Updated January 22, 2026

Many organizations are cutting market research costs and trading long-term benefits for short-term wins. Learn why companies can’t afford to eliminate market research and how to capitalize on what it brings.

Market research has long been vital for a business’s success. Companies that invest in market research often end up with a treasure trove of data that provides valuable insights into customer needs, market trends, and competitor actions. It also helps teams design better strategies, reduce risk, improves product development, and leads to more effective marketing. However, despite these benefits, more companies are choosing to slash their research budgets.

Mounting financial pressure has caused many organizations to rethink their marketing budgets. In November 2025, Clutch surveyed 337 marketing professionals and gathered their thoughts on their companies' marketing and advertising budgets. The data shows companies in various industries are planning to slash market research initiatives, including:

For many companies with increasingly tight budgets, market research is often an optional expense. When it comes time to cut costs, market research can become an easy target. However, scaling back research can be expensive in the long run, as reliable market insights are foundational for long-term strategy and decision-making.

This article examines why reducing market research can harm long-term performance and how businesses can optimize their investment in research rather than eliminate it.

Market research remains a valuable part of business despite the growing trend of scaling back. When budgeting, market research costs are a line that organizations can easily reduce without experiencing noticeable effects in the short term. The return on investment (ROI) that market research brings is more difficult to track compared to other marketing costs, such as paid advertising or limited-time promotions, and the benefits do not stop or slow operations. Because leadership may view market research as giving inconclusive results, they often tell their marketing teams to do more with less.

It’s also challenging to effectively measure the effect of market research. Email marketing and social media campaigns are evaluated by concrete key performance indicators (KPIs), such as click-through rates and conversions.

This is contributing to continued pressure on market research spend: in Q3 2025, the IPA Bellwether Report shows a -6.8% net balance—meaning more firms reported cutting their market research budgets than increasing them this quarter (vs. -7.0% in Q2 2025), even as events (+10.9%) and direct marketing (+9.7%) saw the strongest budget growth.

Companies may incorrectly assume that internal data alone is enough to explain customer behavior. Large amounts of internal data, such as transaction data, web analytics, and customer relationship management (CRM) data, may lead decision-makers to believe they already have a comprehensive understanding of their customers. While this data is important, it only shows what actions customers take and doesn’t answer why they take them.

While the damage may not be immediately visible, over time, it becomes a costly mistake. Organizations should adopt a holistic approach that integrates internal data with market research to achieve advanced personalization.

Cutting or eliminating market research entirely poses a significant risk to organizations that want to stay competitive and achieve their business objectives. Without reliable customer data, decisions become a matter of guesswork and intuition. Guesswork increases the risk of failing to connect with the target audience and missing opportunities for growth.

For example, Walmart has had great success expanding into other countries. In 1997, it began opening stores in Germany, expecting the same results. Because Walmart hadn't conducted the necessary market research, it didn't meet German consumers' expectations. Germans value quality products and sustainability over low prices. Walmart leadership's focus on minimizing costs while maximizing efficiency also didn't align with Germany's traditional labor views. The result was a $1 billion withdrawal by Walmart in 2006.

Another likely outcome of cutting market research is ineffective spending. Because companies begin to rely on less (quality) customer data over the long term, the marketing budget goes toward failed campaigns, product missteps, and incorrect assumptions.

While the consequences may not be immediate, over time, the misaligned messaging, poor targeting, and weak customer understanding become more embedded in the overall business strategy. Once the expenses from these mistakes begin to accumulate, it’s often too late.

Organizations can’t flip a switch for a quick fix once the customer base begins to fizzle out. Suddenly, they must make difficult choices to invest more in market research that will pay off in the long run, even as short-term profits dwindle. Had they made the initial market research investment earlier, their decisions and performance might've been more consistent, resulting in a much better long-term outlook.

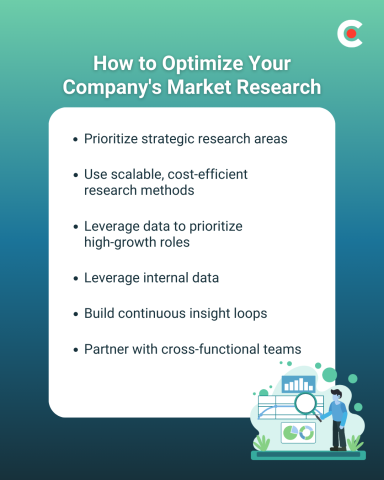

Market research is a crucial component of marketing, and neglecting it can have long-term consequences. Understanding the best practices for market research optimization can take a company from making reactive decisions to executing a proactive strategy.

Market research without a solid plan won’t deliver the benefits that can take organizations to the next level. Not all data has equal value, and companies must determine what will help them and what to disregard by linking data to business goals or metrics. Companies may have different goals, such as improving customer acquisition, optimizing product development, or reducing churn. Aligning research with specific goals makes the insights much more valuable.

One way to prioritize strategic research is to categorize insights into two categories: 'need to know' and 'nice to know.' There is a lot of data that can lead to interesting insights, but if it doesn’t directly lead the business toward achieving goals, it’s negatively affecting the budget. Research needs to inform important decisions that can impact revenue and growth. Because of this, prioritization is a must. Before initiating research, the organization must narrow its focus to shorten timelines and maximize ROI.

Market research has traditionally relied on interviews, surveys, and studies that produce large volumes of data covering a single point in time. While it could yield valuable conclusions, collecting and analyzing the data was tedious and time-consuming. This forced organizations to make reactive decisions based on that information rather than anticipating next steps.

New technology has made it increasingly easy to use scalable, cost-effective research methods. For example, leveraging online surveys, social listening tools, and AI-assisted analysis enables companies to collect data that aligns with their business objectives more quickly and at a lower cost than traditional methods.

Tapping into online communities also provides businesses with candid feedback. While surveys are helpful, insights from real-time conversations on the internet can also be valuable. These communities cost little to nothing to join and enable organizations to gauge public sentiment in real-time, allowing them to get a pulse on how consumers feel. Social listening tools that monitor online sentiment about brands over time are also available.

Another cost-efficient research method is rapid testing. Companies use this method to quickly validate ideas, messaging, and concepts before committing significant resources. It provides enough data to determine whether an idea is strong or weak while avoiding lengthy and expensive research initiatives.

Internal data remains an important asset for making informed marketing decisions. When paired with external market research, it becomes even more valuable. CRM systems, transaction data, and digital analytics give an accurate picture of how customers behave, their purchase patterns, and overall engagement. Organizations that integrate this data with external market research can gain a comprehensive view of the big picture. Teams can find patterns in audience behavior that aren't visible through internal data analysis alone.

For example, analytics alone may show where customers tend to drop out of the customer journey, but the findings don’t explain why this happens. Using an external method, such as customer surveys, gives insights into the motivations or issues behind the action.

Companies that use smaller, more frequent research efforts stay connected to real-time developments and evolving customer needs. These continuous insight loops, fueled by regular customer surveys and feedback, can provide organizations with an indication of when to pivot and adjust their strategies. Additionally, these small research efforts spread investments over the course of a year rather than using them all for a single large-scale study.

Organizations shouldn’t limit insights from market research to a single department or team. Sharing data across teams and the organization as a whole optimizes its effects. When research data supports teams responsible for product development, sales, customer experience, leadership, and marketing, it becomes less of a budgetary expense and more of an organization-wide resource.

Organizations that neglect external market research risk leaning on assumptions rather than data-backed insights. The result can lead to misaligned messaging, ineffective targeting, and a general misunderstanding of customer behavior.

Learning how to do market research effectively and dedicating the resources to it isn’t an optional practice in 2026. Organizations that want to remain competitive over time and avoid product missteps and failed campaigns need to understand their customers' needs and wants through external market research.

Instead of eliminating market research and making short-sighted budgetary gains, companies must modernize, streamline, and prioritize efficient research. This protects performance, reduces risk, and guarantees the long-term success of meeting business objectives.