Updated November 20, 2025

Generative Engine Optimization (GEO) and AI-powered targeting dominate marketing headlines in 2025. Teams are drawn to the promise of new reach and efficiency, but the reality is more restrained, with flat budgets forcing leaders to balance emerging tactics with proven mainstays like SEO, PPC, brand search, and retargeting.

Clutch surveyed 600 marketing professionals to find out how that balance is shifting. GEO marketing investment is gaining on traditional search marketing, with 63% planning to increase GEO investment over the next year. That growth comes at a time when overall marketing budgets are holding steady at about 7.7% of company revenue, according to Gartner’s 2025 CMO Survey, and paid media already accounts for nearly a third of the total. Within those limits, dollars often flow first to performance anchors, leaving GEO to compete for incremental spend.

Three patterns stand out in the data:

Looking for a Digital Marketing agency?

Compare our list of top Digital Marketing companies near you

For the first time, the percent of companies investing in GEO is keeping pace with traditional search.

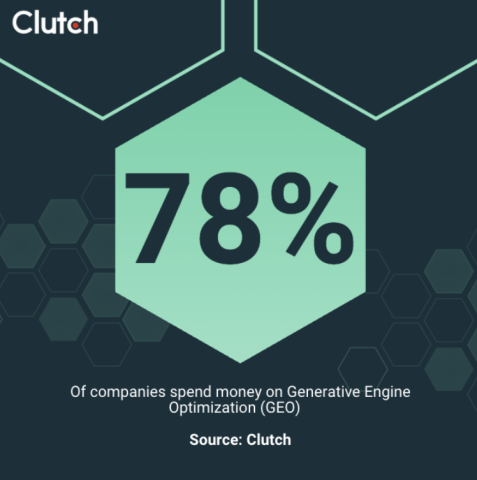

Out of those surveyed, 78% reported funding GEO programs. That figure is nearly identical (77.5%) to those that continue to put money into SEO and PPC. The alignment marks a turning point, showing that GEO has shifted from an experiment to a core part of the marketing toolkit.

“Real estate on Google keeps shrinking, AI overviews siphon clicks, and users hop between search, social, and communities before they decide anything,” said Kamron Yazdani, COO of theKOLLAB.

Spending patterns suggest most companies are testing GEO cautiously, though a committed segment is putting real money behind it. Current monthly allocations break down as follows:

This parity signals that GEO is no longer on the fringe. Marketers are carving out meaningful budgets, placing them alongside SEO and PPC as an established channel rather than a side experiment. This sets the stage for what comes next: how fast those budgets are growing.

Adoption is only part of the story. What stands out in the data is how aggressively marketers expect to focus on GEO in the year ahead. Nearly two-thirds of respondents (63%) say they’ll increase focus on AIO in the next 12 months, including 26% who anticipate significant increases and 37% who expect more moderate growth. That momentum suggests GEO isn’t just holding parity with SEO and PPC — it’s on track to expand well beyond it.

The breakdown shows how expectations vary across the market. 22% of companies plan to keep focus steady, 7% expect to scale back, and 8% remain undecided. With far more marketers planning increases than decreases, GEO is gaining traction as a strategic line item rather than an experimental add-on.

“Truthfully, we’ll probably answer all of this differently in even as little as three months. With AI Mode now live in Google, and rumours it could become the primary destination for searches, we’ll keep flexing our mix based on the signals that matter,” said Jack Oddy, Managing Director of Soap Media.

These growth plans come as most companies already dedicate a substantial share of their budgets to search. More than half (56%) allocate between 10% and 40% of total marketing spend to SEO and PPC. GEO is rising against that backdrop, competing for dollars in portfolios that are already heavily weighted toward search.

Marketers highlight GEO in strategy decks, but AI-driven efficiencies in creative testing and bidding are still absorbing much of the incremental budget. This helps explain why GEO is climbing, yet often supplements SEO and PPC rather than replacing them outright.

Multi-location businesses and service-area brands see GEO as a way to capture visibility in AI-powered search overviews, where traditional paid placements don’t always appear. This is critical in a search landscape shifting toward immediate answers.

For retail and direct-response campaigns, AI bidding in Shopping and retargeting channels already delivers efficiency gains, leaving less room for incremental GEO dollars. That balancing act becomes even more complicated when you look at how divided marketers are on the future of SEO itself.

The survey shows there’s no agreement on what AI means for SEO. 43% of marketing professionals believe SEO is still important but losing ground, while 33% say it’s more important than ever. That divide reflects a market in flux and helps explain why many companies are experimenting with GEO alongside traditional search.

The rest of the responses highlight just how unsettled the picture remains. 16% think SEO is becoming notably less relevant, and 9% say it’s no longer a significant focus at all. With the industry lacking a clear consensus, some are leaning harder into organic search, others are pulling back, and many are trying to strike a balance with AI.

This split, with no clear dominant position, shows that marketers haven’t agreed on AI’s impact on SEO.

“We look for leading indicators that the channel is creating success for us or a client. For example, we have been receiving many qualified leads from ChatGPT this year. This was a leading indicator that we as an agency should be investing more time and money in GEO,” said Jacqueline Basulto, CEO of SeedX.

That lack of alignment may be fueling GEO’s rapid rise, as companies spread their bets across both established and emerging search strategies.

How marketers define success in search varies widely, and that inconsistency makes it harder to judge GEO’s value. Among the companies that run SEO or PPC, website traffic is the most common metric, cited by about 37%. Close behind, 32% use revenue or sales attribution, and 27% focus on lead generation. Others look at brand awareness (23%), while nearly one in ten admit they don’t measure results at all.

Benchmarks from WordStream’s 2025 Google Ads report help put these gaps into context. Across more than 16,000 campaigns, the average click-through rate (CTR) was 6.66% and the average cost per click (CPC) reached $5.26. Conversion rates averaged 7.52%, while the typical cost per lead (CPL) came in at $70.11 — a 5% increase year over year, far less dramatic than the 25% jump seen in 2024.

Those rising CPC and CPL figures highlight why the split in success metrics matters. Teams that measure traffic may look at GEO as a relatively safe way to capture additional volume, especially as CTRs improve in certain categories. But companies that track ROI through revenue or CPL are more cautious, since rising CPCs can erode margins quickly.

For context, 56% of survey respondents already dedicate 10-40% of their marketing budgets to SEO and PPC. GEO spending is still modest against these anchors, but momentum is building — and how success is defined will determine how fast those budgets scale.

More marketers track traffic than revenue, which creates a disconnect between activity and impact. Until companies align their metrics with business goals, GEO’s role in the search portfolio will be harder to evaluate and harder to defend when budgets tighten.

Taken together, the findings show a turning point for search marketing. In this survey, 78% of companies reported funding GEO programs, slightly more than the 77.5% investing in SEO and PPC. That balance marks a shift: what was once an experiment is now a fixture.

“[AI is] changing everything — online content is more important than ever, because AI tools search the web for authoritative information to provide to users looking for answers to specific needs,” said Eric Elkins, CEO of WideFoc.us.

And with 63% of marketers planning to raise GEO budgets in the next year, the momentum is hard to ignore.

Several dynamics will shape what happens next:

The key takeaway: adoption parity and clear growth intent show GEO has moved well past the test phase. It’s becoming part of core planning for marketing teams of all sizes.

Marketing leaders should weigh their own GEO budgets against SEO and PPC and decide which measurement approach best connects search activity to business outcomes. That step will be essential as the industry adjusts to this new balance of old and new search tactics.

Percentages for general marketing opinions (for example, SEO sentiment and GEO growth expectations) reflect the full sample of 600 respondents. Search-specific metrics are based on the 465 companies actively engaged in SEO or PPC.