Updated February 24, 2026

Employee Stock Options Plans (ESOPs) are important criteria for a startup’s potential growth. Although the employees receive these rewards, they also benefit the founders. The most recent data reveals that participants received over $175 billion through ESOPs.

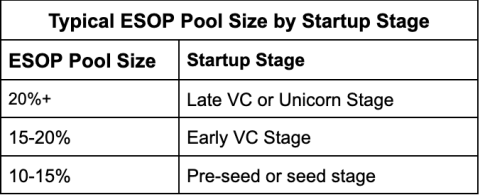

Studies reveal that ESOPs contribute to narrowing the wealth gap by building equity, expanding education, and improving employee well-being. Venture capitalists recommend employee stock ownership plans (ESOPs) for businesses to recruit and retain top staff, especially in competitive sectors. Research indicates that startups strongly support ESOPs, with average equity contributions around the globe falling between 10% and 20%. In Asia Pacific, statistics are more conservative, ranging from 10% to 12%.

When done rightly, ESOPs can be a great source of employee motivation. To begin structuring your stock options effectively, you must set an accurate strike price for the stocks. How do you set your options’ stock price while maintaining compliance with the IRS? 409a valuation!

So, if you want to see your startup’s growth multiply, you need to have a proper ESOP plan and 409a valuation in place. This article will tell you how.

Your startup can bring lucrative growth when you establish your ESOPs and leverage them rightly. Here are a few ways you can use ESOPs to achieve further growth:

ESOPs can be particularly effective if your startup has cash constraints but high growth potential. The employees thus have a stake in the company’s future, so their interests align with your business's and incentivize them to drive the company toward success.

With this equity, your startup becomes attractive to potential hires, especially those in high-demand roles like technology and executive positions.

You must determine the size of your ESOP pool. By balancing the pool size, you help avoid excessive share dilution and still motivate your employees to stay. Typically, the pool size can be between 5% and 15%.

You must keep updating it as your company expands and receives more funding just to make sure it can accommodate more investors and new hires in the future.

ESOPs can inculcate an ownership mindset in employees. When employees feel in charge, it can reduce attrition and increase performance. So, you make appropriate adjustments to the ESOP structure according to employee requirements and business goals.

When startups roll out ESOPs, valuing them fairly and transparently is crucial. 409A valuation determines the "strike price," or the cost at which workers can exercise stock, and aids in determining the FMV. Startups perform these valuations to ensure they provide equity at a reasonable, IRS-compliant price; the strike price must be at or above the FMV as per section 409A of the US tax code.

Getting a 409A valuation is a regulatory step. Not aligning these values can lead to the risk of non-compliance and hefty penalties.

A 409A valuation is a formal valuation conducted by an independent third party to set the strike price for stock options issued to employees and other service providers. Section 409A of the Internal Revenue Code mandates this valuation to help companies avoid penalties.

The strike price at which the stock option holder can purchase the shares is set based on the FMV of the company's stock from the 409A valuation at options grant.

A smaller strike price is usually better for your employees because it means their stock options could increase in value. With a low strike price and a large increase in the company's stock price, employees will benefit more from exercising their options.

The strike price must not, however, be set too low by the 409A valuation since this might result in penalties and regulatory problems. By anchoring the striking price to justifiable, market-driven criteria, the valuation ensures compliance and equity in the pricing and taxation of stock options.

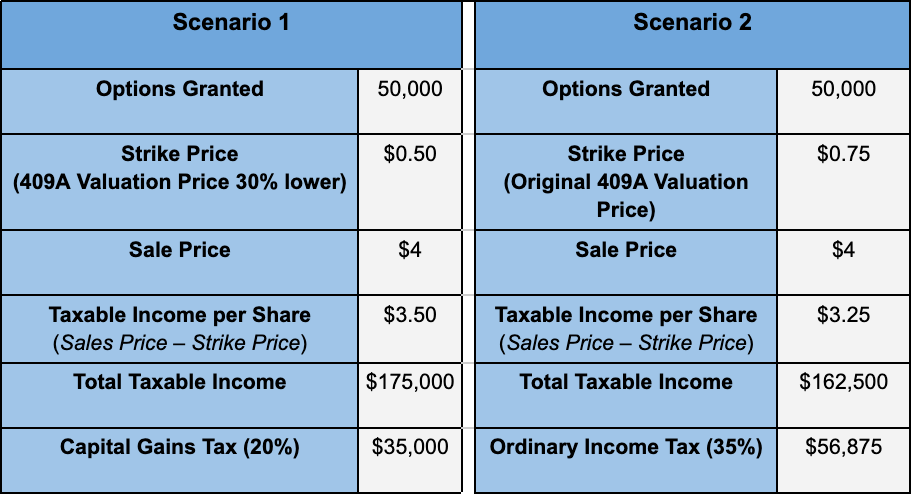

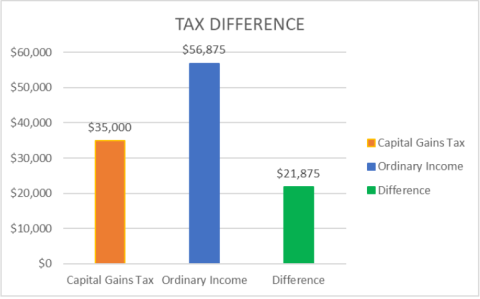

A company plans to grant stock options to its employees as part of a new incentive compensation plan.

An employee is granted 50,000 stock options with a strike price of $0.50 (the 409A valuation price was 33% lower) per share. After four years, they sold vested shares at $4 per share.

The employee is granted 50,000 stock options with a strike price of $0.75 (the 409A valuation price) per share. Since the strike price is higher, the employee exercised and sold the options at $4 per share.

TAX DIFFERENCE

So, if the strike price were $0.50 instead of $0.75, the tax savings would be $21,875.

Flipkart is a well-known example of a startup that leveraged ESOPs. In 2018, when Walmart bought Flipkart, the business started buying back $100 million worth of employee stock ownership plans (ESOPs), one of the biggest liquidity events for employees' shares in the Indian startup scene.

The repurchase of ESOPs gave employees significant financial benefits and showed how ESOPs can help firms create value.

If you want to leverage your ESOPs the same way for your startup, you must know how to determine the appropriate ESOP distribution amount. The following factors are essential in planning.

If your startup plans to issue stock options or other equity compensation, you must prepare for a 409a valuation.

Here’s how you can ensure your company is ready for this:

The IRS may levy heavy fines and penalties if your startup cannot secure a 409A value. Dilution will negatively affect employee remuneration, which might harm team morale. Any occurrence that modifies the company's valuation will also impact stock options. Consequently, you, as a founder, will also be affected.

However, the best part is that you can avoid these circumstances and exponentially grow your business by planning your ESOP structure and performing periodic 409a valuations. Remember that a valuation expert can do this with real-time insights and accuracy. Above all, choosing a certified valuator can offer you much time and energy to invest in your other core operations.

Colin McCrea, CVA, is head of the valuation team at Eqvista. He has years of experience in the taxation and auditing sector for small and medium sized companies in the U.S. He is currently managing company valuations and corporate taxation.