Updated May 9, 2025

The months leading up to tax filing deadlines present an opportune moment for tax accounting firms looking to set themselves up for long-term growth. Learn more about how your tax accounting business can stand out in the market and appeal to small business owners heading into tax season.

Though tax season is a busy time of year for any small business accounting firms, and generating leads may not be top of mind, this time of year provides an opportune moment for accounting firms throughout the US.

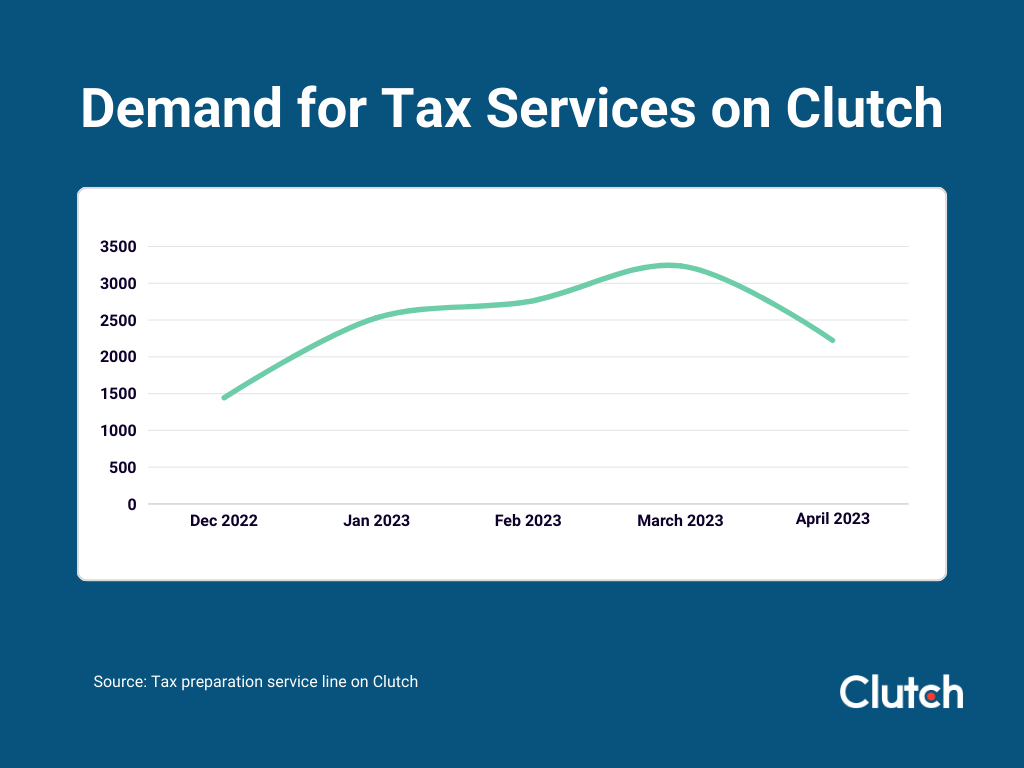

As we head into tax season, small businesses everywhere are beginning to search for tax accountants to handle their filings. Last year, interest in tax accounting services on Clutch increased by 106% MoM between December and April, peaking in March.

By promoting their services and appealing to small business owners, tax firms can capitalize on the surge in interest before tax season, setting up their business for long-term growth and success.

Here are a few marketing strategies to help tax accounting firms like yours promote their services and appeal to small businesses looking to hire:

Email marketing is a particularly effective strategy for strengthening customer relationships. By providing personalized content and maintaining regular communication with existing clients, companies can nurture customer loyalty, leading to increased sales, positive brand advocacy, and, ultimately, business growth.

Focusing on email marketing at this time of year can keep your tax services top-of-mind. As former customers start thinking about filing their taxes, they will be reminded of your services and the quality of your work.

In addition to boosting customer retention, this can also increase the likelihood of reaching new clients through word-of-mouth. Loyal customers often become brand advocates, sharing positive experiences with others and effectively contributing to word-of-mouth marketing.

As tax season approaches, online searches for tax services are likely to increase significantly. Yet, this is unlikely to benefit your business unless you’re listed at the top of search engine results pages (SERPs).

Unless you’ve already invested significantly in local SEO (which can take a significant amount of time and effort), the best way to secure a top position and boost visibility is through paid search advertising.

One of the notable advantages of paid search advertising is its ability to deliver results quickly. To maximize the increase in demand for tax services leading up to the filing date, you need to be able to capture audiences quickly. In fact, many PPC campaigns, like Google Ads, take just a few minutes to set up.

More importantly, PPC advertising is particularly effective because it allows you to target specific audiences, leading to higher conversion rates. Through conversion tracking, you can monitor ad performance in real time and gather essential information for refining their strategies. This information can be applied to existing and future campaigns, leading to long-term success.

Learn more about paid search in ‘5 PPC Advertising Examples.’

Well-crafted website content is incredibly valuable because it can answer user questions and help move them through the sales funnel. For this reason, compelling content can serve as a powerful lead generation tool.

By offering valuable resources, such as ebooks, whitepapers, or informative blog posts, websites can capture the attention of potential clients and prepare them to hire tax services.

Informative and insightful content also positions your team as an authoritative source. This can help build trust with visitors and establish credibility for your business, making them more likely to reach out about the services you provide.

While creating new high-quality content right now is unlikely to rank or have a big impact on your organic traffic before the filing date, it can set you up for a strong SEO strategy heading into next year.

As we discussed above, word-of-mouth marketing is a great way to build your business’s reputation in the tax industry and foster trust. Particularly since business owners are searching for tax services at this time of year, a client referral program is a great way to encourage existing customers to provide your contact information to their peers.

Client referral programs are designed to encourage existing customers or clients to refer new customers to a business. This is typically achieved by offering incentives, rewards, or benefits to the existing customers for every successful referral they make.

For instance, you may consider offering a discount or a gift card to any client who refers your services to someone else.

The program aims to leverage current customers' positive experiences and satisfaction to attract new customers, as referrals from trusted sources are often more effective in driving conversions.

For many B2B buyers looking to hire tax services, online reviews are a great way to learn more about different accounting firms, the services they offer, and the quality of their work. For this reason, curating a strong online reviews presence can help you set your business apart from competitors.

Positive online reviews can provide credibility and help brand perception. Knowing that your team is trustworthy and can file taxes properly while maximizing returns can help potential clients feel confident before inquiring about your services.

In order to build your online review profile and keep it up to date, make asking clients to leave an online review a part of your process. You can include this in follow-up emails or whenever you request feedback. Provide links to your online business profile on review sites like Clutch, and Google Reviews.

In addition to reviews, you should make sure your profile is up to date. Including location and contact information is essential for generating leads. Clutch also allows you to add additional portfolio items to help your business stand out.

Additional reading, ‘Why Reviews Are Important for Business Success.’

Harnessing the power of targeted marketing strategies during tax season is not just smart—it's essential for setting your tax accounting firm apart from the rest.

Whether it's by reconnecting with existing clients through email marketing, growing visibility through search advertising, producing content that captivates and educates, maximizing the momentum of word-of-mouth through client referrals, or building a fortress of trust with online reviews, each strategy can help you maximize growth.

These strategies not only will help you generate leads this year, but set you up on the road to success for years to come.