Updated December 18, 2024

So, your business needs a cloud platform. Given how the ‘Big Three’ – Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) – dominate the market, you’ll likely investigate at least one of them. Each one is famous in its own right – just check out some of their marquee customers:

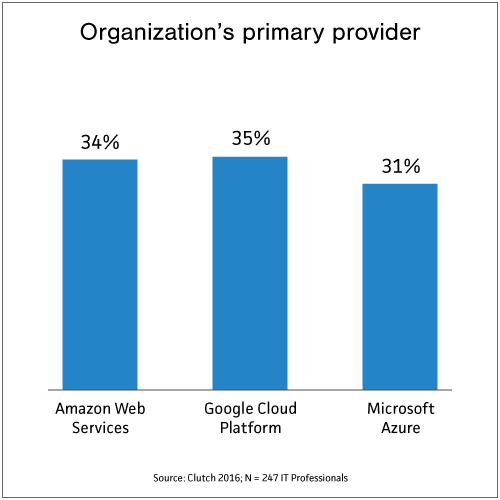

Despite their fame, opinions regarding the different platforms are strong, with individuals often feeling very passionately about their chosen platform. We surveyed 247 organizations – ranging from sole proprietorships to enterprises – to gather more data on the strengths and features of these platforms.

Clutch surveyed 247 professionals working in IT departments across the United States at organizations ranging in size from 2 – 10,000+ employees. Data was collected in November 2016. This survey collected data from 85 Amazon Web Services users, 86 Google Cloud Platform users, and 76 Microsoft Azure users.

NOTE: This breakdown does not fall in line with the three providers’ market share: AWS controls the lion’s share of the cloud market. However, the data’s nearly uniform split between the three providers allows us to examine opinions regarding AWS, GCP, and Azure – widely recognized as the top three contenders in the cloud platform space – more evenly.

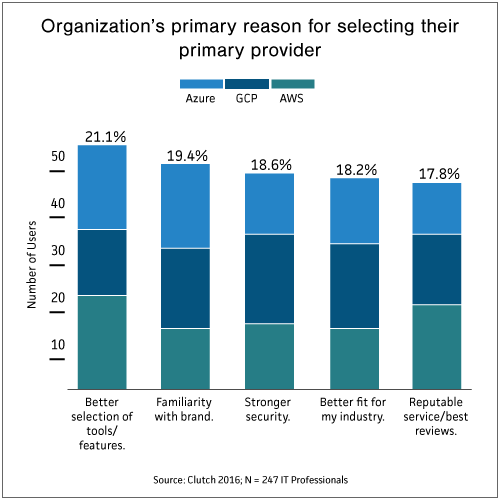

Overall, organizations said that ‘better selection of tools/features’ is the main reason why they chose their primary provider.

This result can be explained by the fact that each provider has its individual strengths, and thus, a customer may go to a provider for a specific set of tools or features. Brian Dearman, Solutions Architect at Mindsight, sums it up: “Infrastructure-as-a-service will reside mainly on AWS, cloud services will be on Microsoft's side, while Google will dominate analytics. Even though every platform offers each type of service, people will want the best.”

Dave Hickman, Vice President of Global Delivery at Menlo Technologies, believes that the providers’ strengths are more fluid, though: “If you do this survey in another 6 months, you will probably get different answers, because there’s some leapfrogging going on.”

He continued, “The answers will be more on-par three years from now, for the same survey… Google is trying to catch up [to AWS] from an infrastructure point of view, while Azure definitely is catching up.”

Other interesting elements we found in our data include the following:

Furthermore, ‘stronger security’ tied for second place with ‘familiarity with brand.’ Nick Martin, Principal Applications Development Consultant at Cardinal Solutions, calls security a “red herring concern,” though. “[These three] cloud providers are very secure, with a wide range of compliance standards being adhered to; this information is easily found, and it shouldn't surprise anyone that [the] provider's data center will be far, far more secure than an on-premises one, even in the case of large organizations,” said Martin.

He continued, “It's up to the organizations themselves to ensure that the solution being deployed by them to the cloud is secure. This should be done regardless of where a solution lands, either with a cloud provider or on-premises.”

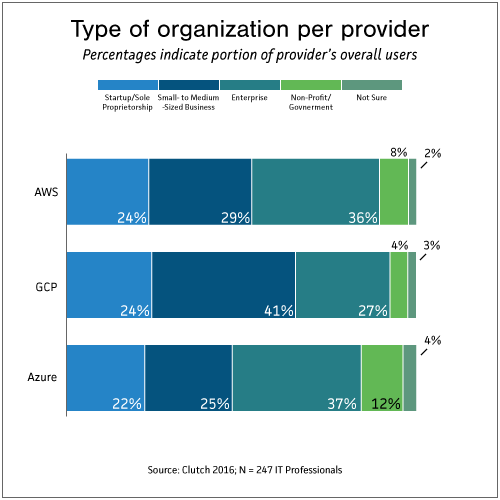

Clutch found that 37% of organizations that use Azure as their primary provider identify as an enterprise, compared to only 25% who identify as an SMB or 22% who identify as a startup/sole proprietorship.

We can attribute Azure’s popularity among enterprises to its brand familiarity and the ease with which it can integrate into the Microsoft systems many enterprises already employ. In fact, 24% of Azure users said their primary reason for choosing the provider was brand familiarity, compared to only 20% of GCP users and 15% of AWS users.

“It goes back to the trust and familiarity issues,” said Martin of Cardinal Solutions. “Windows Server and other Microsoft technologies are prevalent in the enterprise world. Azure provides the consistency required by developers and IT staff to tightly integrate with the tools that Microsoft-leaning organizations are familiar with.”

AWS follows very closely behind for enterprises at 36%. Given AWS’ market dominance and longevity, this isn’t surprising. Meanwhile, GCP dominates for SMBs at 41%. “Small businesses tend to lean more on pricing than security or toolsets,” said Hickman of Menlo Technologies. Thus, Google’s pricing can be more palatable for an SMB.

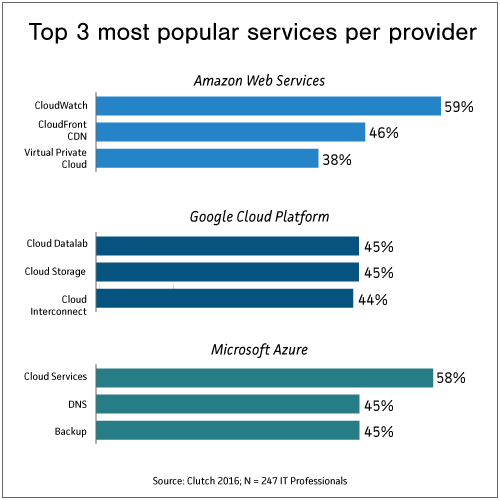

The most-used services for each provider are listed below.

We noted that these results do not fall in line with what many regard as the top-used services for each provider, specifically for AWS. In fact, Amazon CloudWatch cannot be used unless you are also using an Amazon cloud resource or app running in AWS.

Our population sample likely reflects differently than the general population, either due to sample bias, lack of knowledge, or another factor. However, experts found that the top offerings in our survey still do provide insight into each provider’s strengths.

“Going back to when Azure started, their very first offering was cloud services,” said Martin of Cardinal Solutions. “The platform-as-a-service offering in Azure is still one of its key differentiators.”

“[Cloud] Datalab is an analytical tool from Google,” said Dearman of Mindsight, “This supports the notion that this is the main use of the platform.” Furthermore, CloudWatch may still be a widely popular tool: “CloudWatch is basically a tool for watching systems…”, said Dearman. “Everyone needs to watch over their systems’ performance, as well as set up alerts.”

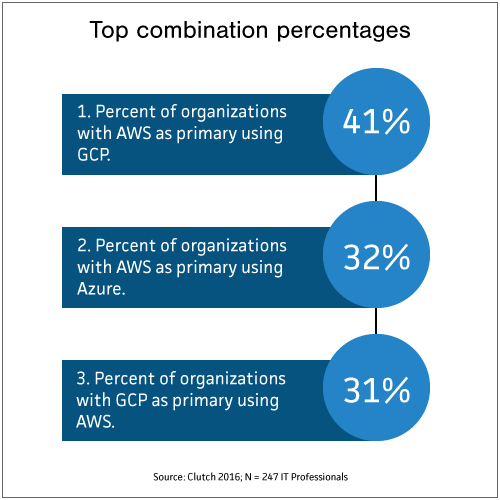

Finally, Clutch found that 41% of organizations that use AWS as their primary provider also use GCP, the highest combination of two providers.

“AWS is being used by many large companies that moved there early-on,” said Dearman. “Many of those companies are also performing analytics, so these two vendors are being seen together.”