Updated December 19, 2024

Startup funding enables entrepreneurs to execute on their ideas by creating products, hiring staff, or developing a website. Finding sources of funding during an economic downturn, however, poses a challenge for entrepreneurs in the COVID-19 era. We surveyed 501 business founders in the U.S. to find the most common sources of funding for new businesses.

Every week, millions of people in the U.S. tune in watch eager startup founders and entrepreneurs make the most important pitch of their careers: the chance to receive hundreds of thousands of dollars in funding from some of the most famous business investors in the world.

The wildly popular show, of course, is Shark Tank, and many successful entrepreneurs come away from the show with coveted capital and a new, famous shareholder to please.

Looking for a BPO agency?

Compare our list of top BPO companies near you

Not every founder, however, can land funding from the moneyed investors on Shark Tank: The reality of most startup funding journeys is quite different. Businesses large and small require funding to develop product prototypes, launch websites, rent office space and get their enterprise off the ground, often before they take on money from outside investors.

We surveyed 501 business founders in the U.S. to determine the top sources of funding for startups, and the challenges entrepreneurs face financing their businesses during the economic downturn caused by the COVID-19 pandemic.

Young entrepreneurs looking to launch their first official venture should take a closer look at their savings accounts.

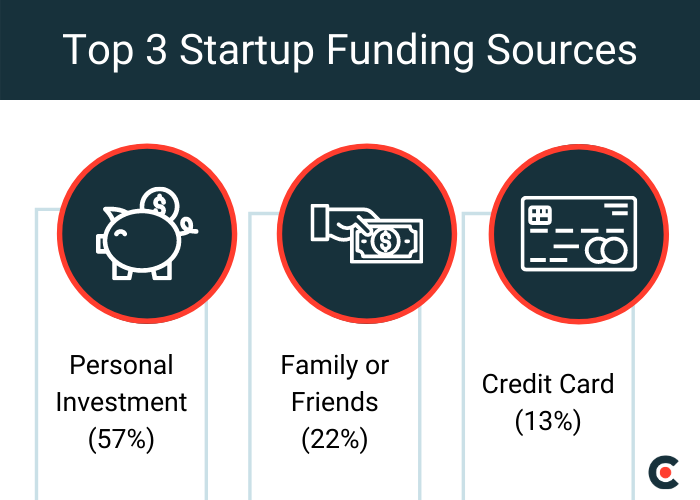

Most startup founders (57%) said a personal investment was their first source of capital in the first 3 months of starting their business.

Almost one in four founders (22%) took on a loan or investment from family or friends in the first 3 months of starting a business, and 13% of founders initially financed their business with a credit card.

Funding needs vary with the type of business. For example, online companies might have lower startup and operating expenses than a company that develops and sells a consumer product.

As businesses grow, expenses usually grow with them. Almost half of startup founders (47%) continued to invest personally in their business after the first 3 months, while 19% took on loans from family and friends.

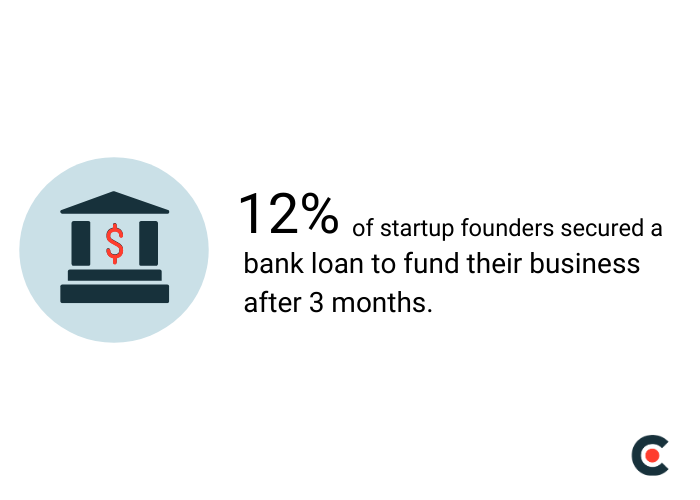

Just 12% of startup founders reported taking out a bank loan to fund their business after the first 3 months.

The COVID-19 pandemic presents a new challenge for entrepreneurs launching ventures to meet the moment. More than 100,000 small businesses have closed permanently, and without an end to the pandemic in sight, it could be some time before entrepreneurs feel comfortable staking their savings on a new enterprise.

An ongoing economic recession doesn’t mean new business ideas are being put on hold, though. Entrepreneurs with healthy savings accounts and lean business plans may be able to launch a successful venture with the right idea and professional guidance.

A recent New York Times feature, for example, spotlighted startup founders who recently created or adapted their businesses to respond to the challenges of the pandemic, such as the strained healthcare system and increasing demand for food delivery services.

Entrepreneurs looking to start a business during COVID-19 can find helpful resources at the U.S. Chamber of Commerce blog and the Small Business Administration’s startup funding costs calculator.

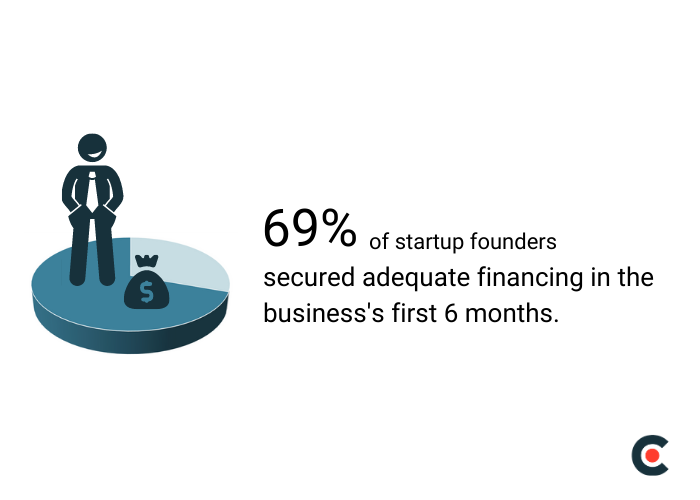

Because most founders self-fund their enterprises, most were able to adequately fund their ventures from the get-go.

More than two-thirds of startup founders (69%) were able to adequately finance their business within 6 months of its launch.

When people self-fund their businesses, they can:

Outside funding often means external accountability that may not always be welcome for new startup founders.

Stakeholders such as venture capitalists and angel investors may have more say in the direction of the business. Taking on investments sometimes means the creation of a board of directors, and allows investors to set targets and goals for the business’s trajectory.

Some startup founders have taken to crowdfunding their business ventures to supplement their personal investments while maintaining creative control over the goals and direction of their business.

According to Statista, the number of crowdfunding campaigns has increased by almost 4% in 2020, with a projected transaction value of $940 million. This indicates crowdfunding’s increasing presence in the finance space.

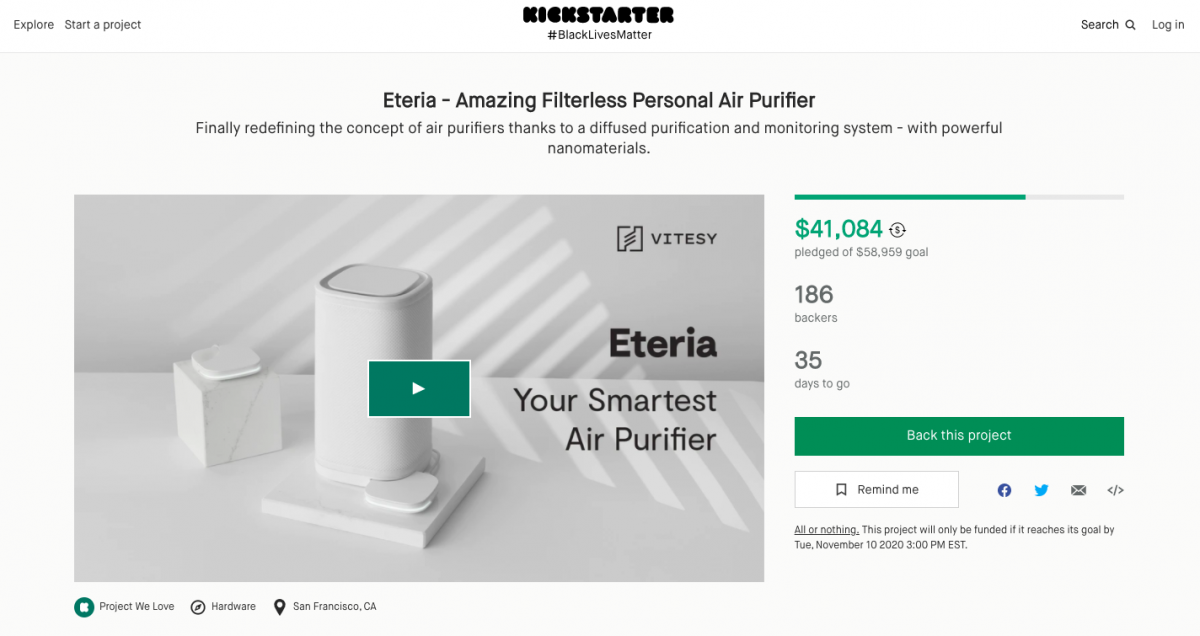

Platforms such as Kickstarter allow people to support products online with just a few dollars at a time contributing to a business’s fundraising goal.

Eteria, for example, is an air purifier product that aims to raise $58,959 in the next 35 days. Eteria’s product profile on Kickstarter acts as an investor pitch, containing vital information about the product’s features and goals. Some companies even offer equity to crowdfunding investors.

Platforms such as Kickstarter can help startup founders supplement personal investments to adequately fund their new businesses.

Almost three-quarters of startup founders (73%) said they were never denied access to capital to fund their business, however.

A great business idea, unfortunately, often isn’t enough for many founders to access the capital needed to start their business. Women, non-binary, BIPOC, and other entrepreneurs from marginalized groups face unique societal barriers to business funding.

One 2019 study from RateMyInvestor found that most venture funding still goes to startup founders who are white, male, and college-educated. Only 1% of founders backed by VCs in the report were Black.

Additionally, years of systemic inequality in the U.S. has prevented Black households from accumulating wealth through the historic denial of bank loans and mortgages, among other policies. Census Bureau data from 2016 revealed that Black Americans’ wealth is only 9% of white Americans’. The lack of diversity in startup funding means the public misses out on vital contributions of founders that represent the U.S. population as a whole.

Since even the smallest businesses cost $3,000 to launch, BIPOC founders face structural challenges to self-funding a business that white founders do not face.

Christina Blacken is the founder and chief narrative strategist of The New Quo, a professional development and communication consultancy for entrepreneurs. She worked hard to self-fund her business but was aware of the structural barriers to funding outside of her control.

“I saved up $20,000 working on my business part-time and holding a full-time job, while also running an Airbnb business,” Blacken said. “It allowed me to validate my ideas, build community, and maintain creative control and set my own goals that aren’t solely focused on growing bigger by any means necessary.”

Blacken took steps to fund The New Quo on her own to ensure the company reflected her creative vision. Other BIPOC founders she knows, though, have had challenges acquiring funding from venture capitalists.

“The first issue I see is affinity bias and ’founder fit’ with VCs, which many studies show comes down to people having more trust when people who are like themselves present those ideas,” Blacken said. “BIPOC are far more likely to be asked to showcase significant amounts of traction and revenue before anyone will take a risk in investing in them, while white founders are not always held to those same standards before a chance is taken on their ideas in the investing world.”

BIPOC are far more likely to be asked to showcase significant amounts of traction and revenue before anyone will take a risk in investing in them

Blacken identified affinity bias as a primary cause of the disparities between white and BIPOC founders seeking funding. Affinity bias is the unconscious tendency to agree with people who are similar to us. As long as most VCs are white and male, startup founders who resemble these funders may be more likely to receive investments.

One of the hardest pitches some entrepreneurs make is the pitch they give to their loved ones.

Family and friends may seem like a logical choice for startup founders looking for investors. Tapping into a support system means investors who understand a founder’s abilities and have their best interests at heart.

Asking for money from loved ones, however, can be hard to do. More than half of startup founders (64%) are uncomfortable with the idea of asking family and friends for financial support when starting their business.

Starting a business always requires a certain amount of financial risk. Founders are comfortable taking on that risk themselves, but may not be as comfortable introducing that risk into their personal relationships.

“If your business doesn't go as planned you risk losing friends and straining relationships with family members,” said Matt Bertram, CEO and SEO strategist at EWR Digital, a digital marketing agency in Houston. “You don't want your close acquaintances feeling that you fleeced them out of their money on a failed business venture.”

When about one in five businesses fail within the first two years of an establishment according to the Bureau of Labor Statistics, founders might not want to involve loved ones in a proposition that could put close relationships – and finances –at risk.

In addition, though lower interest rates during the pandemic mean business loans may be easier to pay back, lenders remain cautious to invest as the pandemic drags on into the fourth quarter of 2020.

Asking family for funding, then, could be a helpful resource for startup founders if done correctly.

Startup founders looking for an investment or loan from friends or family should:

Treating family and friends with professionalism when asking them for money to start a business can help delineate between your personal relationships and the professional challenges of being an entrepreneur.

Financing a business is always a risky endeavor, but the economic downturn amid the COVID-19 pandemic presents new challenges for entrepreneurs looking to launch new ventures in 2020.

Most entrepreneurs fund their businesses through personal savings, which means they take on most of the financial management and risk themselves. Aspiring founders with healthy savings accounts and pandemic-proof business ideas can launch a business despite economic uncertainty.

Because most startup founders fund their companies with personal investment, most report they have not been denied access to capital in the early stages of their businesses. This, however, might not be the case for young entrepreneurs, women, and BIPOC founders who face systemic barriers to receiving funding from banks and venture capitalists.

Most startup founders are also uncomfortable with the idea of asking family and friends for a loan or investment in their new business. When startups fail as often as they succeed, business owners are hesitant to involve loved ones’ finances and risk personal relationships.

Clutch surveyed 501 business founders in December 2019.

55% of respondents were female, 45% were male.

44% of respondents are age 55 and older; 42% are between ages 35 and 54; 10% are between ages 25 to 34, and 4% are between ages 18 and 24.

Respondents are from the South (38%), Midwest (22%), West (22%), and Northeast (14%). 4% of respondents did not identify their region.