Updated January 2, 2025

Startup founders face the challenge of identifying and budgeting for business expenses after they launch a company. Prioritizing expenses helps businesses budget and prepare during periods of economic uncertainty. Clutch surveyed 501 startup founders to understand their spending priorities in the first three months of operation.

A lot can change in 3 months.

As the COVID-19 pandemic took hold around the world between January and March 2020, businesses went from experiencing job growth and economic prosperity to shuttered doors and a dramatic increase in remote work.

Looking for a Accounting agency?

Compare our list of top Accounting companies near you

Not every year will have the dramatic uncertainties of 2020, but new business owners and entrepreneurs still should have a stable budget and clear spending priorities during the critical first three months after launching a startup.

We surveyed 501 business founders in the U.S. to understand how entrepreneurs prioritize expenses in the first three months of the business’s operation.

Any new business faces a myriad of costs in the early months of operation. Even in the first three months of the business, operating costs are most founders’ largest expense.

More than half of startups (59%) spend the most money on operating costs in the first three months of their venture.

Business founders should factor these expenses into their budgets before launching so they are not caught unaware by surprise costs.

According to Investopedia, operating expenses are payments related to compensation, sales, and other items that affect a company’s bottom line.

Many operating expenses may be one-time initial costs for new businesses. Some examples of one-time operating expenses include:

Other operating expenses are recurring costs that businesses should budget for beyond the initial 3-month period. Examples of recurring operating expenses include:

It’s also important to define operating expenses by what they are not, including losses from the business, restructuring costs, or ongoing legal fees.

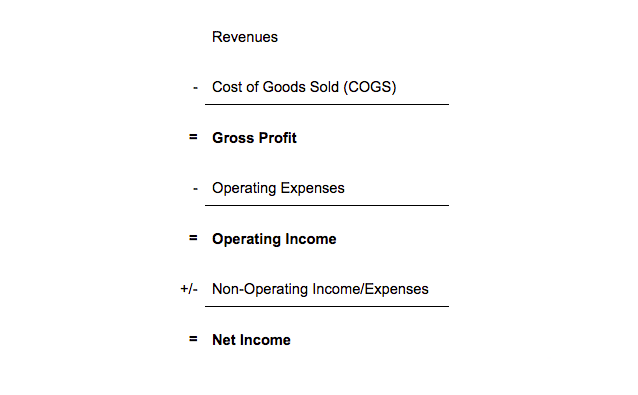

Finance blog Bench offers this formula to explain how businesses can factor operating expenses into their profits and losses:

According to this formula, businesses should subtract operating expenses from their gross profit to determine their operating income, and then subtract non-operating expenses from that total to reach the net income of the business.

Identifying and understanding operating expenses is critically important for new businesses in the first few months of operation. Startups must budget for these expenses when sourcing funding.

Inventory is the second most important business expense after initial operating costs are covered.

About half of startups (55%) prioritize spending on inventory in the first three months of their business.

Inventory refers to the products a business sells, including the materials used to manufacture those products.

Acquiring inventory requires large purchases from wholesalers or investing in manufacturing a product. Selling inventory drives revenue for many companies, so new businesses that prioritize spending on inventory will earn profits later.

Different types of inventory include:

Businesses should remember that inventory doesn’t only include finished products, but also the products while they’re being made and the raw materials allocated or purchased for those products.

Non-physical digital tools such as software can also be considered inventory, though the associated inventory costs are limited to account management for customers and continued investment in developing the product.

The ongoing COVID-19 pandemic has presented challenges for new businesses sourcing inventory of physical products.

COVID-19 has disrupted supply chains around the world, making shipping and fulfillment difficult for companies receiving goods and shipping them to customers.

China, the epicenter of the COVID-19 outbreak, is the source of many consumer goods imported to the U.S. The COVID-19 pandemic, in conjunction with the 2020 Lunar New Year, presented a unique challenge to the global supply chain reliant on the country’s manufacturing power.

Darren Litt is the founder of Hiya Health, a children’s vitamin company that launched during the COVID-19 pandemic.

“We manufacture in the US with globally-sourced ingredients,” Litt said. “Unfortunately, having to ship ingredients from overseas during the pandemic has been extra slow and unreliable.”

Businesses can offset these inventory challenges by investing in in-depth demand forecasting to anticipate product demand and potential shortages. A baked goods company, for example, can anticipate potential pandemic-related flour shortages by stocking up on flour inventory ahead of the expected holiday demand.

Businesses spending money on inventory during COVID-19 should keep shipping delays and inventory shortages in mind when planning short-term spending.

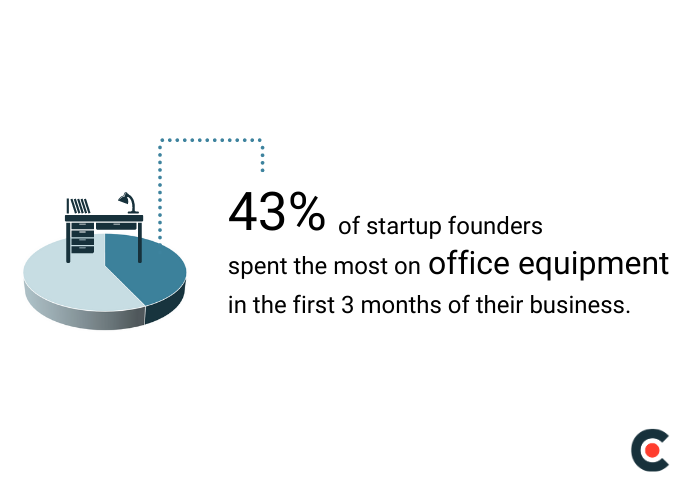

Even before finding a workspace, many startup founders invest in basic equipment to make their business successful.

Almost half of the startup founders surveyed (43%) listed office equipment as a top expense in the first three months of the company’s operation.

Unlike inventory, or goods designed to be sold and drive revenue, office equipment includes small and large purchases that enable startup founders to run their businesses more efficiently.

An entrepreneur running a consulting business, for example, might choose to invest in a laptop with a high-quality webcam to enhance their professionalism when working with clients.

With COVID-19 driving an increase in remote work, startup founders should prioritize investing in critical equipment to ensure access to high-speed internet and a functioning remote work environment.

Office equipment doesn’t just have to be physical materials, such as printers, routers, and monitors. Businesses can also purchase digital equipment and tools to help their operations run smoothly, such as:

New business founders budgeting for office equipment such as furniture, computers, and monitors should list their top priority items to purchase first and limit purchases to absolute necessities in the first three months of the business to keep overhead costs low.

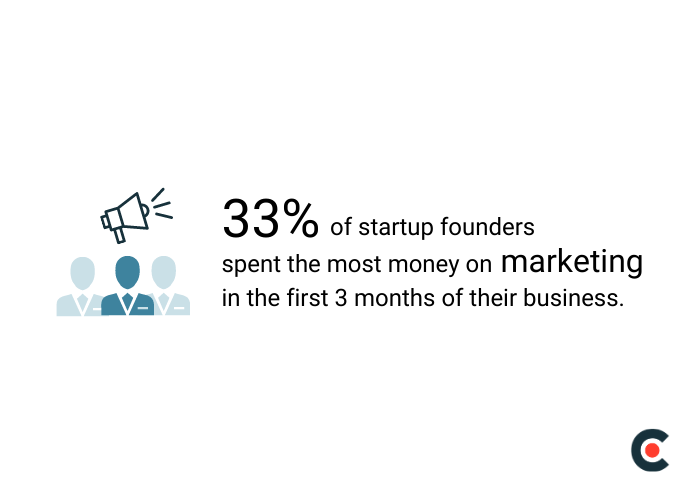

Startups need effective marketing to spread awareness and generate buzz about new products and services. How startups prioritize marketing spend, however, varies dramatically.

Only one in three new businesses (33%) prioritize marketing spending during their early stages.

For some founders like Litt, marketing is a priority after the initial launch of the business.

“Our next three months is about doing a huge marketing blitz to help educate parents about the dangers of excess sugar and to demonstrate to parents why Hiya is the best children’s vitamin on the market,” Litt said.

Waiting a few months may provide founders with profits from a business in full operation that can fuel and improve their marketing.

One reason startups may not spend on marketing is they don’t have to. Several free or inexpensive marketing options exist for startups looking to build brand awareness without stretching their budgets:

Free and low-cost design tools can help startups launch an initial brand identity and create a basic set of brand materials.

Canva is a free design tool and platform that businesses can use to create logos, website graphics, and social media images.

Canva offers design courses for beginners and a suite of color and image tools to help new businesses create a cohesive brand identity.

Free and low-cost design tools help businesses tell a beautiful visual story for their brand for the early years of their business until they can afford to hire an experienced designer.

Social media accounts are free outlets to target and reach potential customers. Create a free business account on social media platforms such as Facebook, LinkedIn, or Instagram depending on where your target market spends the most time.

A B2B service provider startup, for example, might create a free LinkedIn business profile to post content and follow influential B2B content creators.

Follow hashtags on social media channels to see what your audience is talking about and the types of content they want to see. Then, use your free design tool and create a few posts to launch your business profile.

Creating content for a new startup’s website may be inexpensive, but it does require a time investment.

Writing landing page copy or blog posts for SEO is an important branding tactic for new businesses. Written content helps businesses by informing their audiences and increasing the company’s visibility in search engine results.

Startups reluctant to spend money on marketing can take time to research and write a few blog posts related to their business to help their audience make a purchasing decision.

Creating high-quality blog posts can help startups populate a new website without investing in marketing personnel.

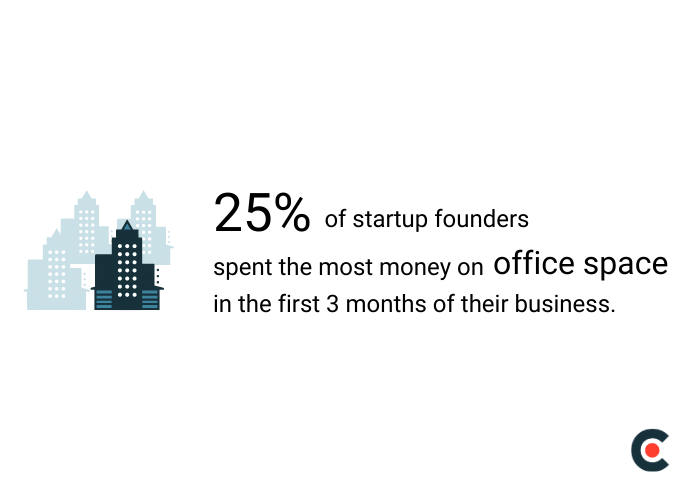

The COVID-19 pandemic might be the primary driver of remote work in 2020, but startup founders are often reluctant to invest in office space in the first three months of a business even in normal times.

Only 25% of startup founders reported spending the most money on office space in the first 3 months of operation.

Many of the most famous internet startups of the late 1990s and early 2000s began in home environments. Jeff Bezos famously started online retail giant Amazon in his garage. A feature film was made about Mark Zuckerberg’s launch of Facebook from his Harvard dorm room.

Ecommerce, digital marketing, and the rise of remote work tools make it easier than ever before for founders to start a business from their homes.

With so many other important expenses to consider, commercial real estate rents are costly undertakings for only one or two people to have a designated workspace.

Additionally, the COVID-19 pandemic has driven most in-person business online. Office building vacancies are on the rise since many tenants hesitate to return to in-person work without a vaccine in circulation.

Pandemic-era startups may eventually benefit from the surplus in commercial real estate vacancies, though. Companies that outgrow their home office setups in the coming year may be able to capitalize on low rents or even more affordable options, such as co-working spaces.

Tough economic times mean new businesses need to budget strategically to meet revenue goals and remain in operation.

Startup founders prioritize operating costs and inventory in the first three months of a business's operation, ahead of other expenses such as marketing and office supplies.

Operating expenses, both one-time and recurring costs, should form the basis of a new business's balance sheet.

Inventory is what businesses sell, but it doesn't always have to be a physical material. Businesses should anticipate supply chain challenges during the COVID-19 pandemic when planning their inventory expenses.

Only one-third of startup founders prioritized marketing spending in the first three months of operation. Many free marketing options exist for businesses in their early stages that may not be ready to invest money and time into promoting their offerings.

Only one in four startup founders spent money on office space, which reflects the increasing trends towards remote work even after the COVID-19 pandemic is over.

Clutch surveyed 501 business founders in December 2019.

55% of respondents are female, 45% are male.

44% of respondents are age 55 and older; 42% are ages 35 and 54; 10% are ages 25 to 34, and 4% are ages 18 and 24.

Respondents are from the South (38%), Midwest (22%), West (22%), and Northeast (14%). 4% of respondents did not identify their region.

![How to Create a Budget for Accounting Services [With Template]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/7dce8a5e1339227e397cf68f6f555f92.png)