Updated August 15, 2025

The start of the coronavirus pandemic reduced people’s spending, and the increase in COVID vaccinations has increased people’s spendings. According to our surveys of Americans, millennials in particular are adjusting their spending based on a changing social and economic landscape.

When the clock struck midnight on January 1, 2020, Americans made resolutions to save their money and make wiser buying decisions.

A pandemic likely was not on their minds as a potential money-saver.

Looking for a Accounting agency?

Compare our list of top Accounting companies near you

The outbreak of the coronavirus pandemic has impacted the daily lives of people around the world. The lasting effects are still unpredictable but have certainly been significant.

Because of the economic uncertainty, Americans spent less money in 2020.

By the time of August vacations in 2021, things had changed. Now, more than 70% of Americans have received at least one COVID-19 vaccination shot.

In March and April of 2020, Clutch surveyed 351 people in the U.S. about how their spending habits had changed since the start of the COVID-19 pandemic. In July and August of 2021, Clutch surveyed 494

Americans about how their spending habits in 2021 were different than 2020.

We found that 61% of Americans spent less money in March and April 2020.

In comparison, only 28% of Americans reported spending less money in 2021.

Overall, we found that the status of the COVID-19 pandemic determines how much money people spend. We also found that the COVID-19 pandemic affected how much shopping people do online. Businesses can use this report to understand the shifting spending habits of millennials and people in other generations.

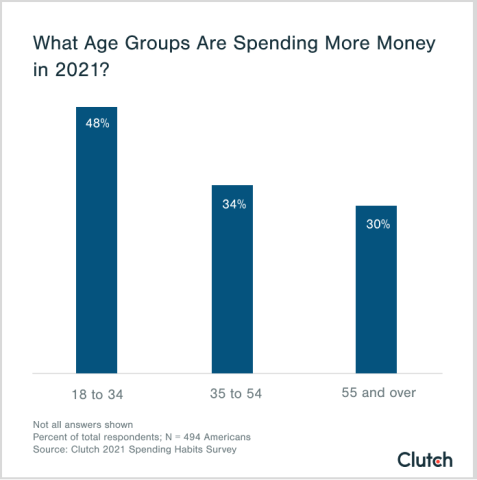

Do you feel like you’re spending more money in 2021 compared to 2020? If you’re under the age of 35, you’re likely correct.

In fact, 48% of people between 18 and 34 years old reported spending more money in 2021 than 2020.

In comparison, 34% of people aged 35 to 54 and 30% of those 55 and older said they were spending more money in 2021.

Why are young people so much more likely to be spending more money this year?

Millennials say that their increased spending in 2021 has been driven by relaxed coronavirus-related restrictions and a sense of making up for lost time.

Anna Barker, personal finance expert and founder of LogicalDollar, a personal finance advice website, says that spending has risen in part because of flush bank accounts.

Barker says that in 2020, there were less venues to spend money, as many restaurants, bars, and other venues were closed or curtailed. Now, most of those places have reopened, and young people in particular are ready to spend their savings and the money many received from government stimulus packages.

Barker says that her own household’s spending has increased as she and her partner resume traveling during their time away from work. Both Barker and her partner believe that if they want to travel, they should do it now, before the Delta variant and cold weather causes increased COVID restrictions.

“There is an ongoing concern that we may be faced with another lockdown in our area, especially as the weather gets cooler,” Barker said. “We're trying to take advantage of this time to see as many new places as possible.”

For many millennials, the first half of 2021 has been an opportunity to make up for lost time and have fun before additional COVID restrictions become widespread.

Being stuck at home gave Americans more time to browse the web and scroll through social media.

With unlimited access to the online world, millennials were making purchases they likely wouldn’t make under normal circumstances.

In early 2020, about a third of millennials (30%) increased their online spending as a result of COVID-19.

Zachary Weiner, a millennial, is the founder of Restaurant Accounting, a service that helps restaurants with their finances. He has found himself spending more money on relaxing activities like coloring books and digital yoga and meditation classes.

“My primary reason for investing in such activities is to help maintain my mental health stability during the pandemic,” Weiner said. “I do find myself spending more online for such causes, but the benefits of doing so far outweigh [their] expenses.”

Zachary Weiner, a millennial, is the founder of Restaurant Accounting, a service that helps restaurants with their finances. He has found himself spending more money on relaxing activities like coloring books and digital yoga and meditation classes.

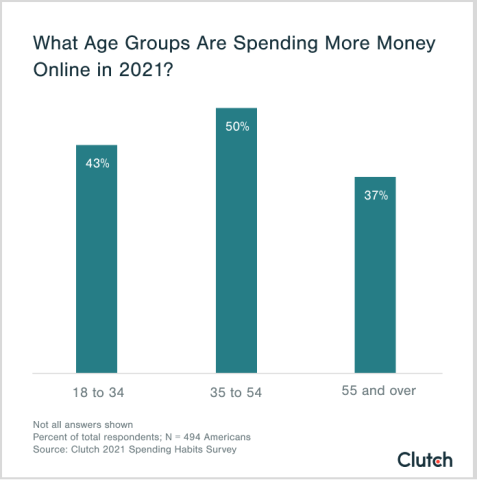

For young people, increased online spending may be a way to maintain mental health and some semblance of a social life. But for middle-aged people, increased online spending is likely an indication of how the COVID-19 pandemic altered consumer behavior.

Half of people aged 35 to 54 (50%) said they spent more money online in 2021, a bigger increase in online spending than any other age group.

Experts say that the reduction of in-person commerce during the COVID-19 pandemic is what caused middle-aged Americans to shift to buying online.

“Prior to the pandemic, most middle-aged people used to do their shopping and buying in-person,” said Cindy Corpis, CEO of SearchPeopleFree, a software development firm. “But since the pandemic, there has been a shift to online shopping.”

Corpis believes that the increase in online shopping by middle-aged consumers is a strong sign for the future of e-commerce.

“If the highest earning age group is beginning to migrate to online shopping, there is about to be a major rise in sales and profit for e-commerce stores,” Corpis said.

"If the highest earning age group is beginning to migrate to online shopping, there is about to be a major rise in sales and profit for e-commerce stores."

Overall, online spending and e-commerce sales have been bolstered by the coronavirus pandemic.

In March and April 2020, Americans assessed where their money was going, which led to them reducing their spending for different luxuries.

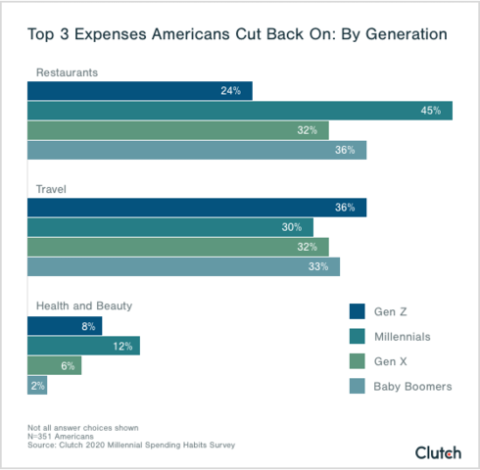

About one-third of Americans (34%) first cut down their spending at restaurants.

Millennials (45%) gave up restaurants first, and 30% cut down on travel expenses.

Other expenses like health and beauty (12%) and shopping and retail (6%) also decreased.

A large portion of Larounis’ typical monthly spend was on travel, but because of events and other cancellations, he’s seen those expenses drop significantly.

“Prior to COVID-19, I spent a lot on travel, and over the past two months, that spend has gone to nearly zero,” Larounis said.

Robison cut back in similar areas.

“I haven’t bought any makeup at all in the last three months,” Robison said. “I’ve also spent less on travel and gas.”

Vehicle traffic is down across the country because of the stay-at-home orders. Non-essential businesses with the technology to interact and work remotely lend a hand to this.

Mason Miranda, a credit industry specialist at Credit Card Insider, found that his love of food was taking a hit.

“My wife and I are big foodies, especially when it comes to trying new restaurants,” Miranda said. “We used to spend a lot more money eating out, trying new places, and even traveling to find good food.”

Since the lockdown, Miranda and his wife revamped their budget, making grocery shopping more of a priority.

Through contactless payments and food drop-offs, restaurants are adapting to meet American needs. Compared to their habits before the coronavirus pandemic, 48% of millennials increased their spending on food and groceries.

Restaurant employees are ensuring their spots meet sanitation standards and offering special menus for customers.

Even McDonalds made cuts to its menu, such as discontinuing its all-day breakfast, to make sure their customers still had the best possible experience.

Immigrant Food, a fast-casual restaurant based in DC, felt the effects of the COVID-19 pandemic early on.

A lot of its customers are professionals, driven toward the restaurant's lunch and happy hour specials. Some of them are World Bank employees that found themselves working from home at the end of February.

Immigrant Food shut its doors before adjusting to fit its community.

Since the shutdown, Immigrant Food introduced virtual events, started offering contactless delivery and takeout, and recently opened patio seating to meet DC’s Phase One guidelines.

All generations are taking advantage of efficient takeout and delivery options, like the ones Immigrant Food offers.

In fact, nearly half of Americans (47%) are spending more on food and groceries, and 44% of them order out 1–2 days a week

Since social distancing began, half of millennials (50%) found themselves ordering takeout one or two days a week.

Meanwhile, only 28% of millennials haven’t eaten out or used pickup and delivery options for their food consumption.

“In March and April, I was cooking and eating from home a lot more than usual, but in May, I got tired of cooking and ate out a lot more,” Robison said.

A study from Datassential shows that 89% of Americans felt safer eating food from a store or at home.

Some people are ordering takeout to support businesses, like Nuells: “I’ve been making an effort to eat out more and order takeout to support my local economy,” he said.

"I’ve been making an effort to eat out more and order takeout to support my local economy."

Others are trying to save money on luxury items to compensate for the cost of food delivery services, like Jess Drawhorn, who owns The Drawhorns Elopement Photographers.

“I’ve definitely found myself removing a $6 pint of ice cream from my cart online while also tipping $35 to have someone bring me my groceries,” Drawhorn said. “I’m trying so hard to save on personal splurges right now, while being as generous as humanly possible.”

Whether millennials are learning to bake sourdough or using their local dining spot’s carryout, food is a big priority in their budgeting.

When out-of-home eating options were limited, many Americans found it was the perfect time to learn how to cook. Two-fifths of millennials (40%) increased their spending on groceries as a result of the COVID-19 pandemic.

Nearly half of Americans (45%) increased their spending on grocery shopping.

Grocery shopping is considered an essential business activity, as food is a necessity. Stores, like Costco, limited their operating hours during the height of the pandemic, even catering special hours to senior citizens and other high-risk individuals.

For some, tackling a big shopping list while pushing their carts is a sense of normalcy in this chaotic time.

“I still do most grocery shopping in-person, whether that be at Costco, Whole Foods, or a local market,” Larounis said.

The number of precautions that grocery shoppers must take for a quick visit to the grocery store may deter others, though. Online grocery shopping is reaching new heights.

According to Nielsen and Rakuten Intelligence, during the week of April 18, 2020, online sales of consumer packaged goods grew 56% in the month of April.

Grocery delivery services like Instacart are providing users access to their favorite local stores from the comfort of their own homes.

Drawhorn loves the convenience and control of shopping virtually.

“I’ve been loving grocery shopping online so I can easily see what’s on sale and keep an eye on my total as my cart grows,” Drawhorn said. “The idea of going into a store still freaks me out, and I’m grateful that I don’t have to do that right now.”

"The idea of going into a store still freaks me out, and I’m grateful that I don’t have to do that right now."

Consuming food is a basic necessity for us to survive. But outside of that, it is an area for comfort.

Cooking and baking are activities that act as stress relievers. They also provide a sense of control in a time where there is little to no control of anything.

Trying out new recipes together has helped Miranda and his wife find new ground in their relationship.

“We’ve found that trying new recipes at home not only saves us money and time, but also helps build our relationship,” Miranda said. “We’ve been able to spend more time together enjoying food … at home.”

All generations are spending more on grocery shopping, but millennials are seeing their spending increase in other areas since being stuck at home.

American spending habits during COVID-19 contributed to a rise in beer and wine sales and a decline in liquor sales.

Whether they planned on it or not, 13% of millennials found themselves spending more on alcohol in March and April. In fact, the beverage industry is listed as one of the most resilient when it comes to economic downturns, according to Forbes.

Not being able to go out to bars certainly limited the amount of spending on alcohol to a degree, but millennials found new ways to drink responsibly.

Zoom, a popular video conferencing application, became a hub for virtual happy hours and game nights.

It’s hard to plan for a trip when the future of travel is uncertain. Nearly a quarter of Americans (23%) canceled trips as a result of the COVID-19 pandemic.

Forty percent (40%) of millennials also stopped making future vacation plans for 2020.

Twenty percent (20%) of millennials had to cancel planned vacations.

Robison’s best friend was set to get married at the end of April 2020. After the wedding was canceled, Robison, as the maid of honor, delayed plans for her friend’s bridal shower and bachelorette party.

The travel restrictions impacted Drawhorn’s photography business because of the number of canceled weddings.

“Over the last ten weeks, I’ve canceled trips to photograph weddings in Sedona and Iceland,” Drawhorn said.

As travel regulations continue to change and the industry continues to adapt, a new normal for vacation planning is imminent.

In 2020, U.S. air travel was down 90% from the year prior.

Airline companies such as American Airlines are giving passengers the flexibility to use or exchange their unused tickets through December 2021.

To combat fear and ease passenger worries, Delta has doubled down on its cleaning program, even adding another sanitation process to disinfect all cabins. Most U.S. airlines now require all passengers to wear masks before hitting the skies.

But, a majority of Americans found themselves not impacted directly by the travel limitations.

More than 30% of respondents didn’t plan vacations in 2020, and once the coronavirus pandemic started impacting their lives, 32% stopped making vacation plans altogether.

Only 15% of Americans continued making future vacation plans.

Miranda and his wife found their own ways for adventure without any baggage by planning date nights.

“We’ve cut back on spending money on events for dates and spent more time on free activities such as hiking, sightseeing, cruising around the country, and playing board games,” Miranda said.

This socially distant way of dating and traveling might become the new normal for many millennials.

As the coronavirus pandemic changes with widespread vaccinations and new variants, American spending habits will change, too. Millennials, in particular, will have to adjust to changes in the economy and everyday life.

The biggest spending habits trends include:

While the U.S. continues to pursue normalcy, millennials and Americans need to consider what the future holds and begin cultivating smarter spending habits.

Clutch surveyed 351 people in the U.S. during May 2020.

About 44% of respondents were female; 36% were male, and 21% didn’t specify their gender.

Baby boomers and older were 31% of respondents; Generation Xers were 29%; Millennials were 11%, and Generation Z were up 7%. 22% of respondents didn’t reveal their age.

In July and August 2021, Clutch surveyed 494 people in the U.S.

29% of respondents were men; 26% were women; 45% did not identify their gender.

12% of respondents were ages 18 to 34; 21% of respondents were ages 35 to 54; 55% of respondents were 55 and older.