Updated December 16, 2025

The rise of OTT ads on video streaming platforms offers a powerful way to reach target audiences. Explore how OTT advertising works and how to leverage data insights to launch effective campaigns.

Over the last few years, how people consume media content has shifted — more and more people are canceling their cable and DirectTV subscriptions in favor of streaming services.

This has created a bit of a challenge for advertisers who have, until recently, relied solely on broadcast advertising to deliver video ad content.

Looking for a Digital Marketing agency?

Compare our list of top Digital Marketing companies near you

Most, if not all, video streaming services have levels of ad-supported tiers. Because of this businesses are being more strategic about their ad placements. Clutch surveyed 453 consumers about their thoughts on advertising. 58% of consumers have seen or heard an ad on a video streaming service, which shows the increased investment businesses have in OTT ads and video streaming.

As a type of over-the-top (OTT) advertising, here’s a rundown of what you need to know to advertise on streaming services.

Unsure where to start on your OTT advertising campaign? Search top OTT advertising companies on Clutch.

Table of Contents

Unlike traditional broadcast programs, which rely on transmission through a satellite or cable provider, Over the Top (OTT) content is media that is delivered via the internet.

Audiences are able to watch OTT content through a range of devices or platforms such as mobile apps, laptops, gaming consoles, tablets, or connected TVs (CTVs) — basically, anything that can connect to the internet can be used to stream OTT content.

While OTT content includes everything that can be streamed online — from music and podcasts to video games and films — one of the most popular types of OTT content is a subscription video on demand (SVoD). This can include subscription-based streaming services such as Netflix, Disney+, and Amazon Prime.

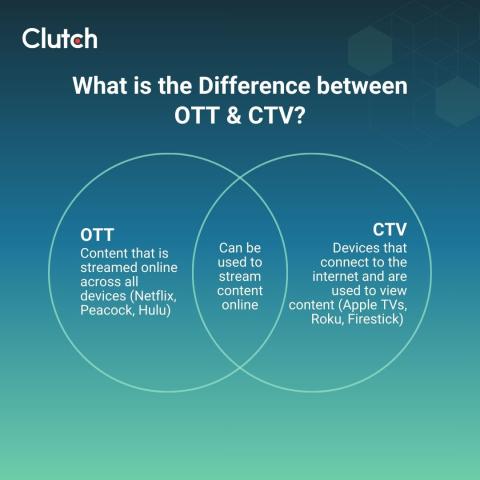

Over-the-Top (OTT) and connected TV (CTV) are often used interchangeably, but they’re actually different. Still, they’re closely related. OTT is the delivery mechanism for video content, while CTV is the device that is used to view the content.

OTT is video content that is streamed by users via the internet. As such, content can be delivered through PCs, mobile devices, and streaming platforms such as Hulu, Prime Video, or Sling.

CTV, on the other hand, refers to devices — such as televisions — that connect with the internet. This can refer to Smart TVs, Roku, Apple TV, or Fire TV.

Interested in connected TV advertising? Check out CTV ad companies on Clutch.

| Benefits | Challenges |

|

|

In 2022, streaming beat out cable television viewing for the first time ever as cable viewership fell 8.9%. Since then, there has been about a 22% YoY.

While increasing cable prices may be contributing to this shift, hit series such as Love is Blind, The Pitt, Wednesday, and The English Teacher are a big part of the reason why many consumers are sticking with their streaming service. The only way to access top content is by subscribing.

This shift poses an opportunity for many brands looking to reach their audience through streaming content. As more people switch to streaming and cancel their cable or DirectTV services, advertisers will need to shift their strategy.

Streaming also is available on more than one platform — while traditional broadcast television is only accessible on a TV, streaming services can be viewed on mobile devices, tablets, desktops, laptops, and CTVs.

While the COVID-19 pandemic increased overall media consumption, the use of digital media in particular skyrocketed. The average amount of time spent on mobile devices in 2025 is a little over 4.5 hours a day.

CTV devices also account for over half of digital video in the US.

Trends suggest that digital video is becoming more and more important to consumers. As such, advertisers need to create ad content to reach audiences on these platforms.

Programmatic ad platforms like LiveRamp, BlueKai, and Experian allow advertisers to target very specific audiences. By limiting who their ads are served to, they are able to cut their ad spend and increase their conversion rate, resulting in a higher return on investment (ROI).

So how specific can you get with your audience targeting?

Chris Tinkham, Media Director at DeVito/Verdi Advertising, says that because streaming relies on the internet to deliver content, targeting can be very niche. Similar to how digital advertisers use consumer data to create banner ads on websites, advertisers can target users based on user profiles, what they buy, what they do online, and their demographic information.

“For example, you can isolate women [ages] 25—54 in households with $100,000+ in income, [and] who are mothers in a ten-county area,” Tinkham explained. As a result, advertisers only have to pay for an impression in that specific household.

While they aren’t able to choose which program their ad will play on, they are able to narrow it down. Tinkham says that they are able to choose what type of content the ad will air on and eliminate certain times of day to maximize the impact of their ads, claiming, “I could [place ads on] all news programming, all sports programs, or all home improvement programs.”

Combined with demographic targeting, these strategies let advertisers get in front of the right audiences at the right time.

Additional resource: Looking for more insight into OTT viewers? Check out new data on streaming from Hulu.

There’s one major problem with advertising on streaming services: for a slightly higher monthly fee, subscribers are able to access all of the same content without pesky ads. Our data also shows that if they can, 55% of consumers will skip an ad.

While the multi-tiered format is great for audiences, it makes it harder for advertisers to reach certain demographics.

Higher-income families (making more than $125,000 annually) in particular are more likely to spend a few extra bucks to stream uninterrupted content. This poses a challenge for advertisers who are trying to target more affluent audiences.

In a recent article for The Marketing Brew, Eric Schmitt, research director and analyst on the Gartner for Marketing, explained this conundrum, “Advertisers want to sell products to them because they have the money to buy the products and services.” He continued, “Well, those are the very same households that are buying out of advertising.”

Thus, high-end and luxury brands such as Lexus, Dior, and even Apple, may not get the return they’re looking for on OTT ads. Without an audience that has the means to pay for luxury items, advertising on streaming services may not be the best approach for high-end brands.

How many streaming services do you subscribe to?

According to The Streamable, 38% of adults pay for 5 or more streaming services.

As more and more companies announce the launch of their own streaming services, the market is becoming oversaturated.

Right now, consumers divide their viewing time between streaming services, cable television, and Direct TV. Frustrated with the inability to watch all content, some consumers are even canceling their subscription services; Netflix, for example, launched an ad-supported tier in order to curb losses after several quarters of declining subscription numbers.

With so many content options available, each service must vie for audience attention.

For advertisers, this means that they’re limited in their reach.

Consider this: if you have 5 streaming platforms and cable, how much time are you spending watching any one streaming service? Do you watch each one every night?

Of course not.

Consequently, companies must advertise on several different channels to reach consumers.

Rather than focusing solely on advertising on streaming platforms, companies should also be advertising on cable networks, online, and on social media to optimize their campaigns.

Although DSP and SSP platforms allow advertisers to target audiences based on their location, they still may not be the best option for small, local businesses.

Scott Ryan, the owner of the media and advertising company TVIQ, estimates that most companies spend at least $50,000 on major streamers. On these platforms, CPMs can easily be $50-$75.

With such high CPMs, OTT can be less cost-effective than cable TV.

Ryan also explained why OTT simply won’t work for small businesses saying that “[S]mall advertisers need quick ROI on small budgets. With a CPM-based pricing model and limited supply, [it] just doesn't offer the scale needed to keep costs in line with ROI.”

Thanks to the popularity of streaming platforms, the cost to advertise on them has gradually increased over the last few years. For example, NBCUniversal started letting local advertisers access Peacock and YouTube in late 2020, ad prices on Peacock exceeded NBC primetime by the end of Q1 in 2021.

However, the biggest barrier to entry for small companies is the cost to produce an OTT commercial; they may have to incur additional costs in order to produce high-quality ad content.

Many cable companies provide in-house production services for smaller companies. If they agree to spend a certain amount with them on advertising, they will help create a low-cost commercial.

In contrast, if a small business wants to advertise on a streaming platform, it will need to hire a video production company that is able to create a concept, outline a script, film, produce, and edit a 15-30 second commercial. Depending on the quality of the ad content, this can cost between $2,000–$50,000.

How the market is currently structured, many small businesses simply can’t afford to advertise on popular streaming platforms. However, there are other options for small businesses looking to reach local audiences.

Danni Winter, the performance marketing director at Noble Studios argues that other advertising strategies might be more effective: “[P]rogrammatic sources like StackAdapt or The Trade Desk, can offer localized solutions. Additionally, Google and Bing ad placements, as well as social media advertising through Meta or TikTok can provide alternative channels to reach local audiences on a CPM basis.”

If advertising on a popular streaming platform is out of budget, companies should look at alternative channels such as traditional advertising, social media, or PPC.

OTT ads generally run between $20‑$60 CPM, depending on platform, targeting, and format. On Hulu, typical CPMs are now closer to $20‑$40, with premium inventory sometimes pushing higher.

Price range depends on a variety of factors, however. According to Tinkham, the biggest factor that influence the cost of an OTT ad is geography, followed by the amount of time a company wants to advertise in that specific marketplace, as well as who they’re targeting.

What Influences The Cost of OTT Advertising?

Tinkham explained, “If you’re targeting a county within Kansas versus the New York DMA . . . the cost could be significantly different just because the size and the number of people in those areas are significantly different.”

To estimate how much an OTT ad would cost, a company should estimate how big an audience is within the geographic area they want to advertise in. Then, companies can multiply the cost per thousand impressions (CPM) to estimate a budget.

Companies looking to buy ad space on streaming platforms often work with media buying and planning agencies that are familiar with the streaming landscape.

Consulting with data providers that have built user profiles, they’re able to create a strategy to target specific audiences more effectively. Then these agencies work with either demand or supply side platforms to buy available ad inventory.

A demand-side platform (DSP) is software that allows advertisers to search for and purchase available ad inventory, whereas a supply-side platform is used by publishers to automate the sale of advertising space. However, both are a type of programmatic advertising.

What are Programmatic Ads?

Programmatic advertising utilizes automation technology to help companies target specific customers. Using data and custom algorithms, automation platforms let companies choose the demographics they want to target.

Through these platforms, advertisers go through a real-time bidding process (RTB) to purchase ad space.

Unfortunately, advertisers aren’t usually able to choose which platform that ad will be served on because they can’t see the price that the DSP or SSP is negotiating.

Instead, advertisers choose the demographics they want to target and the platform uses an algorithm to place them. Once the ad is served to viewers on the streaming platform, advertisers are able to monitor the impressions each ad earns and on which platforms the ad aired.

While most media ad buyers work with a DSP or SSP, some ads must be purchased directly from the publisher. This happens when a company wants to advertise on a platform that doesn't sell ad inventory through a DSP or SSP. For example, if a company wants to advertise on Hulu, it must work with Hulu Direct.

In order to start an ad campaign on a specific streaming service, you will need to know their individual process.

Here is what you need to know to advertise on 5 popular streaming platforms.

Disney launched an ad‑supported version of Disney+ in late 2022, and by 2025 they have solidified its role in their streaming portfolio.

For companies aiming to reach families, the chance to advertise alongside beloved brands like Marvel, Star Wars, Pixar (and National Geographic, etc.) continues to offer strong appeal. Disney has leaned into that, promoting its high‑value content in its ad‑supported tiers.

Though Disney+ is newer to advertising than Hulu or ESPN+, Disney’s experience with those services gives them a well‑worn playbook.

Learn more about Disney Plus Ads here.

Disney owns Hulu, so traditionally advertisers would work through Disney Advertising Sales to plan and execute OTT campaigns across Hulu’s inventory.

In recent years, Disney has expanded into self-service advertising for Hulu via Hulu Ad Manager (which is now integrated into Disney Campaign Manager). Advertisers can use this platform to launch, manage, and track streaming TV ad campaigns with a minimum budget of $500.

This self-serve tool is designed to broaden access for smaller brands and agencies. Disney continues to roll out features and is allowing more small and midsize agencies to use it in pilot phases.

Whether this self-service model will fully scale to support very large brands at premium inventory levels remains to be seen — large campaigns may still require going through managed service or bespoke deals via Disney’s traditional ad sales channels.

Netflix officially launched its ad-supported tier in November 2022 and has since been evolving its advertising ecosystem. In July 2023, Netflix announced a strategic partnership with Microsoft, naming them as their exclusive advertising technology and sales partner.

As a result, advertisers looking to buy ad space on Netflix now do so through Microsoft’s demand-side platform (DSP) integrated into the Microsoft Advertising ecosystem. This centralized platform streamlines access to Netflix’s ad inventory.

While the full details and capabilities of Netflix’s programmatic ad platform continue to unfold, advertisers are encouraged to stay agile as Netflix aims to refine its advertising model. The company has emphasized its goal to create a “better-than-linear-TV advertisement model” that delivers more seamless, relevant, and effective ads for viewers and advertisers alike.

Learn more about Netflix Ads here.

To advertise on Peacock, advertisers must buy ad space directly from the publisher. In 2024, NBCUniversal launched a self-serve ad buying platform called Peacock Ad Manager, combining the scale of its older audience management platform (Peacock AX) with more targeting features.

On this platform, advertisers are able to enter their budget, choose their target audience, outline KPIs, and upload creative content. The platform supports various ad formats including standard video ads, interactive units, and addressable TV spots, reflecting Peacock’s growing focus on delivering highly targeted, measurable advertising solutions.

Paramount+ is another platform that must be bought directly from the publisher. Their EyeQ suite provides streaming and creative ad solutions for advertisers across many of their brands, such as Pluto TV, Paramount +, and Telefe.

Paramount boasts that EyeQ gives advertisers more control over their ad campaigns by allowing them to buy based on genre or demographics, which they call bundling. For example, advertisers can select the EyeQ Latino bundle, which allows advertisers to create ad content on Paramount’s Spanish content.

The platform also supports advanced measurement tools and addressable ad options, helping advertisers optimize campaigns for engagement and ROI in an increasingly fragmented OTT landscape.

While advertising on streaming platforms is very similar to other forms of advertising, there are a few things that differentiate it.

Here are a few tips that can help advertisers create engaging and persuasive OTT ads.

Thanks to demand-side platforms that allow advertisers to select audiences they want to reach, OTT advertising makes it easy to target specific audiences. However, in order to do so, they need to have a solid understanding of who their customers are.

There are a few ways companies can gather information such as their preferences, demographics, and motivations. This includes:

By collecting consumer data, companies are able to maximize the impact of their ads. With a better understanding of their customers, they can limit the impressions they’re paying for and increase their ROI.

Additionally, they are able to create more personal and persuasive ad content to make their ads more effective.

OTT ads appear on Connected TV (CTV) devices, smartphones, tablets, and online video ads.

While the scale of a video ad content may not seem like a big deal, the differences in screen size and orientation can impact how well viewers are able to see details in the video. For example, text that can be read on a CTV, may not be easy to see on a mobile device.

To make sure their ads are effective, companies should create ads that follow sizing best practices for each device. Additionally, they should include close-ups and larger text to ensure visibility. CTAs and other proposition items should be visible on all screen types.

Each streaming service offers various guidelines for advertisers. These guidelines include everything from the dimensions of the video and file size to audio assets.

It’s important that advertisers follow these specifications so they can be aired. Otherwise, they may need to spend more time filming, producing, and editing their ad content even after they’re done.

For example, this is a copy of Paramount’s ad guidelines for their paused ad format that includes a QR code.

In addition, to file size and format, Paramount added creative outlines such as no background color palettes to ensure QR codes can be scanned by viewers.

By adhering to these instructions, advertisers ensure their content can be distributed without issues.

Need inspiration for your OTT ad campaign? Check out these OTT ad examples.

Tresemme took advantage of Parmount+ new paused ad format. When a viewer pauses their video content, a single ad shows up. It features the product, brand name, call to action and QR code.

Users can then scan the QR code using their smartphone’s camera to access a landing page where they can buy the product.

This format is particularly effective because it doesn’t disrupt video content. This creates a more seamless experience that viewers appreciate. In fact, non-disruptive ads increased brand awareness by 24% and ad recall by 25%.

Additionally, it reaches viewers at the right time — right when they end or right before resuming a video. This helps recall and makes viewers more likely to engage with the ad.

Hulu provides another ad format that doesn’t disturb viewers’ watching time. When viewers watch more than three episodes in a row on Hulu, they can watch an ad-free episode sponsored by a brand.

When they sponsor an episode, the brand’s ad is featured before the show starts. Maker’s Mark took advantage of this offering and created its own video ad for OTT streaming.

In their Maker’s Moment campaign, they featured a young woman heading to her father’s apartment. Together, they have a glass of whiskey to commemorate the otherwise casual moment.

MUD\WTR, a natural coffee alternative, advertises on YouTube. Their ads appear before popular YouTube content and during ad breaks.

In their OTT video, the founder of MUD\WTR talks about why he switched from drinking coffee to natural tea. Then he talks about how he got it off the ground and why their drinkers are switching.

How people consume media is constantly changing. In response, advertisers have to evolve and create new strategies to reach consumers.

Recent news that leading streaming services (Netflix and Disney+) are launching ad-supported tiers has made many advertisers excited about OTT advertising. This news provides an opportunity for brands looking to connect with audiences online.

At this point, OTT advertising helps top brands expand their reach and target niche audiences. However, the expense of launching an ad campaign on popular platforms bars many small businesses from participating.

Still, self-serve platforms and targeted campaigns can help companies stick to their budget. With proper guidance from OTT experts, many will still be able to create effective OTT ad campaigns.

| Ad-Based Video On Demand (AVOD) | Ad-supported video content is available whenever a viewer wants it. |

| Ad-Supported Content | Video content with periodical ads, similar to how traditional broadcast advertisers would make money. This is often a more affordable way for viewers to access the content. |

| Advanced TV | A broad term to refer to technological advancements in television and video streaming |

| Connected TV (CTV) | CTV refers to smart televisions or televisions that connect with the internet. This can refer to Roku, Apple TV, or Fire TV. |

| CPM | Cost per one thousand views. |

| Demand Side Platform (DSP) | Software that allows advertisers to search for and purchase available ad inventory |

| Linear Advertising | An advertising system in which marketers pay for a time slot for their ad to air. |

| Linear TV | A traditional system in which a viewer watches a scheduled TV program when it is broadcasted. |

| Online video (OLV) ads | Ads that air before, during, and after online video content. |

| Over-The-Top (OTT) | Media delivered via the internet. Audiences are able to watch OTT content through a range of devices or platforms such as mobile apps, laptops, gaming consoles, tablets, or connected TVs (CTVs) — basically, anything that can connect to the internet can be used to stream OTT content. |

| Premium Video On Demand (PVOD) | Certain video content offered at a higher price point or for an additional cost. |

| Programmatic advertising | The use of workflow automation technology and machine learning to buy or sell ads. This type of technology allows advertisers to set parameters to deliver the most effective ads to their target audiences. |

| Publishers | The website or platform that the ad is delivered to the audience on. For example, Hulu. |

| Self-Serve Advertising | Usually a platform that allows advertisers to define criteria for an ad campaign and purchase ad space. |

| Subscription Video on Demand (SVOD) | Video content that is accessible to viewers who subscribe to that service. You may be familiar with SVOD as streaming services. |

| Supply Side Platform (SSP) | Software that publishers use to automate the sale of advertising space. |

| Transactional Video On Demand (TVOD) | Content is purchased through a pay-per-view model |

| TV Everywhere (TVE) | TVE allows consumers to access content anywhere using login credentials |

| Video On Demand (VOD) | Video content that is accessible whenever the viewer wants it. |

Read more about advertising strategies and how brands can combat ad fatigue in our latest survey report.