Updated January 2, 2025

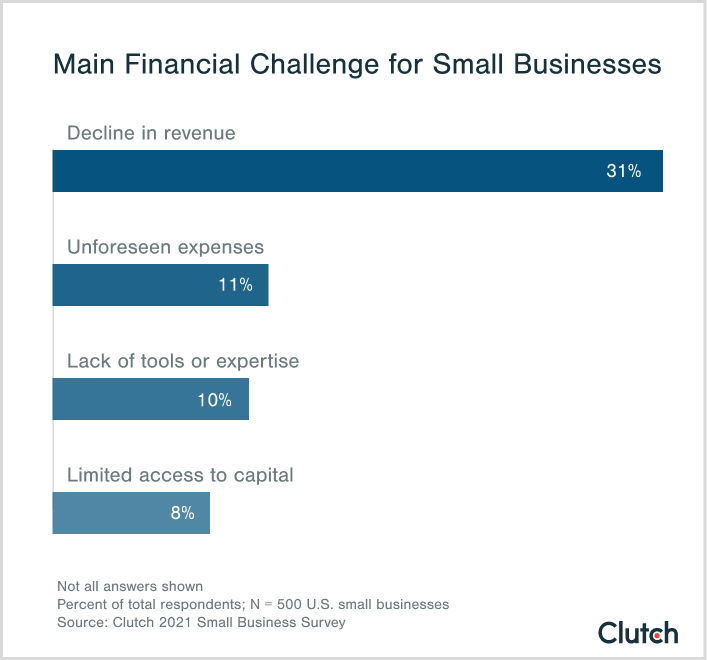

Small businesses faced a number of financial challenges in 2020 and should be prepared to encounter them again in the future. Clutch surveyed small business owners and managers and found that companies’ main financial challenges in 2020 included declining revenue, unforeseen business expenses, lack of financial tools and expertise, and limited access to financial capital.

Scott Hasting started with one policy: There would be no layoffs.

Hasting, the co-founder of BetWorthy, which develops online sports betting software, recognized when the COVID-19 pandemic struck that his company’s business would be strongly affected.

Looking for a Accounting agency?

Compare our list of top Accounting companies near you

The sports world came to a halt, and Hasting came to some tough conclusions, including:

Hasting is not the only small business owner who faced financial challenges in 2020. Clutch surveyed 500 small business owners and found that nearly one-third of small businesses (31%) said their main challenge was declining revenue.

Other financial headaches included:

Dealing with financial challenges is part of running a business, and experts told Clutch that by using the right financial tools and employing appropriate budgeting processes, companies can weather financial difficulties.

Businesses can use this report to learn about the financial challenges they may face and develop strategies to overcome them.

Businesses exist to make money, and when the cash flow slows, business leaders have reason to be concerned.

The COVID-19 pandemic made 2020 a difficult year for many companies. Nearly one-third of companies (31%) said their biggest financial challenge was a decline in revenue.

Businesses in certain industries were more likely to see their revenue drop because of COVID-19.

For example, Casey Halloran, co-founder and chief executive of Costa Rican Luxury Vacations, a travel service, said that his company saw a 70% year-over-year reduction in revenue from March to December 2020.

The solutions weren’t easy. Halloran elected to:

But Halloran never stopped marketing or selling his product. In fact, the Costa Rican Luxury Vacations team decided that they would make bringing in new revenue their biggest focus.

Now, more than a year after businesses felt the effects of COVID-19, Costa Rican Luxury Vacations is earning about 70% of its pre-pandemic revenue.

Just as COVID-19 presented cash flow challenges for companies that rely on in-person travel, the smallest businesses were much more likely to endure reduced revenue in 2020.

Close to half of companies with 1 to 10 employees (45%) said their main financial challenge in 2020 was a decline in revenue. Only 16% of businesses with 251 to 500 employees said the same.

Experts say that the smallest businesses were more likely to face financial challenges because they often provide niche services.

Naomi O’Callaghan is the general manager of Wood Flooring Ireland, a wood flooring business with six full-time employees. She says that her family-operated team has used new revenue-generating marketing activities to survive the pandemic.

“As construction projects halted globally in 2020, we had to grapple with the effects,” O’Callaghan said. “We upped our online presence with an emphasis on social media, mainly Instagram. If customers can’t enter your physical showroom, it is imperative to create a digital version.”

Now, Wood Flooring Ireland is in the process of opening a second facility and expanding its services in Ireland.

Declining revenue is a serious issue that requires a serious business strategy. Small businesses in particular should anticipate the challenges of declining revenue during an economic downturn.

There are always issues when running a business: Employee dissatisfaction, providing health care, paying taxes, staying passionate and excited about the work – all are challenges that any business owner or manager may encounter.

Another inevitable small business challenge? Unforeseen expenses: 11% of small businesses said their main financial challenge in 2020 was unforeseen expenses.

Experts say that while it may be impossible to predict the reason for or amount of unexpected expenses, it is certain that a small business will at some point endure them.

“The reason that businesses have unforeseen expenses is similar to why regular people do,” said Omer Reiner, licensed realtor at Florida Cash Home Buyers, a real estate company. “Life is unpredictable!”

Reiner says that businesses can never fully anticipate when the cost of raw materials will increase, or rent will go up, or equipment will break down.

To adjust for these moments, Reiner suggests that small businesses have money or a line of credit set aside. That way, companies can adjust to new circumstances while continuing to service customers.

In general, experts believe that businesses should configure their budgets to account for unforeseen expenses.

Naomi Bishop is the chief executive of Surfky, which provides reviews and insights about loans, credit cards, and insurance, among other topics. She says that a business’s adaptability to unforeseen expenses can be determined by whether it practices static or flexible budgeting.

Bishop prefers flexible budgets, saying that they are especially useful for handling one-off costs such as unforeseen expenses.

Overall, small businesses should manage their finances with the anticipation and expectation of unforeseen expenses.

Many small business leaders have felt the frustration of not having the expertise or ability to handle a specific task.

When managing finances, that frustration may be especially acute: if running a business is about turning a profit, then not being able to manage financial documents can feel like a complete business failure.

But companies feeling that frustration aren’t alone: 1 in 10 small businesses (10%) said their main financial challenge in 2020 was lacking the tools or expertise to manage finances.

Experts say that companies without the tools to manage finances usually haven’t made it a priority.

“Many small businesses don't have a handle on their finances because it's not where they invest resources,” said Ann Martin, director of operations at CreditDonkey, a ratings site for business finance providers. “But running payroll, doing taxes, and preparing for an audit are specialized skills.”

Martin says that CreditDonkey addresses the complications of financial management by investing in QuickBooks, a prominent accounting software service.

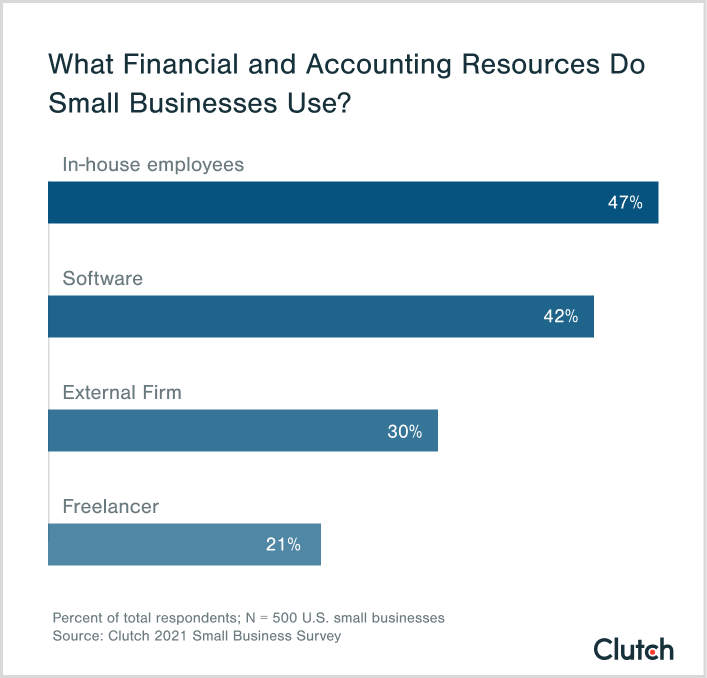

CreditDonkey isn’t alone: 42% of small businesses use accounting software such as QuickBooks to manage their finances.

Other common financial management resources include:

Businesses also can outsource their accounting operations to a dedicated companies for support. Whatever solution they pursue, businesses generally consider the costs and benefits each of these financial management resources provides before deciding what tools to invest in.

Learn more about hiring an accounting professional. Read Clutch's 'Accounting Glossary: 74 Terms to Know.'

Money is the oxygen of business, so few issues choke a company as much as lacking access to financial capital.

Sometimes companies need more money to pay their employees; other times to test run a new product or expand to a new market.

Whatever the reason for needing it, 8% of small businesses said that their main financial challenge last year was lacking access to additional capital.

Alan Harder is an entrepreneur and in 2020 founded his own mortgage brokerage.

He has taken on business debt in order to fund his ventures, but also recognizes that there are times when banks won’t extend more credit.

In those cases, Harder has employed financial strategies such as:

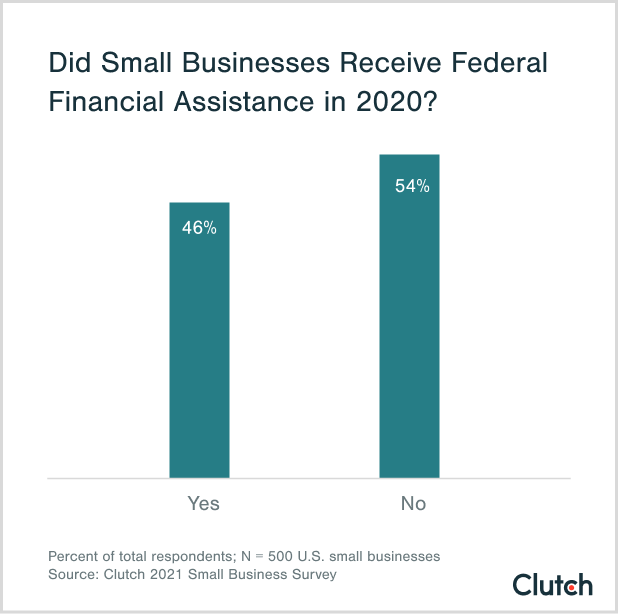

In 2020, some businesses considered these options and elected to pursue additional financial capital, particularly through federal financial assistance.

In response to the COVID-19 pandemic, the U.S. Small Business Administration introduced financial assistance and loans for small businesses.

Nearly half of small businesses (46%) took advantage of this federal assistance and loans in 2020.

Michael Jacob, owner of Filterking.com, an e-commerce company that mails fresh air filters to customers, said that his business received a paycheck protection program (PPP) loan in 2020.

“We needed the money to keep our staff payroll going in the 2nd quarter of 2020 while business was stressed,” Jacob said. “The funds helped us continue our business as normal and not make any layoffs. If we did not take the funds we would have cut half of our staff.”

Now, Jacob’s business is back to normal operating capacity and his employees’ jobs are safe.

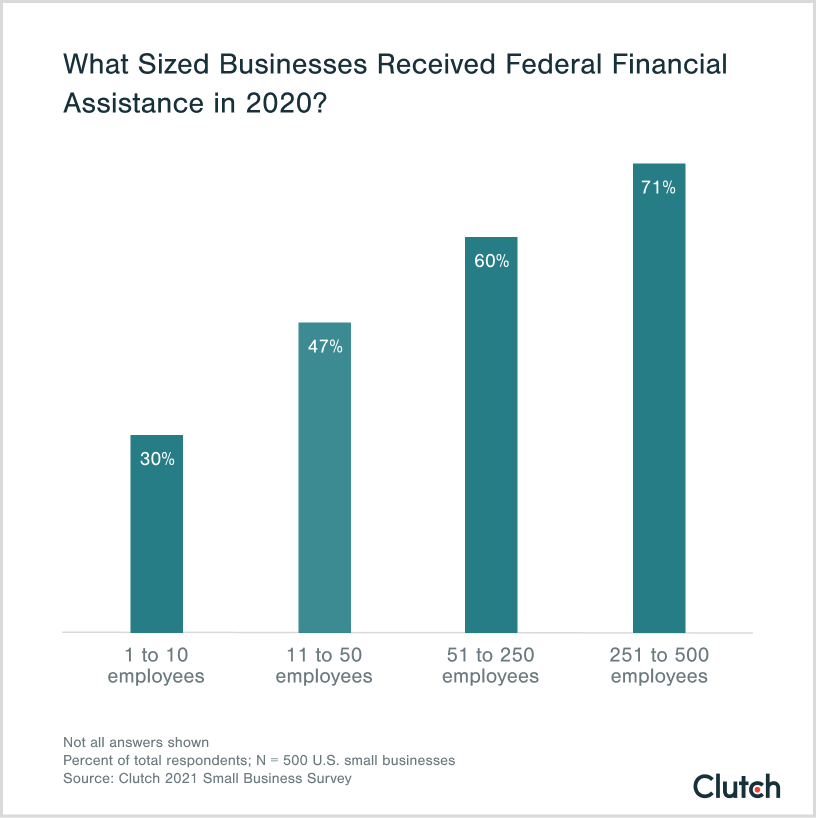

Federal financial assistance provides obvious benefits for businesses, but some companies are more likely to access it than others.

Less than one-third of small businesses with between 1 and 10 employees (30%) received federal financial assistance in 2020.

Meanwhile, close to three-quarters of companies with 251 to 500 employees (71%) received financial assistance last year.

Experts say that larger businesses are more likely to receive federal financial assistance because of need and ability to access the loans.

Rob Chamberlin, president of Security 101, an electronic security systems company, says that larger companies were more likely to receive federal loans for 3 reasons:

Since PPP loans will be offered until June 2021, small businesses will continue to face the challenges of securing federal financial assistance.

In general, small businesses should be prepared to overcome limited access to financial capital.

Financial challenges are a typical part of operating a small business.

In 2020, the main financial challenges that businesses faced included:

Experts say that consulting with financial experts and demonstrating adaptability will help small businesses weather financial challenges. Even in the midst of a difficult year, many businesses were able to grow revenue and serve customers.

Clutch surveyed 500 small business owners and managers in the U.S.

Forty-three percent of the businesses (43%) have 1 to 10 employees; 25% employ between 11 and 50 people; 18% employ 51 to 250 people; 15% employ 251 to 500 people.

Thirty-five percent of respondents (35%) live in the South; 23% live in the Northeast; 22% live in the West; 20% live in the Midwest.

Fifty-three percent of respondents (53%) are male; 47% are female.

Twenty-six percent of respondents (26%) are between 18 and 34 years old; 50% are between 35 and 54 years old; 24% are 55 and over.

![How to Create a Budget for Accounting Services [With Template]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/7dce8a5e1339227e397cf68f6f555f92.png)