Updated January 29, 2026

Consumers are turning to wearable technology for a clearer picture of their health and wellness, using real-time data to guide everyday decisions. But as these devices collect increasingly personal information, questions about how that data is stored, shared, and protected are becoming just as important as the insights themselves.

A new year often comes with new goals, and for many, that means taking their health and fitness more seriously.

From smartwatches to Oura Rings, people increasingly rely on connected devices to better understand their daily habits and health. Wearable tech has become increasingly popular, with 71% of consumers possessing some form of wearable tech.

Looking for a Mobile App Development agency?

Compare our list of top Mobile App Development companies near you

Health and fitness is driving adoption, but as these devices collect more personal data, privacy and security concerns are growing. Users want devices that not only provide accurate insights but also protect their sensitive information and give them control over how it’s used.

We surveyed 379 wearable technology users to find out what they’re looking for when they buy new wearable technology, what features appeal to them, and how they feel about the security of their data.

Search for wearable app developers on Clutch.

Unsurprisingly, the majority (67%) of consumers who have wearable tech use it to monitor their fitness, activity, and health data. 21% have wearables for convenient features like notifications, 5% use them for safety features, and 3% use them for fashion.

Products like Apple Watches, Garmin watches, the Oura Ring, and other fitness trackers have been marketed as a great way to track diet, sleep, and exercise. They provide continuous, real-time data that provide insight to users’ lifestyle choices and habits.

This appeals to consumers because wearables make it easy to track health in ways that fit everyday life, from counting steps to monitoring chronic conditions and spotting unusual changes. The data helps users measure progress toward goals like weight loss or endurance training while keeping an eye on potential health concerns.

By turning daily habits such as movement, sleep, and recovery into clear insights, wearables support healthier routines and more informed decisions that improve overall well-being over time, but only if they’re consistent. That’s why 69% of respondents report wearing their devices every day.

Wellness features naturally encourage daily use, since tracking things like activity, sleep, and stress works best when the device is worn regularly. Over time, wearables feel less like optional gadgets and more like everyday tools people rely on.

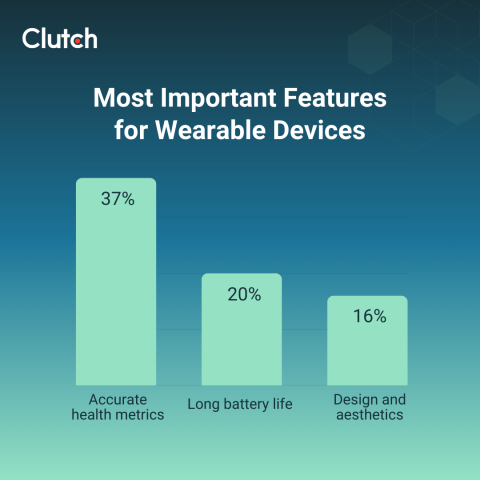

Consumers care most about the accuracy of their health data (37%), followed by their battery life (20%), and design (16%).

This trend is expected, given that consumers initially adopted wearable tech to monitor their health and fitness and now use those insights to guide decisions about their bodies. Inaccurate information would make the purpose of buying and wearing this technology irrelevant.

With consumers wearing these tools daily — and often when they sleep to track their sleep quality and sleep cycle — battery life is also an important factor. They don’t want to lose valuable data, whether that’s how much of their time asleep they spent in REM or their pace on a long run.

While new features may be interesting, users rely on consistent, trustworthy metrics to track trends over time, manage conditions, and spot meaningful changes, making reliability far more valuable than flashy additions.

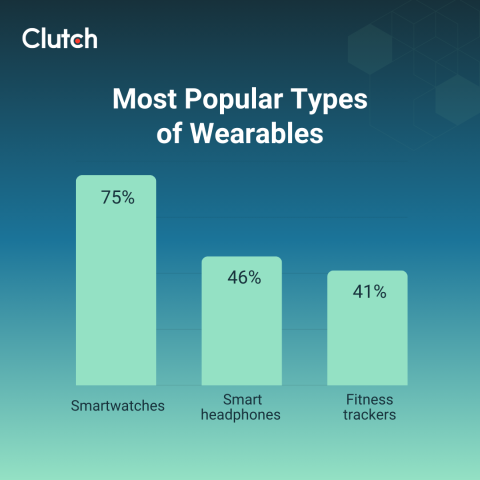

The most popular types of wearable technology are smartwatches, with 75% of users reporting that they own and use one. In comparison, only 46% of people who use wearables report using smart headphones and 41% use fitness trackers.

Smartwatches are so popular because they serve several different purposes. Beyond tracking health metrics, smartwatches can be used to tell time, receive notifications for calls, text, and apps, and even be used to make payments.

While these aren’t the driving reason for people to buy wearable technology, they are popular app features. Over a third (38%) of users report that they use notifications features regularly, more than any other feature that isn’t directly related to health and fitness.

Other wearables often excel in one area, like monitoring heart rate or counting steps, but users might feel that they have limited uses outside of their intended purpose.

Ultimately, smartwatches are designed to fit into daily routines. Screens provide real-time information like live workout stats and health insights, integrations with other apps make them super convenient to use, and they’re designed for all-day wear, making them the favored wearable device for nearly all users.

Since consumers wearing their devices nearly every day, wearable tech companies are collecting tons of data, including sensitive health data, making many users uneasy.

Three-quarters (74%) of consumers are concerned about the security and privacy of the data their wearable devices are collecting.

Wearable technology captures sensitive details about daily routines, stress levels, sleep quality, and potential health conditions. When biometric data is mishandled or misunderstood, the impact can feel deeply personal, and the misuse of that information can lead to anxiety and loss of brand trust.

Users may worry about being judged, stigmatized, or defined by incomplete data, especially when they have little visibility into how their information is stored, shared, or protected.

Beyond the personal impact, wearable tech data can have real-world impact. Information about activity levels, sleep patterns, or heart health may be used by insurers, employers, healthcare providers, or financial institutions to assess risk or make judgments.

Even when the data isn’t being used to confirm a medical diagnosis, it can shape coverage options, workplace perceptions, or access to services, which is why consumers are increasingly cautious about how their wearable data is collected and used.

“As a rule, wearable devices are secure,” says Serhii Kholin, CEO of Onix-Systems. “However, their security highly depends on how they’re built, how they’re connected, and how users manage them.”

Ultimately, consumers are not just buying wearable tech for insights; they are trusting brands with intimate data, and that trust depends on how responsibly it is protected.

Nearly three in five (58%) of wearable tech users feel confident that their personal data is protected, despite reports that there are significant security vulnerabilities in many smart wearable devices.

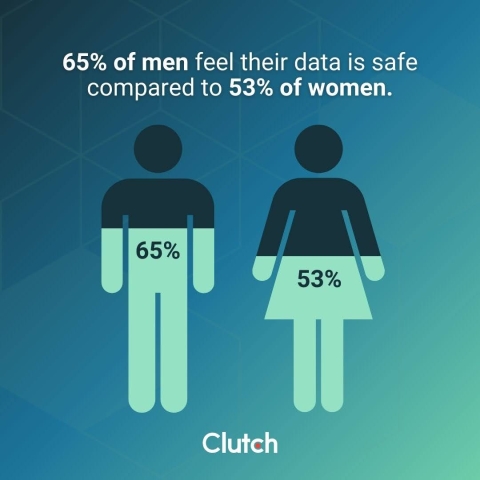

However, men and women slightly differ in how confident they are that their data is protected — 65% of men feel their data is safe compared to 53% of women.

This may be because wearables and health apps track data closely tied to women’s bodies and life stages, which historically has impacted them differently.

For instance, health apps often track menstrual cycles and fertility, which can expose intimate details about health and family planning. Women may be worried about bias related to caregiving, pregnancy, or health, as well as coverage implications and control over personal decisions.

Data privacy and security are now major factors in wearable choice, with 69% of users saying they would consider switching devices over privacy concerns.

“When it comes to how safe a wearable is, that can vary wildly based on the product and its manufacturer,” says Iryna Brui, a content lead at the software engineering company, Mindstudios. “Most gadgets sold as fitness devices might have basic encryption for data transmission—yet real health-focused tools demand compliance with rules like HIPAA or GDPR, opening a whole new bar for protection.”

For wearable brands, this makes data security a high-stakes issue, as even a single misstep can undermine trust and drive customer churn. That’s why privacy policies and transparency play a direct role in whether users stay loyal to a wearable brand or decide to switch.

When policies are vague or difficult to understand, users are left unsure about how their sensitive health data is being used or shared. That uncertainty can quickly turn into mistrust, especially as awareness of data misuse and breaches grows.

“Tell users what's collected, where it's stored, who sees it, for how long. In plain language,” Abhijith HK, the CEO of Codewave, advises companies that collect user data. “Companies can do way more. I’d like to see a standard where health data is handled like financial data.”

Transparency is essential. Brands that clearly explain their data practices, offer visible privacy controls, and demonstrate strong security standards can reduce churn by reinforcing user confidence.

Oura, for instance, emphasizes data privacy and security as core parts of its brand promise, framing protection of highly personal health information as a priority rather than an afterthought.

On its website, Oura states that trust and secure handling of health data are fundamental to their mission, using industry-level security practices like encryption in transit and at rest as well as third-party audits and certifications to safeguard user data. More importantly, Oura underscores that users are in control of their personal data, and that data is only shared with others with explicit consent.

Wearable companies can differentiate not just through features, but by positioning trust, clarity, and user control as core parts of the product experience.

Garmin users trust that their health data is secure the most (75%), followed by 70% of Samsung owners, and 63% of both Apple and Oura users.

Users may perceive these brands as more secure and trustworthy because they emphasize control and transparency around data sharing as well as unique positioning in the market.

Garmin, unlike some other brands, does not monetize user data for advertising. It also uses an opt-in approach, so most activities are private by default, and users must actively choose to share their data publicly or with third parties. Its reputation is rooted in precision and reliability and is used largely by runners, cyclists, and outdoor athletes, setting it apart from many of their competitors. This gives users a greater sense of security over their personal information, even if that might not be the case.

A 2025 analysis of data policies across wearable devices revealed that the most secure wearable tech companies are Google, Apple, and Oura. Though it’s important to note that none of these companies were perfect in how they managed user data.

While popular, Samsung fell short in transparency reporting, vulnerability disclosure, and security over time, showing a discrepancy in how consumers perceive the brand and reality.

There’s still a lot that consumers can do to make sure their data is as secure as possible.

“A common security gap with wearables is missed updates: many users keep their phones current but rarely open the companion apps, where wearable firmware updates and security patches are delivered,” says Dmytro Umen, CEO at Brights. “Users should also regularly review which apps have access to their health data and revoke permissions they no longer need. Most consumer health and fitness data is not protected by HIPAA, meaning it may be shared with third parties according to app privacy policies.”

Apple leads the market with 63% ownership, followed by Samsung (26%) and Fitbit (26%).

“What sets Apple apart isn’t what they sell, but how privacy became a significant part of everything they do,” says Brui. “What makes the Health app connections so secure? Rather than each fitness tool storing its own messy database with weak safety habits, everything feeds into a single clear hub—where only specific permissions let each app join in.”

While Apple’s data privacy and security policies surpass most of their competitors, it’s not the only reason users are adopting it. Apple’s integrated ecosystem and ease of use is incomparable. Apple Watches easily connect with the iPhone and Apple Health, creating a seamless user experience.

Apple Watch users can access apps directly from their wrist, check notifications, track workouts, control music, respond to messages, and manage daily tasks without ever pulling out their phone. This level of functionality allows users to prioritize their health data while integrating wearable technology seamlessly into their daily lives.

On top of that, Apple’s user-friendly designs and intuitive interfaces also make it easy to understand and navigate. By using smart defaults, automation, and consistent interactions across devices, Apple reduces friction and creates an experience that feels familiar and effortless from the start, making it the preferred product for most users.

Apple’s market dominance reflects strong branding and deep trust in the Apple ecosystem, where the Apple Watch feels like a natural extension of the iPhone rather than a separate device.

That ecosystem makes Apple the default choice for many consumers and sets clear expectations for seamless integration, intuitive design, and consistent performance. As a result, competing wearable brands are often judged against Apple’s standards for usability and overall experience.

Wearable tech users expect their devices to perform extremely well and are willing to buy a new device to ensure performance — 59% of consumers plan to upgrade their wearable devices every 2–3 years.

Most are purchasing new devices either because their existing device is worn out and/or it’s malfunctioning (58%), or because they desire for better performance (53%).

This indicates that consumers expect consistent performance and dependable hardware. They rely on their wearable devices and are willing to replace them if the device feels inaccurate or unreliable.

Consequently, wearable technology brands face growing pressure to improve device durability and reliability. To remain competitive, they need to provide accurate data, improve battery life, and invest in longer-lasting materials. Otherwise, they risk users switching to other brands who are providing meaningful upgrades and better performance.

While most wearable technology brands focus on marketing the devices themselves, the app is a strong selling point for most users. Three in four users (74%) say the quality of the companion app is very or extremely important, and most (58%) check their companion app at least once a day.

The companion app is the mobile app that connects to the wearable device, which provides additional features and information that is difficult to access on the device itself. Here, data collected from the wearable device is displayed and makes it easy for users to track their progress.

With wearable tech wearers regularly checking their apps to understand their health data, it’s important that the apps are intuitive and easy to navigate. As importantly, data needs to be displayed in a way that’s easy to understand.

Additionally, 51% of users rely on third-party apps, such as Strava, MyFitnessPal, and Headspace, underscoring how important integrations, APIs, and platform openness have become in the wearable experience.

Users want their health and fitness data to flow easily into apps they already use for training, nutrition, recovery, or goal tracking, rather than being locked into a single ecosystem.

When integrations are seamless, wearables feel more flexible and meet user expectations. Otherwise, users are more likely to become frustrated or consider switching devices.

Health and wellness continue to drive the adoption of wearable technology. However, data privacy concerns are a growing risk to brand loyalty and long-term growth. Wearable technology brands need to focus on securing their data and promoting transparency in order to attract and retain users.

Additionally, wearable tech companies need to provide seamless user experiences that are reliable and, most importantly, provide accurate information.

By balancing trust and usability, brands can differentiate themselves in a crowded market and meet the rising expectations of consumers.

This report is based on a survey conducted on December 16, 2025, using the online polling platform SurveyMonkey. We surveyed 379 consumers in the United States between the ages 18-99 of all income levels. The respondents were 48% male and 52% female.

Participants were asked a series of multiple-choice and single-selection questions about their experiences and preferences for brand authenticity. Quotas were applied to ensure a balanced distribution across demographic segments. All respondents were required to complete the survey in full to be included in the final analysis.