Updated February 26, 2026

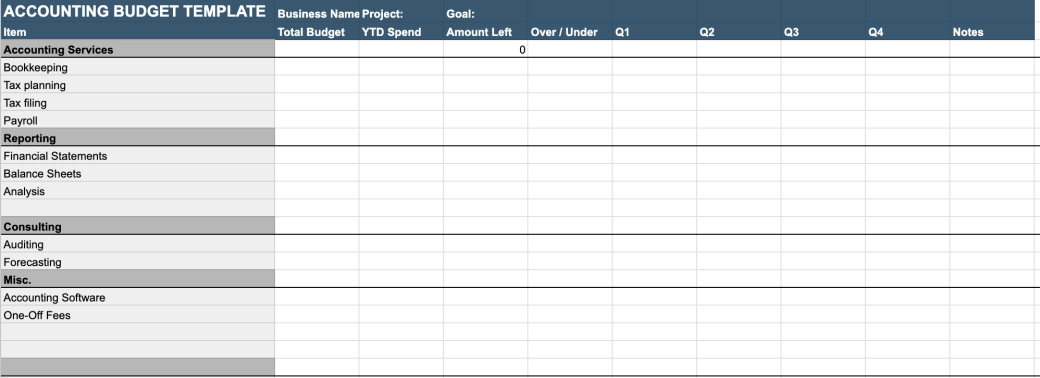

Creating a budget for accounting services is an integral step toward achieving your financial goals. Use our accounting budget template to streamline the process for your business.

Accounting plays a crucial role in the success and growth of businesses, no matter their size. The importance of accounting help for businesses cannot be overstated. It provides accurate financial information and reports that are essential for decision-making, tracking income and expenses, managing cash flow, ensuring compliance with tax regulations, and planning for future growth.

Are you looking for ways to manage your finances effectively and optimize your accounting services? Creating a budget can be a game-changer in maintaining financial stability and making informed business decisions.

Looking for a Accounting agency?

Compare our list of top Accounting companies near you

In this article, we will guide you through the steps of creating a budget specifically tailored for accounting services.

After your budget is in place, hire an accounting firm to support your accounting needs.

There isn’t a standard budget for accounting services because of the differences between accounting systems and other considerations. Still, each budget should try and factor in the following:

It is important to remember that any type of budget should be flexible. Review past financial records, consider future business needs, and chat with the relevant stakeholders to accurately estimate how to allocate funds.

Setting up financial goals is important when crafting a budget for accounting services.

Your financial goals give a clear direction for your business. These goals outline everything that you want to achieve financially, so aligning your accounting budget with them will ensure that the proper resources are being allocated.

These financial goals can also help with long-term planning and critical decision-making and provide your business with some accountability.

By incorporating your financial goals into your accounting budget, your chosen accounting resource (whether it is an accounting firm or CPA (certified public accountant)) can ensure that they are working to achieve your desired outcomes to the best of their ability.

To have an accurate budget for accounting services, your business needs to assess the revenue that is coming in.

Revenue serves as the foundation of your budget. You can create a realistic and achievable budget by accurately assessing your revenue. Understanding your expected income streams allows you to allocate resources effectively, set appropriate spending limits, and make informed financial decisions.

Understanding your revenue and connecting factors will inform your planning for accounting services. Your team will be able to understand the need for bookkeeping services or any support for business taxes.

By clearly understanding your revenue, you can create a more reliable and effective budget that aligns with your business goals and objectives.

The best way to ensure your budget for accounting services stays on track is to make sure that your team is frequently monitoring your expenses.

You can identify any issues or overspending early by tracking your actual expenditures against the budgeted amounts. This allows you to take corrective actions and make necessary adjustments to bring your expenses back in line with the budget.

Monitoring expenses helps manage costs effectively. For example, you can make sure payroll services or outsourced bookkeeping services are a full-time focus for an accounting firm, whereas tax-related services are just a focus during specific quarters.

By closely monitoring expenses, you can maintain financial discipline, optimize resource allocation, and achieve your desired financial outcomes.

Owning a business can be a challenge, especially when things change from day to day. When crafting a budget for accounting services, think frequently about adjustments.

Considering adjustments and seasonal trends helps ensure that your budget reflects the realities of your business. By considering factors such as seasonality, cyclical fluctuations, or specific events that impact your industry, you can create a more accurate and realistic budget.

Some adjustments can include exploring added technology solutions like accounting software that will streamline processes or prioritize services that might be seen as more essential than other accounting services like payroll.

By reviewing your existing budget and seeing how much you allocate to accounting services, you will be at the right starting point for making adjustments.

Small business owners and entrepreneurs alike need accounting support.

Factor in hiring a CPA, accounting firm, or other types of accounting support into your budget.

Conduct thorough research to find reputable accounting firms or resources. Consider factors such as their experience, expertise, reputation, and services offered. Online directories, referrals, and professional organizations can help in your search.

After vetting different resources, you’ll be able to find which fits your business and budget the best.

Use our free template to help your team with your accounting fees. Each business has its own requirements, but having an accountant or CPA supporting your business needs is crucial.

Plan your accounting services budget according to your business priorities.

Download your budget template for outsourced accounting services.

Consider the following factors when creating an accounting budget for professional services:

The cost of accounting will evolve over time, especially as your business grows. It’s critical for your small business to remain flexible and find the best accounting partnership for your goals.

See what it costs to hire top-tier accounting services with our pricing guide.

Creating a budget for accounting services is a critical step in ensuring your business's financial success and stability. By carefully considering your business needs, evaluating different service providers, and determining cost-effective solutions, you can allocate your resources wisely and optimize your financial management.

A well-planned budget empowers you to make informed decisions, track expenses, and identify potential areas for improvement. It also allows you to effectively monitor the performance of your accounting services and make adjustments as necessary.

Ultimately, by prioritizing budgeting for accounting services, you are setting yourself up for greater financial control, increased efficiency, and long-term success in managing your business's financial health.