Updated December 12, 2024

Small businesses take a variety of approaches to budgeting. Clutch surveyed small business owners and learned that most small businesses plan to have a budget in 2021, but that a business’s budgeting strategy depends on its size and the overall economic environment.

Updated April 15, 2022

You may have heard this quip, or something like it: Don’t tell me what you value, show me your budget and I’ll tell you what you value.

Looking for a Accounting agency?

Compare our list of top Accounting companies near you

That advice applies both personally and professionally. Just as people demonstrate what they care about when they spend, businesses expose their values when they budget.

Still, budgeting is not universally-practiced, according to Clutch’s recent survey data.

We surveyed 335 small business owners and managers to learn about their budgeting processes and found that:

Business owners will approach the budgeting process based on their needs, specifications, and attitude.

Need help managing your small business budget? Hire an accounting firm using Clutch. Search for top agencies based on location, price, and review ratings.

Budgets may seem ubiquitous, but not every business considers them necessary.

In fact, half of small businesses (50%) operated without an official budget in 2020.

Experts say that companies may forgo a formal budget for fears that a budget would be unnecessary or fail to anticipate fluctuations in business earnings.

Rhett Molitor is the co-founder of Basis 365 Accounting, a cloud-based accounting service. He says he’s seen small businesses forgo budgets because creating one seems restrictive.

“A lot of people create their own small business because they don’t want to work for a corporation,” Molitor said. “They want to do their own thing.”

These small business owners may see a budget as something that will limit their business’s growth by tying them down to a rigid structure.

“You don’t really want to hold yourself accountable to anything because that’s what you’re trying to escape,” Molitor said.

But other experts think these businesses may create more challenges for themselves by skipping a budget. This is because budgeting helps small businesses focus.

“Having a budget keeps everyone working toward the same goals and helps scale your business,” said Wanda Medina, co-founder and CEO at Maventri, a full-service digital firm providing accounting, marketing, and administrative support services.

Medina says that without a budget it's difficult to determine what your challenges are and how quickly you need to fix them before running out of financial resources. Budgets ease the process of monitoring finances and making decisions.

“From month to month, you’ll be able to improve and get back on track,” Medina said. “If your expenses go up, you’ll know why, and you can fix it next month.”

When teams are misaligned on their goals, miscommunication can arise and limit long-term planning.

Donna Conte, service area leader for accounting services at Warren Averett, a full-service accounting and advisory firm, agrees that budgeting improves long-term planning.

“Without a budget, you have no measuring stick to evaluate your goals and performance,” Conte said. “[A budget] is part of developing a business and its growth goals.”

“Without a budget, you have no measuring stick to evaluate your goals and performance.”

Overall, half of small business owners may be shortchanging their businesses’ potential by skipping a budget.

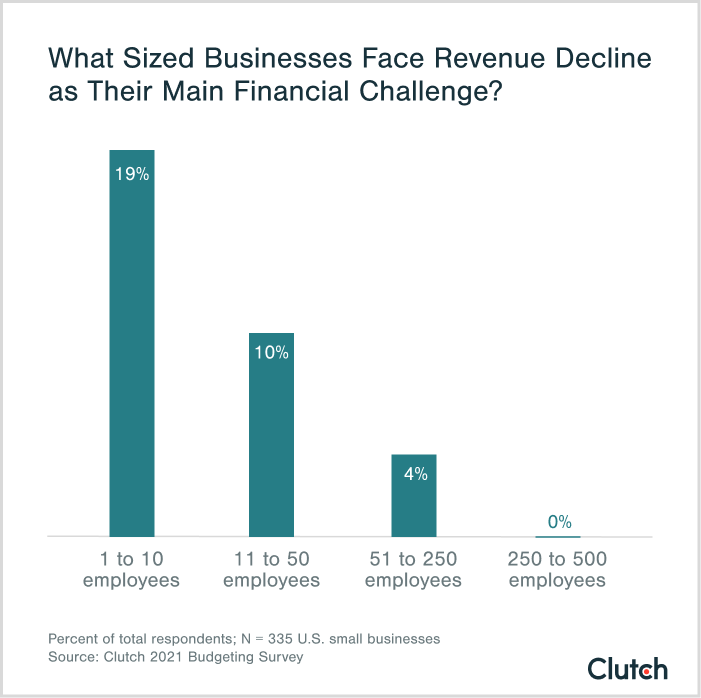

The smaller the business, the less likely it is to have a budget.

Among businesses with 1 to 10 employees, nearly one-fifth (19%) did not have any kind of budget – documented or informal – in 2020.

By comparison, 0% of companies with 251 to 500 employees did not have any kind of budget in 2020.

Experts say that the smallest businesses may be able to get by without a budget, even if a budget could benefit them.

“Smaller companies have fewer costs than larger ones, and therefore they are easier to track,” said Bryce Welker, owner of CPA Exam Guy.

Welker says that when he first founded his company, he committed his spending to memory. But as his company grew, his perspective changed.

“Hiring more people forced me to confront the significant expenses I was incurring and the potential for disaster if our capital was poorly managed,” Welker said.

Other experts say that as a business grows, a budget provides vital direction.

“As a business goes from $1 million to $5 million to $10 million to $20 million – at some point, you have to create a budget because you don’t know where that ship is sailing,” Molitor said. “Before you could see ahead of you, but the bigger you get – you’re going to get hit with surprises.”

The smallest businesses may live without budgets, but larger businesses use budgets to navigate increased spending and unexpected financial obstacles.

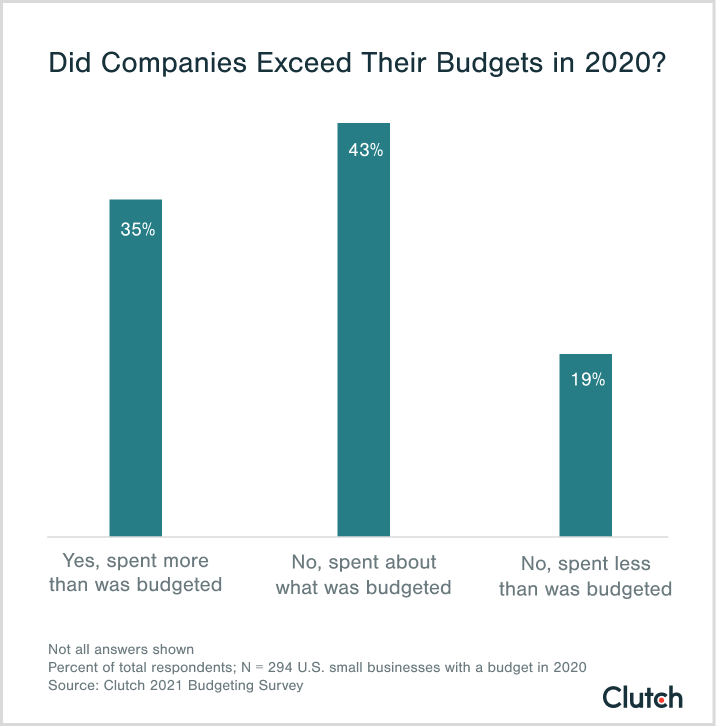

The day-to-day obstacles of running a business may make small business owners fear that sticking to a budget is impossible. But despite the challenges, small businesses with budgets generally don’t exceed them.

About one-third of small businesses with budgets (35%) exceeded their budget in 2020.

Meanwhile, 43% of small businesses spent about what they budgeted for, and 19% spent less than their 2020 budget.

Experts say that having a budget helps businesses regularly evaluate their financial progress.

Matt Ross, COO of RIZKNOWS and The Slumber Yard, two e-commerce websites, recommends cross-checking your businesses budget with its financial performance every month.

“By looking at your actual results versus your budget every 30 days, you can see how and why your business is missing the mark and make timely adjustments,” Ross said.

Budgets may serve as a useful financial reference for businesses, but it is still possible to exceed a budget.

Roy Morejon, the president and co-founder of Enventys Partners, a consultancy specializing in e-commerce, says that there are 3 reasons businesses break budgets:

Budgeting does not guarantee that every part of a business’s spending will go to plan. And when budgeting doesn’t work, experts tend to blame the challenges of unexpected expenses.

“Small businesses will break their budgets for the same reason that we all break our budgets in our personal finances: unexpected expenses, emergencies and opportunities,” said Jeff Zhou, CEO of Fig Loans, a loan provider.

Zhou says that the opportunities provided by financial investment or a hiring spree can cause businesses to exceed their budgets. But those losses are sometimes dwarfed by the profit return such business activities provide.

Zhou says that breaking a budget isn’t always a bad thing, and that budgets should be flexible to reflect the unpredictable dynamics of actually running a business.

Overall, businesses with budgets usually spend what they planned, and have clear benchmarks to judge their expenses against.

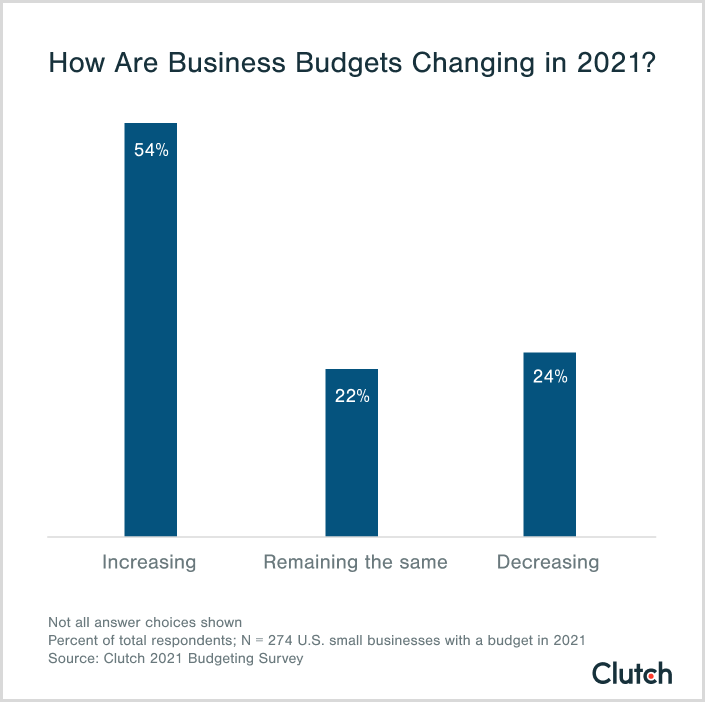

Among small businesses that budget, most plan to spend more in 2021.

More than half of small businesses (54%) say that their 2021 budget will be larger than their 2020 budget.

A little more than 2 out of 10 businesses (22%) expect their budget to stay the same, and less than one-quarter (24%) expect it to decrease.

Experts say that the improving global business environment will fuel more spending and higher budgets for companies.

“It's all about positioning for the next boom,” said Alina Clark, growth manager and co-founder of CocoDoc, a software development company. “A large number of businesses are planning for bigger budgets ahead of the expected post COVID-19 resurgence.”

Clark says that companies are particularly likely to increase their hiring and payroll budget and boost marketing spending.

Increased budgets should theoretically lead to bigger profits. Experts say that small businesses should budget for revenue in addition to spending.

Caitlin Smith, Managing Director of Blackbird Philanthropy Advisors, a philanthropy consulting firm, recommends keeping your goals focused and emphasizing growth goals, rather than only spending plans.

“When creating a brand new budget, you need to have some specific, realistic goals in mind,” Worm wrote. “These can include: ‘To break even in Q3’ or ‘To have ten customers paying $10,000/year or more by end of the year.’ The budget should tell a story of how you will run your business and what goals you want to achieve.”

Most small businesses plan to spend more this year, and companies with growing budgets are probably also planning for a boost in profit.

Businesses take different approaches to budgeting depending on their size and the economic environment they operate in.

Most small businesses (54%) will have an official, formally-documented budget in 2021. As business spending increases, companies will be more likely to create and adjust budgets.

Companies looking to adjust to budgeting in the post-COVID era should remember that:

Some businesses owners consider budgeting unnecessary and others employ a variety of budgeting strategies. But small businesses should strongly consider creating and documenting a budget in order to plan and track finances.

Additional Reading

In 2018, Clutch surveyed 302 small business owners or managers who are involved or very involved in their business’s financial decisions. Small businesses are defined as those with 500 or fewer employees.

Fifty-eight percent (58%) are female and 42% are male.

Sixty percent (60%) of respondents have owned or managed a small business for 5 years or more; 17% for 3-4 years; 13% for 1-2 years; 10% for less than 1 year.

In 2021, Clutch surveyed 335 owners and managers of small businesses with 500 employees or fewer.

Forty-five percent of respondents’ businesses (45%) had between 1 and 10 employees; 34% had 11 to 50 employees; 17% had 51 to 250 employees; 4% had 251 to 500 employees.

More than half (52%) of survey respondents were male, and 48% were female.

Fifty-six percent (56%) of respondents were between 18 and 34 years old; 35% were between 35 and 54, and 9% were 55 and older.

Respondents were from the South (38%), Midwest (24%), Northeast (21%), and West (17%).

![How to Create a Budget for Accounting Services [With Template]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/7dce8a5e1339227e397cf68f6f555f92.png)