating across marketing services, with more firms looking to merge capabilities or expand regionally. If there’s a strategic fit, this might be the window to explore it.

Data privacy has become a requirement, especially in tools that handle customer interactions, behavior, or analytics. The best place to start? Bake it in. “Privacy by Design,” as it’s called, means building protections into your product architecture from day one. It’s fast becoming a non-negotiable standard for software firms looking to stay competitive.

Third-party cookies are on their way out. If your team hasn’t started moving toward a first-party data strategy, this is the year to prioritize it. The shift means marketers will need to think more about user journeys, consent flows, and what kinds of value they’re offering in exchange for data.

And while AI may feel like a buzzword, it’s becoming a tool you can’t ignore. That doesn’t mean you need to overhaul your stack overnight. A good way to start is with pilot programs focused on real use cases, especially since half of B2B leaders are already using AI in some capacity. That’s not the future talking; that’s what’s happening right now.

This industry is always changing. Whether you're managing growth, trying to make sense of AI tools, or figuring out how to hit your next KPI without violating a dozen privacy laws, staying up to date isn’t optional.

What we’ve covered here is just a starting point. The big themes: automation, personalization, compliance, and creator-driven commerce, are going to keep evolving. The challenge is knowing when to pivot and when to double down.

If you're looking for expert support, Clutch can help. Browse top digital marketing agencies to find a partner that fits your goals and your pace.