Updated December 10, 2025

Fintechs are increasingly bringing crypto to everyday users. But doing it right also means building strong safeguards that encompass everything from compliance to secure custody. The platforms that prioritise responsibility over speed will earn lasting trust and shape India’s digital-asset future.

Financial systems around the world are changing rapidly. Consumers and businesses are increasingly using mobile payments, digital wallets, and online financial services for everything from everyday transactions to investments and credit.

This shift is creating opportunities for innovations such as cryptocurrency and tokenized assets to become part of mainstream finance. And, crypto is now a natural extension of this behaviour. What started as an investment curiosity is evolving into a new class of financial utility. It encompasses everything from remittances and reward systems to tokenized assets and on-chain participation.

Looking for a IT Services agency?

Compare our list of top IT Services companies near you

Fintechs sit at the frontline of this transformation. Their intuitive interfaces and large customer bases make them the go-to choice for millions exploring digital assets. But crypto is not an unfenced field. It operates at the intersection of finance, technology, law enforcement, and consumer protection. For fintechs, responsible integration is not simply a compliant design; it is strategic foresight.

The most successful platforms of the coming decade will be those that treat trust as an integral infrastructure layer, rather than a marketing line.

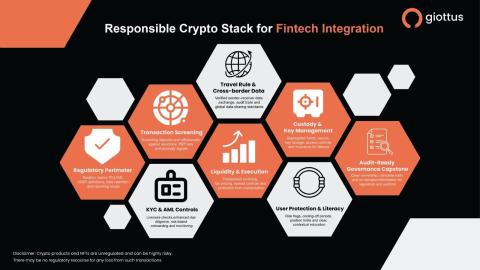

Building a strong crypto product starts with understanding the rules wherever you operate. This means understanding taxation, anti-money laundering (AML) requirements, cross-border transfer regulations like the Travel Rule, data-retention obligations, and licensing rules for digital-asset service providers.

Planning for these requirements from the outset helps teams design a product that scales smoothly, creates trustworthy partnerships, and stays compliant rather than reacting to regulatory challenges later.

Crypto is not a single offering. Trading, custody, tokenized rewards, on-chain actions, and cross-border flows all require different controls and different partner-accountability frameworks.

Fintech teams that define their use case with surgical clarity (before writing code) avoid misaligned risk models and downstream compliance gaps. Precise scoping is the difference between a product that scales and one that must be rebuilt mid-flight.

When a fintech company starts offering crypto services, it needs to verify the identities of its users and monitor transactions just like a traditional bank would. KYC (Know Your Customer) helps the platform know exactly who its users are, while AML (Anti-Money Laundering) safeguards prevent illegal activities like fraud or money laundering.

This means doing thorough checks on high-risk users, confirming addresses, and keeping an eye on unusual behaviour in real time. These steps protect users, build trust, and make sure the platform runs safely and responsibly.

Illicit activity almost never walks in openly; it enters through transactions. Fintechs must therefore screen every deposit, withdrawal, and wallet interaction in real time.

It should be cross-checked against sanctions lists, PEP databases, enforcement alerts, and blockchain-based anomaly signals. This is one of the most significant differentiators between a secure platform and a vulnerable one.

As cross-border transfers become increasingly common, Travel Rule compliance is crucial to the ecosystem's credibility. Vendors and liquidity partners must be able to exchange verified sender-receiver information without friction, maintain complete audit trails, and meet global data-sharing expectations. Fintechs that build Travel Rule readiness into product plumbing signal long-term maturity to regulators.

Users trust what they can understand. Fintechs should have clear visibility into how liquidity is sourced, how spreads are constructed, how volatility is absorbed, and what prevents market manipulation. Opaque execution frameworks invite user distrust and regulatory concern. Transparent models, by contrast, anchor credibility even in high-volatility markets.

Whether held internally or via a vendor, custody is where user expectations are absolute. Segregated fund storage, secure key-management systems, cryptographic access controls, and insurance for custodial failures are now baseline requirements. A fintech may outsource custody, but it cannot outsource responsibility.

Responsible crypto integration is not solely about compliance; it is also about care and consideration. Platforms should incorporate contextual guidance, risk flags, cooling-off periods, and sensible position limits for novice users.

Globally, regulators are shifting towards consumer-duty frameworks that demand not only “disclosure” but “demonstrable user understanding.” Fintechs that embed literacy and protection cues will be the ones consumers trust the most.

On-chain data is powerful. However, it is often an underutilised intelligence layer. Real-time wallet-risk scoring, cluster detection, behavioural anomaly tracking, and liquidity-flow mapping allow fintechs to identify threats before they become systemic challenges. When blockchain analytics is integrated into AML workflows, compliance becomes predictive rather than reactive.

A crypto-enabled fintech must operate with audit-ready discipline at all times. This means clear governance structures, complete activity trails, thorough AML/CFT assessments, and the ability to furnish information to regulators swiftly and coherently. Audit readiness is not about expecting scrutiny; it is about being built to withstand it.

Fintechs now hold a significant part of the digital-asset adoption curve in its hands. The real differentiator will not be who integrates crypto first but who integrates it responsibly.

Platforms that invest early in compliance architecture, user protection, transparent pricing, and advanced risk intelligence will not just meet regulatory expectations. They will become the standard by which the market measures maturity.

Crypto is more than a new asset class. It is a new financial grammar. And the fintechs that learn to speak it responsibly will shape the future of the world’s digital economy.