Updated January 3, 2025

Fintech has transformed how people interact with financial institutions. As a result, people expect fintech apps to be user-friendly, fast, and visually appealing.

For many years, financial applications were mostly enterprise applications that were rarely updated and largely used by internal team members performing routine tasks.

Today, however, the benefits of financial applications have extended to sophisticated end users that expect simple, elegant design — much like other consumer applications they use.

This means that financial systems need to be updated. But where do you start? Below are seven musts for your financial application in today’s world.

Looking for a Mobile App Development agency?

Compare our list of top Mobile App Development companies near you

We often put up barriers that restrict app usage to protect sensitive data in the financial sector.

Instead, we need to protect data while building natural sticky mechanisms upfront to drive usage and adoption.

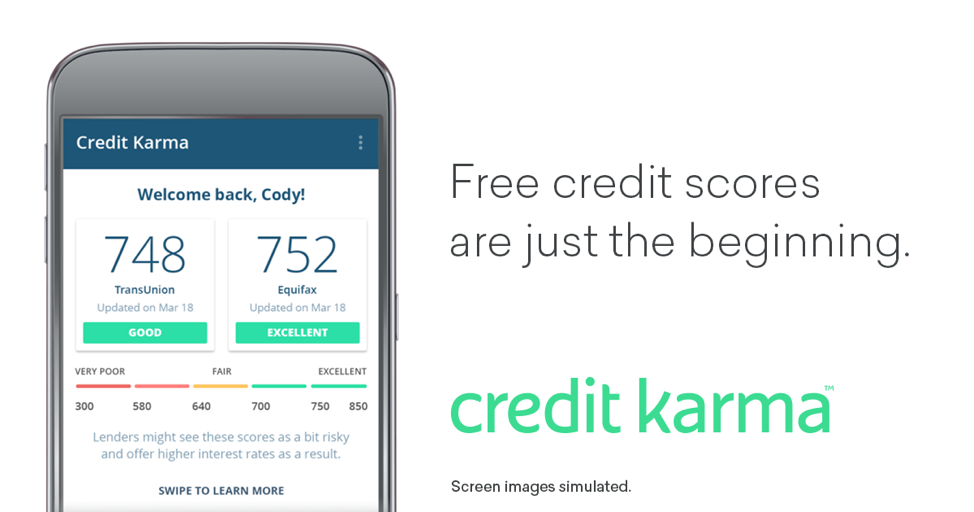

For example, Credit Karma — one of the top 10 Fintech companies to watch in 2019 — does not require users to register a credit card, unlike other sites.

Also, as part of their services, Credit Karma also offers free credit scores and educational resources for their 85 million users.

By showing users your app’s value upfront, users will know exactly what your app will offer them.

If we think of managing finances in terms of Maslow’s hierarchy of needs, reporting accurate data is the staple or baseline need.

Your financial app should do a good job reporting financial information, show progress to an end goal, and visually display opportunities and recommendations.

For example, Mint helps consumers track their expenses and income in a graphical user interface.

This helps users better understand where they are spending their money to help them save money and create a budget.

Reporting data is important but consumers also need to know why that data is important and how they can apply it to their goals.

Financial services are personal, and the stakes are high: In consumer banking or finance, you are dealing with someone’s future.

In the brick-and-mortar world, this could be overcome with personal relationships. You have a banker or broker who knows you and your goals. This same personalized and user-centric approach needs to be replicated online to create trust.

One example of a financial services company providing this level of personalization is Betterment, an online, automated investment platform (i.e., a robo-advisor).

Betterment offers tailored products and hybrid pricing that allows for access to human advisors to set it apart from its competitors.

For example, Betterment offers a dashboard where users can find a financial overview, and summaries of their holdings, activity, and performance.

Providing this level personalization (combined with data security) helps build trust between you and your app’s users.

Financial applications are increasingly being built for the millennial or digital native. But this generation tends to lack investment funds, so why are so many apps catered to this generation?

Millennials and Generation Z grew up with technology and tend to rely on technology more than older generations. As a result, they expect their technology to be simple, user-friendly, and fast.

We always recommend simplicity when it comes to design because it’s more difficult to interact with a convoluted UI.

With Fintech, you’ll want simple, clear messaging presented in a way that encourages engagement (e.g., removing barriers to entry, breaking information into smaller chunks).

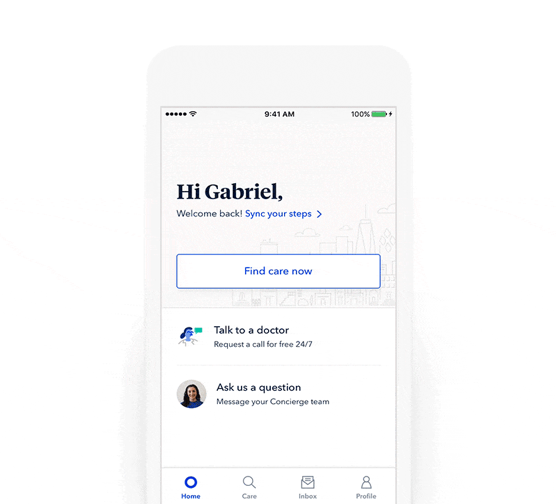

For example, Oscar, a technology-focused health insurance company, has taken an entrenched, older industry and used technology and design to make the experience user-friendly.

Members can use the app to access health information from an intuitive and informative dashboard where they can order refills and talk to a doctor in 15 minutes.

Similar to health care, the financial industry is an older, more established industry. Fintech apps can help simplify the traditionally complicated aspects of the industry.

When it comes to financial data, there is a natural mistrust or fear of cybersecurity or loss.

To assure users, we need to reaffirm actions and build trust online one interaction at a time.

Fintech applications should always be transparent about the data they will collect and the steps they will take to protect it.

Your app should allow access to data but should also present it in an appealing way – No one wants to look at monotone charts and blocks of numbers, and users may not know how to consume this type of information.

The visuals your app provides should provide users with clear takeaways and guide them to a clear call to action.

For example, if they are viewing their monthly spending report, they may want to know what they spent the most on so they can budget better next month.

Fintech apps allow people the opportunity to manage their financial livelihoods and assets from their mobile phones. As a result, these fintech apps must be secure, user-friendly, and useful to those using the app.

Those looking to design a fintech app should make sure they demonstrate the app’s value immediately and build trust with their user base by making their app easy to use and helpful.

Do you have a financial application that could benefit from one of these recommendations? Contact us and we’ll show you an approach you can take for unifying or modernizing your UX that is efficient and cost-effective.