![How to Budget for A Business Relocation [With Template]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/da44ab3f488dff79138f31d3d3df081c.png)

![How to Budget for A Business Relocation [With Template]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/da44ab3f488dff79138f31d3d3df081c.png)

Updated February 16, 2026

Get ready to revolutionize your commercial real estate services with our free budgeting template. Learn the secrets to crafting a seamless budget that will take your business to new heights.

Are you ready to take charge of your commercial real estate (CRE) services?

Commercial real estate provides the foundation for small businesses to thrive, offering them the opportunity to make their mark in the market and establish a strong presence. Whether it's a cozy café, a trendy boutique, or a bustling office space, commercial real estate is a launchpad for dreams to become a reality.

Looking for a Real Estate agency?

Compare our list of top Real Estate companies near you

Use this article to help plan your company’s goals for commercial real estate with the top considerations and free budgeting template.

Building a commercial real estate budget involves various factors to ensure accurate financial planning and management.

Here are some key components that are typically included in a commercial real estate budget:

Before establishing a budget for commercial real estate services, business owners must know what they want to do with their property.

Create a plan for your business goals with your commercial building. By clearly outlining your objectives, you can allocate resources effectively and avoid unnecessary expenses. This ensures that every dollar spent contributes directly to achieving your specific goals.

Setting clear goals allows you to identify which areas of your commercial real estate services require the most attention and investment. You can allocate funds accordingly, ensuring you make strategic decisions aligning with your objectives.

By defining your goals upfront, your business creates a benchmark to measure your progress. This enables you to evaluate the effectiveness of your budgeting decisions and adjust strategies if necessary, ultimately ensuring optimal performance and success.

The next step is to gather and analyze data as it relates to your ideal property’s income and expenses—time to research the real estate market and evaluate the property value of several properties.

For example, you want to see how much work has been put into a property’s construction to know if future upgrades are needed.

When you get closer to closing on a property, you should have access to financial statements and other reports that will help you evaluate as well.

Armed with this information, you can stay ahead of the game, recognize risks, and seize opportunities.

Next, be sure to estimate your expenses for commercial real estate services within your budget. These expenses include the costs that you incur while maintaining and operating your property, such as repairs, insurance, taxes, occupancy fees, and more.

Accurate expense estimation allows you to identify potential risks and develop contingency plans. It enables you to anticipate unexpected costs, such as property repairs, legal fees, or market fluctuations, and set aside funds or acquire appropriate insurance coverage to mitigate these risks.

To estimate your expenses, you will need to consider factors like your property’s size, location, amenities, age, and more.

For example, if your business has chosen an older office building, you might need to make more improvements early on, like replacing the HVAC system or upgrading the decor.

Estimating expenses is crucial for effective financial planning and budget allocation.

Understanding the profitability of your property helps you evaluate the ROI. By assessing the expected income against the initial investment and ongoing costs, you can gauge the long-term financial benefits and make informed decisions about acquiring, developing, or divesting commercial properties.

Planning for profitability also ensures that your property investment is valuable and viable – you can determine if the property will generate the desired returns (open storefront for visitors, enough square feet for your internal team, etc.) and fit within your overall business objectives.

Ensure your budget aligns with profit goals while maximizing your commercial property investment return.

When crafting a budget for commercial real estate services, consider the benefits of hiring a commercial real estate firm.

These firms have a deep understanding of the market, allowing them to provide valuable insights. Along with their knowledge, commercial real estate firms have access to a wide range of property listings. They can help your business find the right property that aligns with your requirements.

Overall, hiring a commercial real estate firm brings a wealth of knowledge, expertise, and resources to the table. Working with professionals in the field ensures that your budget aligns with your goals, increases profitability, and enhances the overall success of your commercial real estate endeavors.

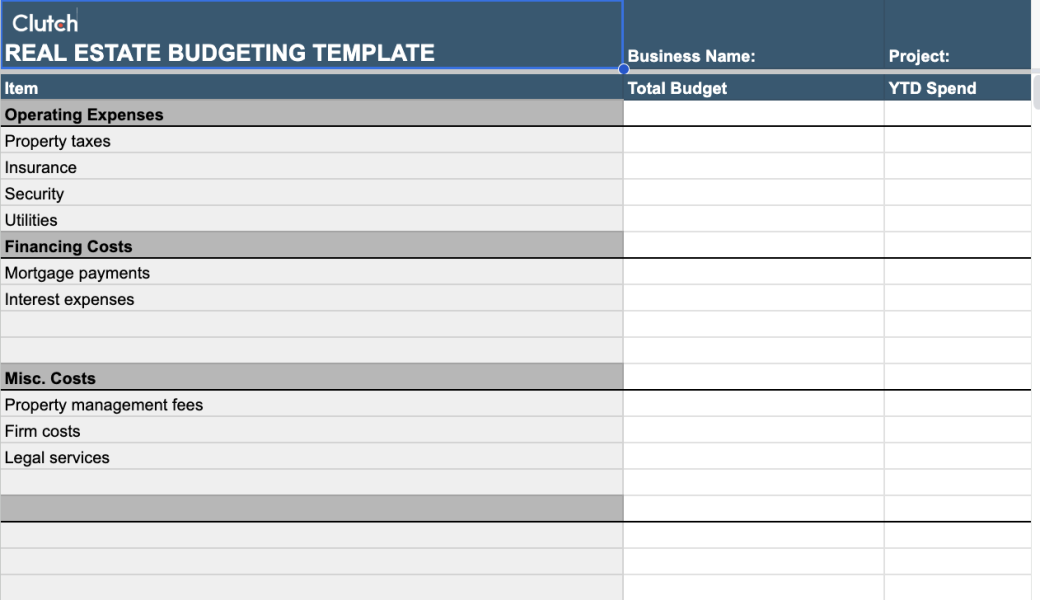

Use our free template to budget for commercial real estate services. Each business has its own requirements and bottom line for finding a new property.

Future property owners should plan their budgets according to business priorities and operating costs.

Download our budgeting template for commercial real estate services

Consider the following factors when creating a budget for commercial real estate services:

All of these factors might depend on a number of circumstances, so be open-minded when crafting the CRE budget for your company.

Creating a commercial real estate budget is not just a necessity, but a powerful tool that can propel your business towards unparalleled success.

It's important to note that commercial real estate budgets may vary depending on the specific property type, location, market conditions, and individual investment goals. Be strategic about how you want to position your company when going through the budgeting process.

Consult with professionals such as real estate agents, accountants, and property managers for accurate budgeting advice tailored to your unique circumstances.

Hire a commercial real estate company to help with your real estate needs.

, 2, Use our budget template for your company’s commercial real estate planning.

![How to Budget for A Business Relocation [With Template]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/da44ab3f488dff79138f31d3d3df081c.png)