Updated February 14, 2026

Because the financial services industry is data-centric in nature, potential use cases for AI appeared abundant upon the tech’s mainstream introduction. Many industries look toward the financial services industry for indicators and potential pitfalls of integrating AI solutions. Early learnings point to a race for data acquisition, the threat of data bias, and a missing human touch in spaces that need it.

Businesses are enthusiastic about introducing AI to their operations for improved departmental efficiency. About a third of companies (33%) expect their finance and accounting departments to start using AI in the near future.

This shouldn’t come as a huge surprise, as AI technology is an asset in two mission-critical areas: automation and data analytics.

Looking for a Artificial Intelligence agency?

Compare our list of top Artificial Intelligence companies near you

Automation with AI allows daunting processes like client communication and customer experience to be more organized and elegant, which leads to increased productivity and cost savings.

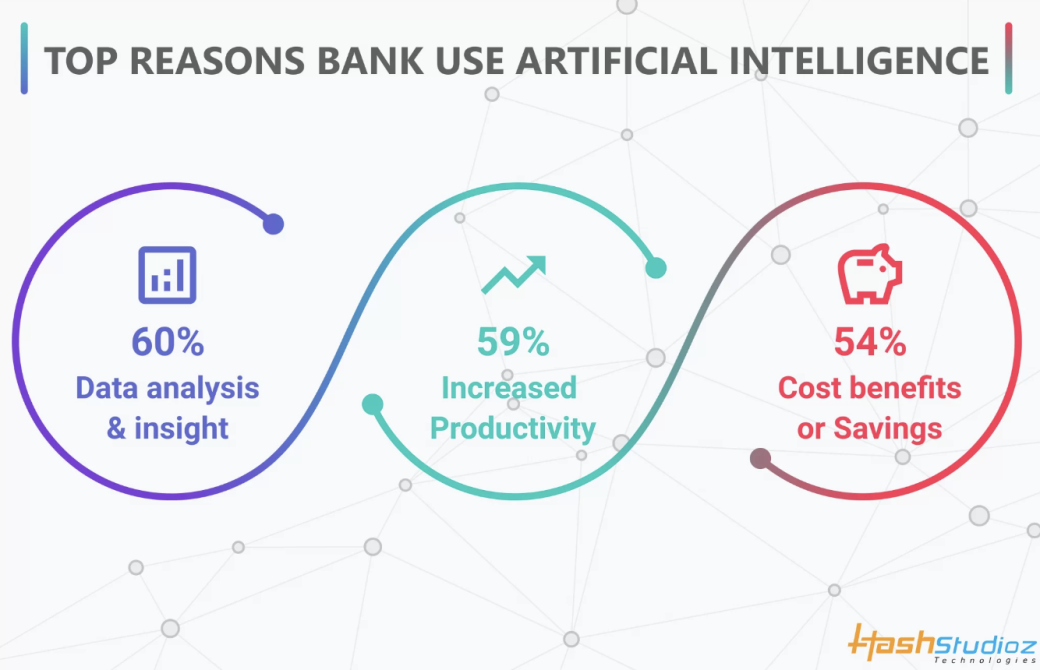

Data analytics via AI enables forecasting and predictive financial analysis, which means faster, more confident decision-making. Particularly for financial services, data analytics is an area of special interest, with 60% of banks stating it as their reason for adopting AI tools.

Source: Hash Studioz

Andrew Gosselin, CPA, strategy consultant, and senior editor of Money Inc., believes that AI serves as a “financial weatherman” for companies that need to brace themselves for challenges and change.

“Remember the financial crisis of 2008? The aftermath was a rallying cry for better risk analysis and prediction. Fast forward to today, and AI has become that silent custodian, sifting through mountains of structured and unstructured data to give early warnings of potential financial storms.” — Andrew Gosselin

In his work, Gosselin has seen AI identify a complicated case of financial fraud that would’ve gone unnoticed without it. He also notes that AI has the ability to manage trade portfolios “with a granularity that was previously unthinkable.”

AI presents a compelling argument for adoption, promising efficiency, accuracy, and cost-effectiveness. And this only scratches the surface of what financial services professionals can do with AI tools.

However, especially in this industry, any drawbacks of AI should be taken seriously. Before adopting AI for financial purposes, it’s necessary to consider the implications of big data, bias, and the importance of the human touch in certain services.

AI has the power to disrupt industry dynamics rapidly in finance. Finance is an incredibly data-driven industry, which leaves the door open for AI technology that can outperform traditional solutions.

Let’s take trading, for example. As shown in the growing popularity of passive fund managers over active fund managers, big data is already a preference and expectation in the asset management space. Data has democratized investing in that it offers a cheaper, more accessible avenue for asset management than active managers offer.

Mihir A. Desai, Professor of Finance at Harvard Business School, notes this trend and the potential for mass consolidation in data-reliant spaces in an AI world. AI brings the element of speed to otherwise slow analysis projects requiring daunting information gathering.

Fast data processing is becoming favored in the industry where it’s available, but the problem is that the volume of data and resources it requires isn’t attainable for everyone. Large-scale funds may have the resources to invest in scaling up on data, but smaller companies will likely be pushed out of the market for their lack of ability to compete on this front. Thus creating higher entry barriers for new players and consolidation within the existing industry.

However, while requiring comprehensive data sets favors big companies, it’s not set in stone that AI will be the answer to everything in this field. At this point, experts are still split on whether fast data processing via AI accurately accounts for performance indicators that can’t be quantified with hard data. Sectors like finance, with a lot of real-time data, will save time using AI to process information, but this may be a luxury to do at scale for some.

As touched on above, AI is only as powerful as the data behind it. Even as more and more data becomes accessible to big and small players in the financial services field, it’s difficult to establish certainty regarding the accuracy and equity of AI-generated recommendations.

Bias is a major consideration in every industry, but it has serious legal consequences in finance. For instance, in services like mortgage origination and underwriting, the Federal Reserve Board is concerned about AI perpetuating biases and violating fair lending legislation. Flawed data sets could cause AI to come to incorrect and discriminatory conclusions about potential borrowers, restricting credit opportunities to communities that need them.

Especially from a regulatory perspective, careful oversight and transparency will be essential in maintaining an ethical handling of emerging technologies in finance. However, this demand for complete and accurate data should be extended to all areas of the sector.

These regulatory concerns reflect international collaboration efforts to address consumer protection risks arising from using AI in financial services. As regulators focus on legal and compliance issues, financial companies utilizing AI must also consider potential biases and fair lending risks within their models.

The call for transparency around AI models and the incorporation of technological advancements into oversight responsibilities further highlight the need to balance innovation with ethical considerations in the financial sector.

The level of mainstream enthusiasm for AI shouldn’t be overlooked. Companies in finance and many other spaces are all looking for opportunities to streamline their businesses, but at this point, much AI activity is experimentation. What’s looked at as a quick fix may lead to major ethical issues down the line.

Any biases that exist within the data AI models are trained on will exist in AI-based interactions. This is one of many reasons the value of human reasoning will remain at the core of strong business decisions.

Gosselin believes the future of AI in finance will be focused on how AI and human reasoning can work together to achieve the best possible outcomes.

“It's poised to be an era of collaboration, where AI complements human judgment rather than replacing it. We're looking at a future where your financial advisor might be a blend of human expertise and AI precision.” — Andrew Gosselin

One cannot rely on AI alone. Rather, AI should serve as a tool to support human thinking, evaluation, and creativity.

When talking about AI in finance, much time is spent discussing data processing for decision-making rather than areas such as client support and services.

There’s plenty one can do with AI in customer service that consumers are already familiar, such as facial recognition, chatbots, and automated self-service options. There are also AI forecasting and predictive lead segmentation solutions on the provider side.

While all of these things are essential in facilitating customer support at scale, some areas within financial services thrive because of the human touch they offer. Consumers are more confident working with a human when making significant investments. Seventy percent of consumers prefer human representatives to chatbots and CX tech, mostly because they don’t trust technology to get their requests and goals right.

This trend extends into finance in high-value spaces where faster isn’t necessarily better, such as estate and wealth management. These industries have been slower to adopt fast-moving AI, quite possibly in favor of the high level of human touch involved in client interactions.

Industries like these may resist the AI revolution for longer, but don’t expect zero change. It’s important to note that the average age of wealth management clients is over sixty-four. Clients of generations that didn’t grow up with AI-adjacent tech may slow adoption for now, but younger generations more attuned to technology could very well reverse this trend in the future.

The aforementioned considerations aren’t meant to keep financial teams from adopting AI — they’re intended to emphasize the importance of a knowledgeable AI business model.

The last thing companies want to get caught in is legal or compliance issues around a new tool that was supposed to make things easier. Further, businesses don’t want to waste precious dollars on emerging technologies that don’t solve their problems or business objectives.

Therefore, companies considering bringing AI into financial services operations must discuss their plans with AI experts who understand the industry's complexities.