Updated April 30, 2025

The majority of small businesses are impacted by current economic conditions. Thanks to rising tariffs and a looming recession, many are shifting gears. Clutch surveyed 500 SMB leaders to learn how businesses are shifting their strategies to ensure growth in 2025.

Changes in the economic landscape, whether it’s on a global or national scale, dictate how businesses operate and prioritize strategies. Companies should brace for shifts that may affect their growth or bottom line.

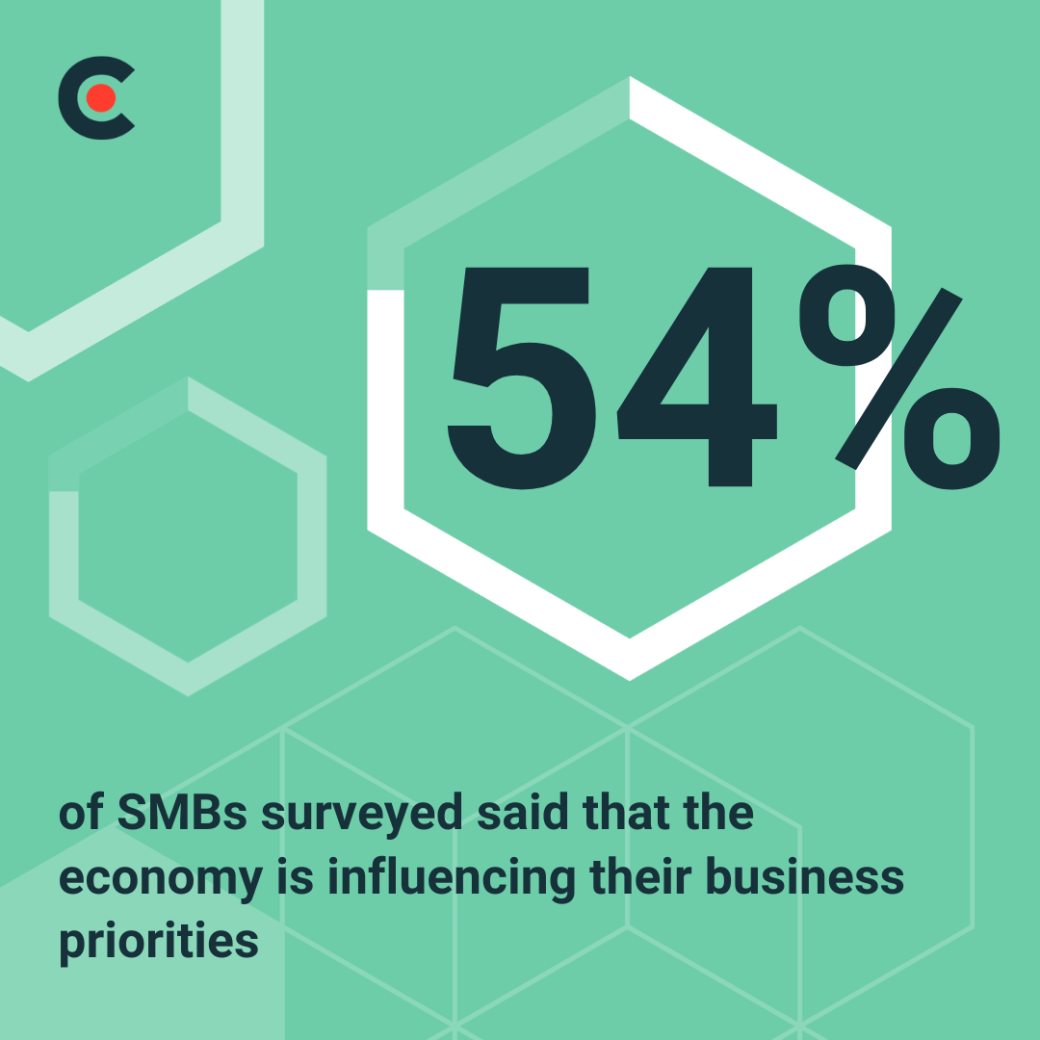

Clutch’s latest survey of 500 SMB leaders shows that 54% of respondents said that the economy is influencing their business priorities. The figure suggests the heightened awareness of leaders to economic shifts affecting their competitiveness.

Adapting to the economic climate is a natural response from well-informed leaders, and it is essential to business survival and long-term success.

Companies and organizations need to understand how economic conditions drive strategies and guide business decisions. This blog dives into how intertwined economics and business are. We’ll also discuss how businesses can build resilience to withstand ensuing economic developments.

Read more about the survey in ‘The Small Business Growth Playbook for 2025’

2025 is turning out to be an incalculable year for businesses because of the uncertainty brought by changing tariff policies. The international economic and trade order is being destabilized, sparking trade frictions from powerhouses.

The wave of tariff implementations, particularly from the United States and China, have influenced global trade dynamics. These near-term decisions will shape the medium- to long-term field for many industries.

Companies, governments, and consumers are feeling the effects. This economic uncertainty will raise prices, weigh on foreign imports and exports, and potentially disrupt supply chains.

Business leaders are compelled to rethink their priorities to keep their businesses in the best position to flourish despite heightened volatility. They are no longer able to ignore economic signals.

No industry or niche is safe from shifting economic conditions. While some sectors prepare for greater impact than some, it’s unlikely that one market will remain untouched. Having a clear understanding of how differing variables affect businesses will help not just mitigate downside but also seize unexpected opportunities.

Here’s a more detailed breakdown of the different repercussions of economic shifts:

Economic conditions directly affect consumer spending trends because of inflation pressures. A healthy and stable economic climate drives consumer spending. On the other hand, unfavorable conditions lead to eroding purchasing power.

Current conditions prompt customers to think about modifying their spending habits; most will likely strive to save funds and only buy essential products. This lack of consumer confidence leads to slow demand for businesses.

Since consumers are more thoughtful of their spending, intending to cut costs, they’ll focus on brands that they trust to deliver good quality at a reasonable price.

The latest developments affect what businesses will offer customers and how they will package their products or services to compete with other brands.

Economic shifts squeeze profit margins because it impacts operating and manufacturing costs.

Components and raw materials are on the frontline against inflation. Additionally, businesses also need to take into account possible price hikes for necessities like electricity, transportation, and property leasing. While incremental price changes for separate variables feel inconsequential, aggregate costs can pile and weigh finances.

Moreover, economic conditions also influence supply chains; precarious situations make it difficult for businesses to optimize their operations as they will be at the mercy of potential delivery delays, supply shortages, and complicating logistics.

Companies need to closely monitor or even reconsider their resource allocation and operational processes to counteract tumultuous settings.

The overall labor market is a complicated topic that has intricate links on business growth.

Difficult economic times lead to increased unemployment as there is imbalance between workforce supply and business demand. The higher the unemployment rate goes, the more it weighs on the economic slump.

Economic environments also affect hiring and workforce decisions. Businesses are required to reassess their wage structures, benefits strategies, and recruitment plans whenever there’s growth or downturn.

Economic settings shape the broader monetary landscape for businesses — interest rates, access to capital, etc. Company decisions on borrowing, investing, and saving are affected as different financial facets veer.

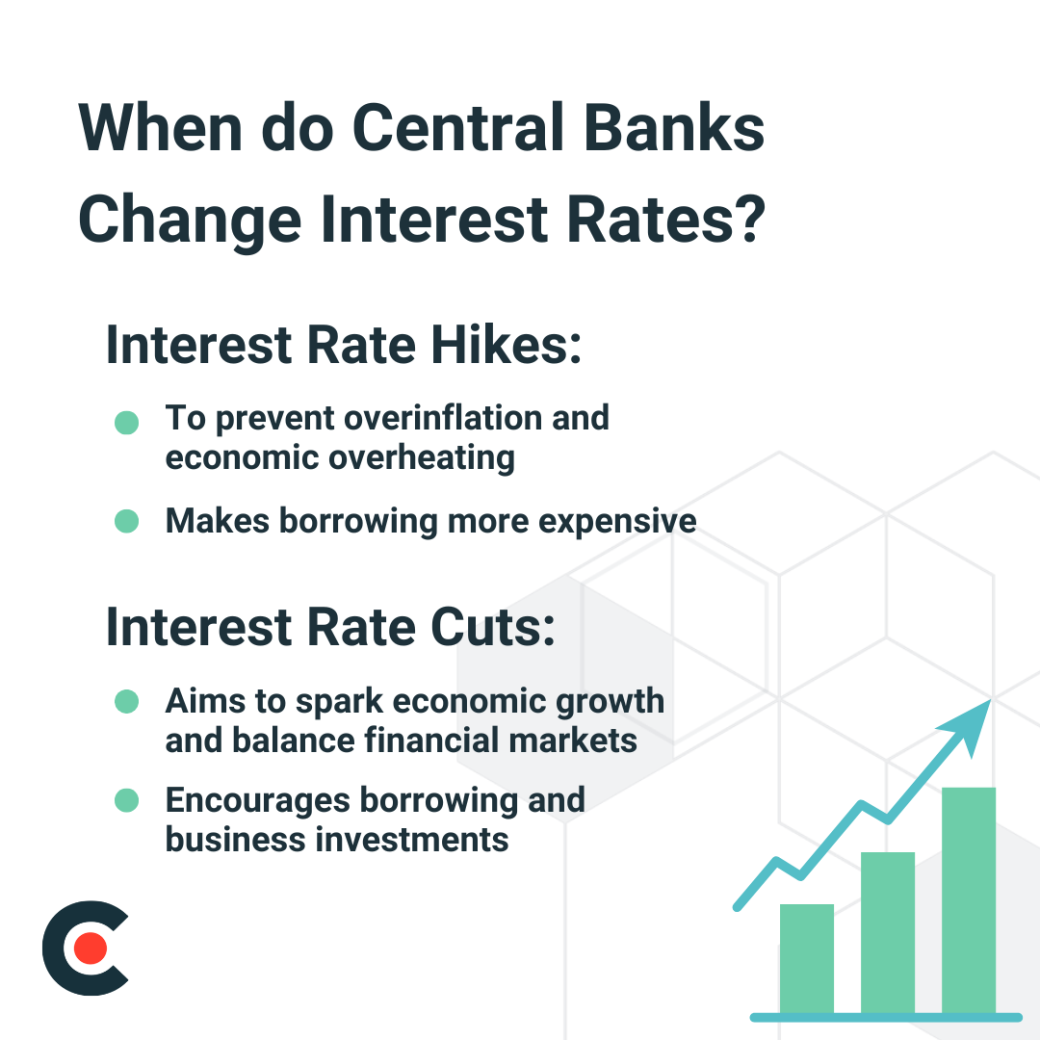

Central banks are the governing bodies that decide when to loosen or tighten interest rates to balance economic outlook. These financial institutions closely monitor the landscape to determine the best move to spark growth or prevent overinflation.

There are a number of key economic indicators that influence central bank decisions; but basically, they raise interest rates when inflation is too high or when the economy is overheating. In contrast, they lower interest rates when growth is slow or when a recession is looming over.

Low interest rates are important to helping businesses through challenging conditions. Companies seize the opportunity to borrow to invest in optimizing their operations to ensure profitability when interest rate cuts are announced.

Important reminder: be mindful of taking debts. Part of making strategic decisions is understanding if your company needs it and how much it should take to fund essential initiatives or investments.

Governments and regulatory boards observe economic conditions to adjust markets and ensure stability. Economic circumstances determine whether regulations need to be tightened or relaxed to protect business growth and strengthen consumer confidence.

During times of uncertainty, regulatory bodies often loosen some requirements to stimulate struggling markets, often in the form of tax cuts or subsidies. Alternatively, they might tighten rules to prevent economic overheating; imposing stricter consumer protection requirements and firmer labor requirements.

Regardless if they’re bullish or bearish, regulation shifts impact business decisions. For instance, during the COVID-19 pandemic, several industries suspended taxes and eased regulations to help companies stay afloat.

Whether its inflation or growth, shifting economic conditions affect several business areas. Some changes spark near-term adjustments while others require more long-term prospecting.

The following are 5 key functional and business areas affected:

Businesses need to closely watch economic indicators to align their strategies accordingly. Leaders should be strategic to seize opportunities during prosperous times or navigate through stagnation.

Recent developments in the national and global economies have been sounding the alarm bells for many businesses and industries. The complex economic circumstances make it a strenuous task to predict how the market will look in the near future.

Despite economic concern, 84% of SMB decision makers expressed a promising outlook for growth in 2025, reflecting the resiliency of small businesses.

Businesses are pivoting to ensure optimal profitability — tempering prices, strategies, and resource allocation. The persistence of many companies and organizations highlight the importance of cost management.

In times of economic uncertainty, companies face a massive roadblock that shakes core operations. Having the flexibility, proactivity, and strategic mindset is key to ensure your business emerges strong through the turbulence.

Here are 5 practical tips for maneuvering your business in times of economic unpredictability.

Clever and informed financial planning will be the backbone of your business operations through uncertain conditions. Understanding how your revenue will be impacted, proper income forecasting, and managing expenses will help your company go a long way.

Essentially, robust financial planning helps with:

Businesses that have healthy financial plans are able to absorb economic shocks and build long-term resilience.

Leveraging cutting-edge tools to analyze real-time and historical data across core business functions give business clearer insights for decision making. Using data eliminates unnecessary guesswork, supporting tasks and functions such as:

Gathering and examining key data allow businesses to pivot in real-time as it eliminates unhealthy guesswork and overreliance on intuition.

Strategically controlling cash inflow and outflow to ensure liquidity helps businesses maintain financial stability amidst economic headwinds. This tip is crucial for the following:

Regularly optimizing cash flow gives businesses the ability to proactively identify issues and opportunities.

Transparency and communication shouldn’t be underestimated. By improving employee and team communication cadences, companies foster smart decision-making.

Here are some ways communication can contribute to business stability through trying economic conditions:

Clear communication allows businesses to free up decision-making bottlenecks that could be hindering their operations. Increasing the frequency may feel extraneous but it’s valuable to navigating changing economic environments.

Focusing on what your company is good at and maintaining a clear vision is helpful to effectively weathering economic turbulence. A well-defined mission statement is the foundation companies need to make informed decisions. This clarity helps with the following:

Strength and mission alignment are the cornerstone of business resiliency. Businesses that show their authenticity build strong customer and employee connections that drive growth amid volatility.

Economics controls how the market moves. Every major business decision is dictated by economic conditions – fundamentally changing strategies, processes, and priorities.

Great companies and organizations don’t just ride the economic wave; they have a proactive approach that lets them interpret the tide. Securing forward-looking contingency plans requires businesses to invest in exceptional technologies, flexible operations, and solid infrastructure.

Cover all grounds with a trusted service provider. Whichever project or service provider you need, Clutch can help you find partners you can rely on.