Updated December 19, 2024

Americans are looking at their budgeting habits and making important money-saving decisions because of economic uncertainty during the COVID-19 pandemic. In a survey of more than 500 Americans, Clutch found consumers prioritize personal budgets to combat waiting for economic stability.

“That’s just not in my budget.”

How many times have you said that in response to your friends who love to go out to eat or seem to have all the money in the world to travel?

Looking for a Accounting agency?

Compare our list of top Accounting companies near you

How many people do you think make this statement with a specific budget in mind?

Managing a budget is crucial anytime, but especially in 2020 with the impact of COVID-19 on the economy.

According to the World Bank, the global economy will likely shrink by over 5% this year, making this the deepest recession since World War II.

The financial impact of the coronavirus will affect mortgages, car payments, student loans, and bill payments. People facing job losses also need to be prepared for this unprecedented time.

Despite this economic hardship, thirty-seven percent (37%) of Americans are saving the same amount of money from their paychecks as before the pandemic.

The benefits of budgeting are vast, but not something that most Americans think about every day. While the economy’s unpredictability is top of mind now, budgets go beyond the headlines and set up for long term success.

Clutch surveyed 502 Americans about their budgeting habits this past year. We found that budgets are important to people's lives, but can change frequently due to outside influences or new priorities.

When a couple gets engaged, plenty of questions and scenarios run through their mind.

Where should we have the ceremony? What food should we serve? What should the color scheme be?

The first follow-up to these questions should be a simple one: What is our budget?

More than half of Americans (58%) feel comfortable creating a personal budget.

People who do not have a budget tend to save less than people who do. Without a secure budget, people find themselves spending more than necessary or getting off track completely by screening honeymoon destinations.

Tremaine Wills, an investment advisor at Mind Over Money, believes in the correlation between saving money and having a well-planned budget.

"If you aren’t tracking your money and you attempt to save more, you likely end up taking the money out of your savings regularly due to expenses you haven’t accounted for," Wills said.

If you aren’t tracking your money and you attempt to save more, you likely end up taking the money out of your savings regularly due to expenses you haven’t accounted for.

Budgets keep people accountable, which means fewer people should be dipping into their savings accounts.

“The first step for organizing a budget is to start tracking expenses,” said Anna Barker, a personal finance expert at LogicalDollar. “Once someone knows where their money is going they are able to begin allocating their money more effectively.”

With a budget, you can assign money for certain spending. Start by writing down your high-priority expenses and the frequency of those payments, such as rent or student loans.

A budget should cover all of your financial needs. If your budget needs to be revisited, allow for that flexibility.

Baruch Silvermann is the CEO and Founder of The Smart Investor, an online academy for investors. He has practical advice for Americans impacted by COVID-19.

“A lot of people order endless, unnecessary items online because they’re bored sitting at home,” Silvermann said. “Instead, make it a challenge to see just how much you can save during this period.”

If you find yourself having a little money left over at the end of the month, put it to good use. Invest in something for your remote working station, get ahead on a payment, donate to charitable causes, or even start looking ahead to the future.

All the hard work spent crafting your budget will be for nothing without a system for accountability or outside resources to keep you in line.

Danny Kofke is an elementary school teacher. His wife, Tracy, is also a teacher. The couple has two teenage daughters, so saving money has become second nature.

“We budget every dollar we make,” Kofke said. “I used to teach pre-K and have found that money behaves like four-year-olds – if you don’t tell it where to go, it runs all over the place.”

I used to teach pre-K and have found that money behaves like four-year-olds – if you don’t tell it where to go, it runs all over the place.

Kofke and his wife create a new budget every month, factoring in their mortgage and electricity bills. They also factor in holidays, insurance payments, and vacations.

Every month, he transfers $100 into a fund for their annual summer vacation.

The purpose of a budget is to keep finances in line. But what happens when priorities get out of whack? Or get stuck in their tracks?

Everyone loves to look at a nice blanket of snow, but the majority of the time, you find yourself stuck and searching for any way to get your car out.

Getting out of debt is a similar battle that many US consumers face.

On average, each household with a credit card carries more than $8,000 in debt. A person’s budget might change depending on higher interest rates and economic expansion.

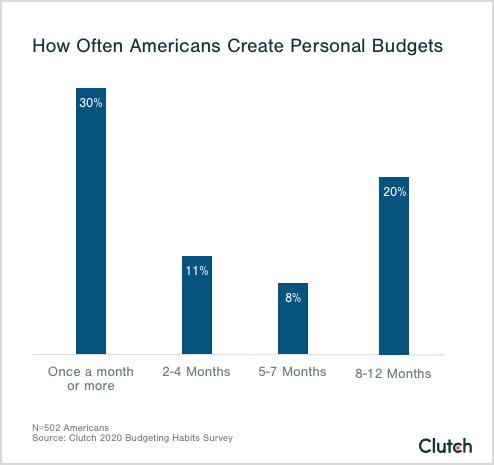

In the past 12 months, 20% of Americans created a personal budget once a month.

Millennials (34%) and baby boomers (31%) are the groups that change their budgets the most often. For the Americans who create a personal budget once a month, it illustrates the need to monitor expenses and prevent debt.

How people begin paying off that debt is up to the individual. Two popular methods are a bit cold, but effective. These methods are:

According to debt.org, the total US consumer debt is at $13.8 trillion. A lot of this is due to a little piece of plastic.

Since 1950, the modern-day credit card has been a staple in many American homes. The average credit cardholder has around four cards, which gives more people greater purchasing power.

The coronavirus pandemic has led us into unfamiliar territory – especially when it comes to buying and spending.

People are worried about how the virus could spread, and if handling an exposed dollar bill could leave you with higher medical bills.

With the fear of handling money, many businesses are going completely cashless, which means more swipes for the smallest purchases.

How can a budget stop this slippery slope of credit card spending?

Anna Keisler is a financial planning associate at SG Financial. She suggests a simple first step to deal with debt.

“The best thing to do is to see where you’re starting: See how much money you make, how much you’re spending, and how much you owe,” Keisler said. “Then you can create a plan that works for you to tackle debt.”

Here are a few ways to easily cut down spending:

Changing your budget frequently is okay, and may even make it easier to off your debt as quickly as possible. Once you have a plan in place to start managing your debt, the less you'll worry.

Once a couple’s wedding budget is in place, they’ll be ready, even if disaster strikes.

Organized finances provide peace of mind when economic hardship hits. Almost half of Americans (49%) felt financially prepared for the economic impact of the coronavirus.

Before COVID-19, 41% of Americans only saved between 1% and –20% of their paycheck.

Andrew Roderick, CEO of Credit Repair Companies, says to organize finances and allocate money for savings as soon as possible.

“Save as soon as you're paid,” Roderick said. “Don’t wait until the day before and save what you have left because you likely won’t have anything left.”

Save as soon as you're paid.

A good place to start is setting up automatic payments between checking and savings accounts. Once an initial deposit is set up, all the work is done.

To keep finances on track, people should plan their expenses with their income. If there isn’t a balance between the two, there’s a problem.

Money is serious business to most, but making planning and budgeting fun ensures budgeting becomes seamless.

Shayne Sherman, CEO of TechLoris, a computer tech company, suggests gamifying your budgeting process.

“Use a calculator to crunch numbers – use Monopoly money to see how much you spent in a month," Sherman said. “You need to change the way you look at money if you want to change your habits.”

To make budgeting as stress-free as possible, recognize what method works best for you. Talk out your challenges with someone because their advice could impact your decision-making.

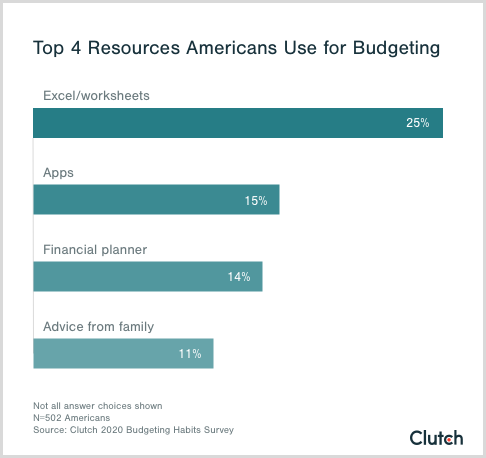

While 44% of Americans don’t use any of the resources referenced below, people are considering outside help to make their budgeting goals reality.

Budgets are a lot to keep an eye on. As more and more people are discovering the benefits of budgeting, tools such as Mint.com are gaining popularity.

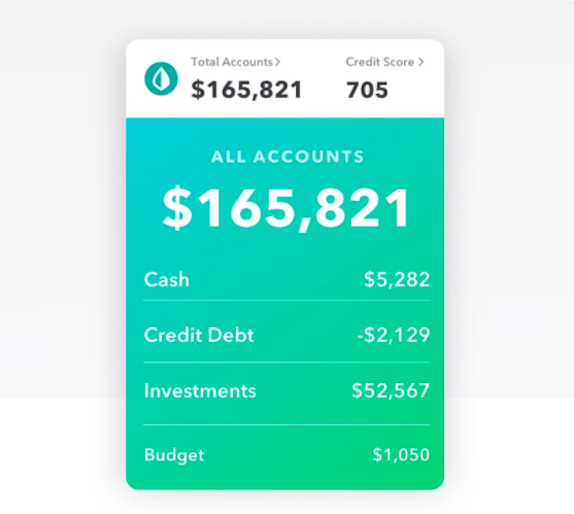

Mint tells users their total account balance, credit score, and owed payments, storing all of the important budgeting information in one place.

But, there isn’t a one-size-fits-all budgeting tool for everyone.

“The hardest thing about budgeting is finding a system that works for you,” said Rebecca Lake, a personal finance expert and owner of Boss Single Mama. “I’m not a spreadsheet person, so I use a calendar with due date reminders and automatic payments to make it work.”

Your system for budgeting can be as complex or easy to use as you make it. Just make sure you keep up with it.

While COVID-19 put a damper on future travel and event plans, a budget can still force you to map out your goals for money-saving.

In June, a majority of Americans (59%) spent most of their paycheck on housing, including rent, utilities, and mortgage payments.

Following housing, Americans spent the most on health insurance (9%), individual vehicle costs (8%), and education (6%).

Rebecca Forst relays financial tips from her past experiences on her blog, Financially Minded Millennial.

While she and her husband are close to being debt-free, the coronavirus threw their plans for a loop when her husband was laid off.

Their travel and personal care budgets are all going to savings. Their entertainment budget is going somewhere else.

“We now make cooking a form of entertainment,” Forst said.

Forst and her husband are spending more on a necessity but finding ways to make it fun and creative for themselves by trying new recipes.

Elizabeth Warren, U.S. Senator from Massachusetts, popularized the “50/30/20” rule for budgeting.

In her book, All Your Worth: The Ultimate Lifetime Money Plan, the plan splits your budget: 50% on needs, 30% on wants, and 20% on savings.

The intuitive plan helps people reach their financial goals while looking ahead. It allows for control and flexibility.

“If your goal is saving for retirement, make sure you contribute to that each month,” said Jackie Rockwell, a blogger that covers financial topics. “If your goal is to pay off student loans, then include those in monthly payments to your budget.”

Expenses like student loans are necessities and are beneficial in the long run.

A secured budget will make those long-term goals closer to reality.

The purpose of a budget is simple: to save money. Budgets benefit future goals and investments, organize finances, and keep consumers out of debt.

It is a misconception that budgets prevent you from having fun. In reality, a well-planned budget gives people the power to spend their money on what’s most important to them.

The first months of managing a budget can be hard. It isn’t something that will miraculously make sense overnight. Getting your finances under control starts when you’re ready.

Figure out what will hold you accountable. Is it family? Is it a concert with your favorite musician?

Consult outside resources to find out the best place to start, such as financial bloggers or friends and family who’ve struggled with money.

Most importantly, have confidence in yourself and your decisions. The coronavirus pandemic caused a lot of people to start thinking about their expenses. Make the decision to carry on that mindset as you plan for the future.

Clutch surveyed 502 people across the U.S from July 7-July 11, 2020.

41% of respondents were female; 44% were male, and 15 % didn’t specify their gender.

Baby boomers and older make up 32% of respondents; Generation Xers make up 28%; millennials make up 22%, and Generation Z makes up 4%. 14% of respondents didn’t reveal their age.

Respondents are from the South (33%), Midwest (32%), West (23%), and Northeast (11%).

Clutch surveyed 502 people across the U.S from July 7-July 11, 2020.

41% of respondents were female; 44% were male, and 15 % didn’t specify their gender.

Baby boomers and older make up 32% of respondents; Generation Xers make up 28%; millennials make up 22%, and Generation Z makes up 4%. 14% of respondents didn’t reveal their age.

Respondents are from the South (33%), Midwest (32%), West (23%), and Northeast (11%).