Updated August 25, 2025

How Emerging Trends, Talent Pressures, and AI Are Redefining the Industry

In 2025, software development isn’t just supporting digital transformation — it’s driving it. From custom enterprise systems to the apps on your phone, the modern digital experience traces back to code. And this year, the pace of change feels different. AI is becoming standard, competition is global, and the pressure to move faster is constant.

This report dives into where software development services stand right now. We’ll walk through global market growth, where the biggest changes are happening, and what’s driving them. You’ll also find a close look at the challenges companies are facing, especially around regulation and talent. If you’re building, buying, or investing in software in 2025, this is what you need to know.

Looking for a Software Development agency?

Compare our list of top Software Development companies near you

Software development services play a pivotal role in the global economy, driving innovation, productivity, and competitive advantage across nearly every industry. In 2025, the global software development market is valued at $570 billion, on pace to surpass $1.04 trillion by 2030. This is a 13% compound annual growth rate (CAGR) that far exceeds global GDP projections.

Spending on software alone is projected to reach $1.23 trillion this year, up 14% from 2024, making it the fastest-growing segment of IT investment. As organizations increase reliance on digital infrastructure, demand for development services continues to accelerate across enterprise, government, and startup sectors alike.

North America remains the dominant market. The United States accounts for $353.5 billion in software revenue, which is nearly half the combined total of the world’s top 10 countries. However, the fastest regional growth is coming from the Asia-Pacific market, which will grow from $176.2 billion in 2024 to $406.6 billion by 2030, a nearly 15% CAGR.

This economic expansion sets the stage for large-scale change across the software development ecosystem, from how services are bought and sold to how teams are built, regulated, and evaluated.

Several key developments in 2024 set the stage for where software development is heading in 2025. From AI breakthroughs to market-shaping acquisitions, last year was anything but static.

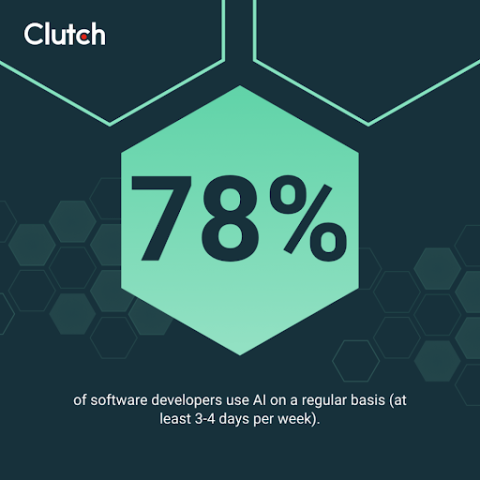

AI became deeply embedded in the development process. According to a 2025 Clutch Survey, 78% of developers use AI several times per week. GitHub echoed this trend with a 98% increase in generative AI projects, along with a 59% rise in contributions across those repositories.

Mergers and acquisitions reshaped the competitive landscape. Synopsys announced a $35 billion acquisition of Ansys, the largest software deal of 2024. IBM followed with its $6.4 billion purchase of HashiCorp, adding major cloud infrastructure capabilities to its portfolio.

Regulatory pressure increased significantly. The European Union’s AI Act took effect on August 1, 2024. It includes penalties as high as 35 million euros or 7% of global revenue for non-compliance. This marks one of the most consequential regulatory shifts for AI development practices worldwide.

Industry leaders posted strong performance despite macroeconomic headwinds. Accenture became the most valuable IT services brand in the world with a $40.5 billion valuation. Tata Consultancy Services (TCS) reached $30 billion in annual revenue.

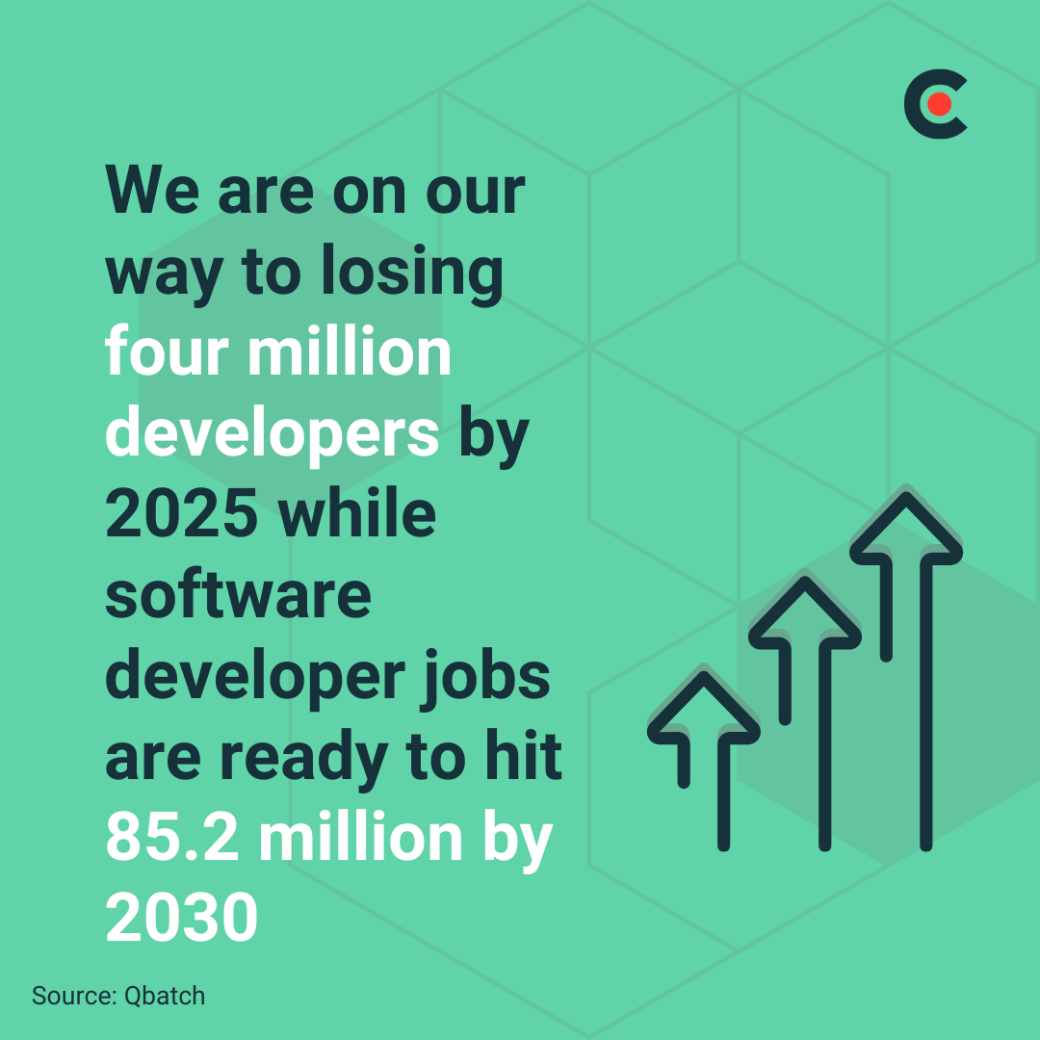

Talent shortages continued to escalate. 87% of companies reported current or expected developer shortages. The global shortfall could exceed 4 million developers by the end of 2025.

The year’s biggest headlines tell a clear story: software is scaling faster, getting smarter, and more regulated. Here are the standout stats:

The global software development services industry continues to show strong, sustained growth. In 2025, estimates for total market value vary depending on scope and methodology. Business Research Insights reports a global market size of $435.99 billion in 2024, projected to reach $1.47 trillion by 2033 at a 15% compound annual growth rate. A more conservative forecast from Global Growth Insights places the 2025 market at $288.93 billion, with growth to $702.19 billion by 2033 at a 12% CAGR.

Spending isn’t just up, it’s accelerating across nearly every category. Worldwide IT spend will reach $5.74 trillion in 2025, up 9% from 2024. Software spending alone will grow 14%, totaling $1.23 trillion. Security-related software is also gaining share. Information security investment is expected to hit $212 billion in 2025, a 15% annual increase.

India is emerging as a powerhouse, with IT spend projected at $160 billion this year, growing 11% year over year.

Artificial intelligence is now the fastest-growing area in software development. The global AI market is expected to grow from $279.22 billion in 2024 to $1.81 trillion by 2030, reflecting a 36% CAGR. Machine learning alone will expand from $35.32 billion in 2024 to $47.99 billion in 2025, continuing at a 31% CAGR through 2032.

Mobile development also shows strong momentum. The mobile app development market is projected to reach $302.1 billion in 2025, with long-term growth to $753.34 billion by 2033 at a 12% CAGR.

Regional demand for software services continues to shift. North America maintained a leading share in 2024, accounting for over 34% of global custom software development. But Asia Pacific leads in growth, with the highest CAGR globally through 2030. Europe also shows strong momentum, with a 26% CAGR in the custom development segment.

In terms of go-to-market strategies, 86% of software companies target North America, while 73% prioritize Europe.

Enterprises continue to view software development sourcing as a strategic lever, blending cost efficiency with access to specialized skills and faster innovation cycles. The custom software development market is forecasted to grow from $43.16 billion in 2024 to $146.18 billion by 2030, expanding at more than 20% CAGR, while broader global IT outsourcing industry (including application development and maintenance) is projected to reach $1.2 trillion by 2030.

Delivery models are mixed. According to Global Growth Insights, the demand for low-cost development has led 59% of organizations to partner with offshore vendors. However, over 64% of enterprises are shifting to hybrid offshore models, while more than 53% are outsourcing AI and machine learning projects.

AI adoption is accelerating in outsourced delivery. 83% of executives report AI use in services contracts, though only a quarter see measurable productivity gains so far, underscoring the need for stronger governance and clearer outcomes. Together, these dynamics signal that software development sourcing is no longer a binary “in-house vs outsource” choice but an evolving portfolio strategy where flexibility, measurable outcomes, and AI-enhanced delivery are the new success markers.

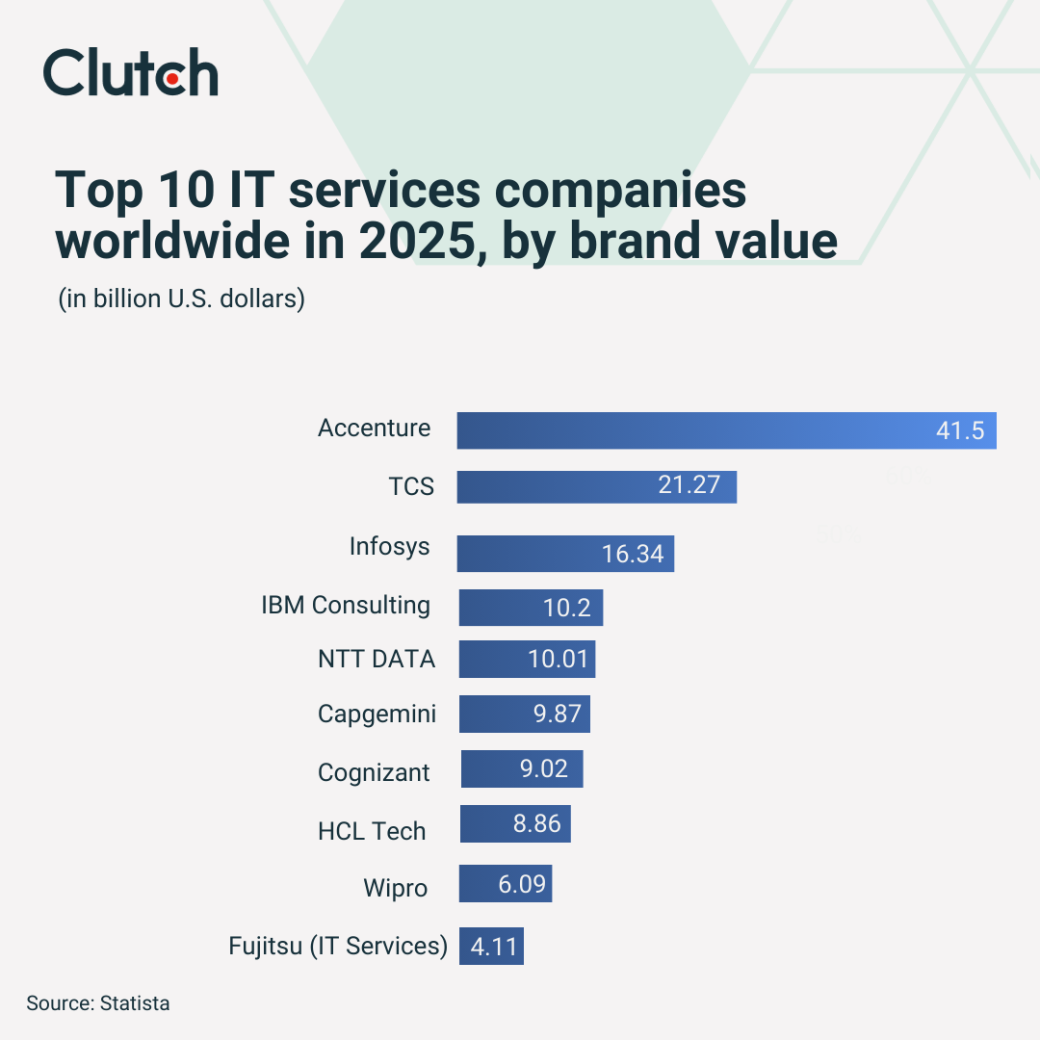

The software development services market is led by a group of global firms with strong financial results and well-established brand recognition. Accenture holds the top spot as the most valuable IT services provider, with a $41.5 billion brand valuation and $16.5 billion in Q3 FY24 revenue.

India’s tech firms are also holding their ground. Tata Consultancy Services (TCS) now ranks as the second most valuable IT services brand globally, with ₹2.48 trillion in annual revenue, which translates to about $30 billion USD, and employs over 612,000 professionals. Infosys reported ₹1.58 trillion in revenue, or approximately $19 billion USD, despite reducing its workforce by nearly 26,000 people. Wipro followed with ₹89,760 crore, or about $10.8 billion USD, and with similar staff cuts during the same period.

Mergers and acquisitions are picking up speed in 2025. The largest deal of the year was Synopsys’s $32.5 billion acquisition of Ansys. Other major transactions included IBM’s $6.4 billion acquisition of HashiCorp and Thoma Bravo’s $5.3 billion acquisition of Darktrace.

Activity stayed strong through the year, with Q3 alone seeing a 19% jump in deal volume and a 15% increase in value. Managed service providers, in particular, are seeing more consolidation, with deal flow expected to rise another 50% this year.

The recent surge in private equity and market consolidation is a fascinating development, and we see it as a significant opportunity, not a threat. While the giants are getting bigger, the needs of small-to-mid-market businesses are becoming more specialized and nuanced. These companies require the kind of agile, hands-on partnership that larger, consolidated entities often struggle to provide.

Josh Webber, Co-Founder & CEO

Big Red Jelly

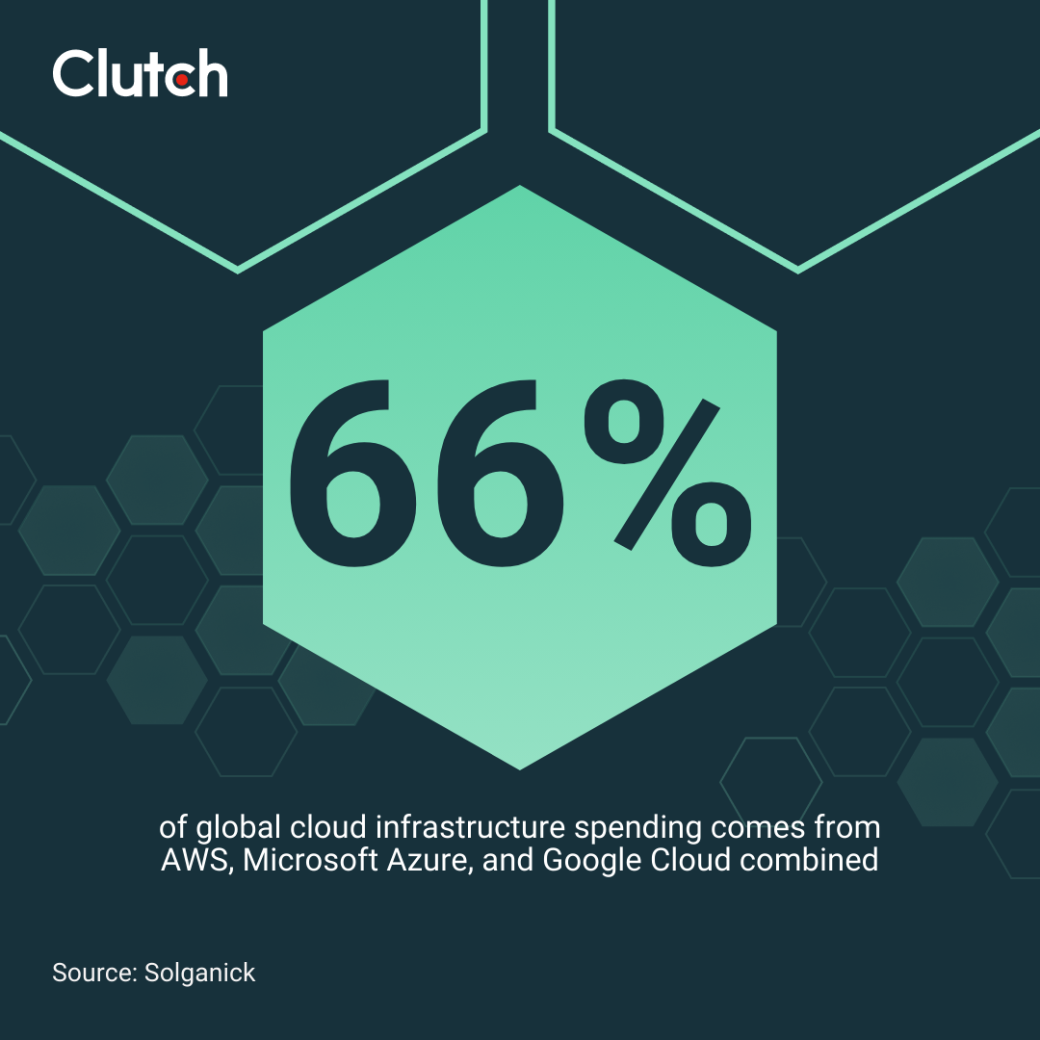

The software development field is still spread across a wide range of providers, but cloud services are heading in a different direction. A few large companies now dominate the space. Amazon Web Services, Microsoft Azure, and Google Cloud together account for 66% of global cloud infrastructure spending. That kind of market share puts them well ahead of the pack.

The U.S. continues to lead in overall software revenue, generating around $353.5 billion in 2024. That’s nearly half of what the top ten countries bring in combined. At the same time, many firms are turning to new regions to expand their reach and find new customers, especially where markets are still growing.

Here are the software development trends that are rising to the top in 2025.

Artificial intelligence is now a core part of modern software workflows. According to Clutch data, 78% of senior developers say they use AI tools several times a week or more, and 30% of enterprise code is now generated by AI.

Enterprise adoption is accelerating, with 71% of organizations using generative AI.

GitHub saw a 98% jump in generative AI projects. More developers are contributing too, with contributions up 59% in just one year.

Industries like fintech, software, and healthcare are leading in AI use, applying it to tasks ranging from predictive maintenance to customer personalization and DevOps acceleration.

We've found that AI works best for us when we focus it on a small, often subjective, scope of responsibility such as providing advice on a strategy or helping to brainstorm new project planning ideas. However, it can be beneficial in completing objective tasks as well, as long as they are simple and well defined. With respect to software development, for instance, we use Claude Code integrated directly within our project management system to automatically complete repeatable tasks such as building an entity listing page, or running browser-based tests from predefined user stories. We measure productivity gains simply by comparing expected work-hours without AI versus how long these tasks take with AI. We've found these types of automations, once properly deployed within our ecosystem, save us around 25% on an average, greenfield project.

Martin Pellicore, President

Pell Software

Low-code and no-code development is reshaping who can build software. The market for these platforms is expected to reach $86.9 billion by 2027, growing at a 23% CAGR. Platform evolution is also driving adoption of cloud-first principles, containerization, and microservices. Most new apps will follow cloud-native design, supporting rapid scaling and faster release cycles.

Cloud infrastructure spending is on track to reach $723.4 billion in 2025, growing 22% year over year. At the same time, edge computing is gaining traction for latency-sensitive use cases.

Cloud-native development, serverless computing, and containerization are accelerating software delivery across industries. Healthcare, manufacturing, and retail are investing in edge AI to support diagnostics, automation, and real-time analytics. These trends point to a move away from centralized systems. Companies want faster, more responsive apps that can scale easily. Cloud-native builds and edge AI help deliver that.

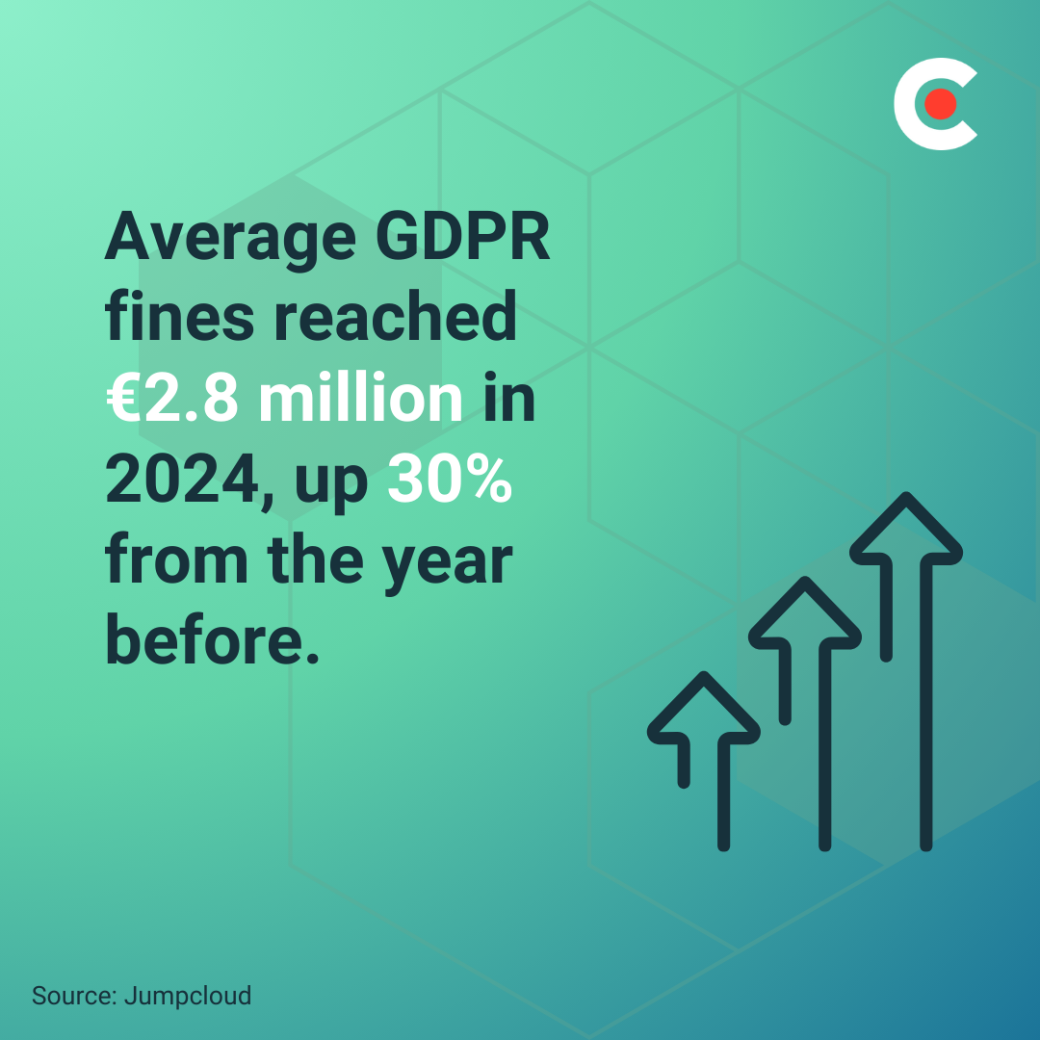

New rules around data privacy and AI are putting added pressure on software teams. Average GDPR fines reached €2.8 million in 2024, up 30% from the year before. The EU AI Act, effective August 2024, imposes penalties up to €35 million or 7% of global revenue. In the U.S., CCPA rules come with their own costs, sometimes up to $7,500 per incident. All of this means developers are spending more time making sure their software meets legal standards, not just user needs.

While IT budgets remain strong, macroeconomic instability creates challenges. Global IT spending will hit $5.74 trillion in 2025, up 9%, yet cost pressures persist. Developer hourly rates range from $24 to $49, and supply chain constraints are slowing delivery of critical infrastructure. Currency fluctuations and inflation are also impacting project margins, especially for companies relying on offshore resources.

The talent gap is nothing new, but it's getting harder to ignore. Today, 87% of companies say they’re already feeling the impact or expect to soon. The shortfall could result in $8.5 trillion in annual lost revenue by 2030. Recruiting is only part of the problem, as the average tech tenure is just two years, and remote work adds complexity. Many companies are turning to hybrid models and nearshore teams to boost retention and collaboration.

Our primary strategy to attracting and retaining software development talent is the same as our strategy for attracting and retaining clients: build an authentic culture that is genuinely interested in learning about, building, supporting and enhancing amazing business software applications.

Martin Pellicore, President

Pell Software

Looking ahead, the market is expected to more than double over the next decade, ballooning from just under $290 billion in 2025 to over $700 billion by 2033. Custom development will grow even faster, reaching $146.18 billion by 2030. Enterprise use of generative AI will expand rapidly, and job growth will help close the global skills gap, with India positioned to become the largest developer base.

Software development overall will reach $131 billion by 2033. Outsourcing, in particular, is growing even faster — up from $5.3 billion in 2025 to $131.8 billion just eight years later. Asia-Pacific, Eastern Europe, and Latin America will drive new opportunities, while quantum computing begins to reshape architecture and security needs.

The software development services industry in 2025 is growing fast, but it is also more complex, competitive, and regulated than ever. From surging AI adoption to global consolidation and chronic skill shortages, service providers and buyers alike must adapt quickly to stay ahead.

Explore top-rated software development agencies on Clutch to find the right software development agency for your next project.