Updated December 16, 2024

More than half of small businesses (56%) expect the cost of compensating their employees to increase in 2021 through providing health benefits, offering PTO, expanding family leave, and listening to employee requests. Compared to the past, more small businesses are designing compensation strategies in order to keep their employees healthy, motivated, and productive.

The beginning of 2019 came with a “continued swell of employment opportunities" as job openings exceed the number of available workers. The strong job market meant that candidates were more likely to be considering multiple employment offers, and that businesses had to offer a competitive compensation package to recruit and retain talent.

Things are different in the beginning of 2021.

Looking for a Human Resources agency?

Compare our list of top Human Resources companies near you

The labor market is healing but more people are currently unemployed than at the height of the Great Depression.

Companies are less likely to leverage employee benefits to attract new workers, but still use compensation strategies to keep their workforce happy, motivated, and effective.

In fact, we found that more than half of small businesses (56%) plan for the overall cost of compensating employees to increase in 2021.

<<Helpful Resource: Estimate employee costs with the OmniCalculator, global employment platform>>

Clutch surveyed small business owners and managers in the U.S. to understand how their compensation strategy has changed from 2019 to 2021.

We found that businesses most frequently use compensation strategies such as providing health benefits, offering paid time off, and listening to employees’ requests.

Small businesses can use this report to plan for employee benefits.

Small businesses can offer employees a number of perks, and tend to place a particular emphasis on health benefits.

Currently, nearly half of small businesses (45%) offer their employees health benefits.

Other popular benefits include:

Only about 1 in 10 small businesses (11%) do not offer any employee benefits.

In 2019, small businesses were generally aware that providing basic benefits was integral to fulfilling employee expectations.

“I think it’s just standardized practice,” said Matthew Burr, founder and president of Burr Consulting, a human resources consulting firm that advises small businesses. “Vacation, PTO … all that stuff is expected in our society now. You’re not going to be able to recruit and retain people if [you don’t offer basic benefits]. It’s not going to work out in your favor.”

In 2021, experts are unsurprised that health benefits are the most common perk offered by small businesses.

Ted Liu, founder and CEO of Just SEO, a search engine optimization firm, says that there are 2 reasons why offering health benefits is a popular compensation strategy:

While health benefits are always a bedrock compensation strategy, experts say they took on special importance during the COVID-19 pandemic.

“Health benefits have never been more critical than during the midst of a pandemic,” said Courtney Quigley, a business reputation consultant for Rize Reviews, an online reputation management company. “This pandemic brought fears and anxiety that changed the way people work, eat, buy, and live.”

Quigley says that health benefits help make employees feel secure financially and personally, and that they will remain an important employee benefit even as the business climate shifts away from the COVID-19 pandemic.

When it comes to compensation, time spent off the clock is as valuable as time spent on it. Businesses grant employees paid time off (PTO) in order to recruit and retain talent and avoid worker burnout.

More than 4 in 10 small businesses (41%) offer PTO in 2021.

In 2019, HR experts said PTO is an effective compensation strategy because it is inexpensive, simple to implement, and practiced by many other businesses.

“That’s a commonsense perk to me,” Burr said. “PTO doesn’t really cost the company anything because eventually, you’re going to come back and make up the work anyway. It’s standard and should be offered to everybody.”

In 2021, Burr says that PTO has taken on added importance as businesses try to maintain a work-life balance for employees during the COVID-19 pandemic.

“[Companies] need to ensure that people are disconnecting from technology and not burning out by working 24 hours a day,” Burr said.

Remote work has blurred the line between work and home for some employees, and offering PTO is a strategy some small businesses use to keep their workforce fresh and productive.

In 2019, small businesses were more likely to offer PTO for the first time than any other benefit.

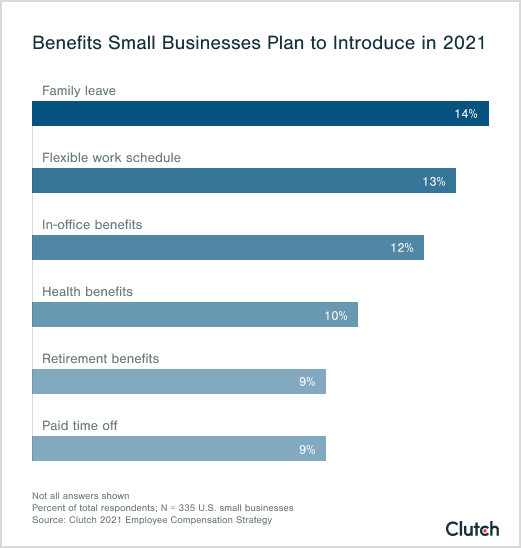

Since then, companies have had time to reflect and adjust to the challenges of the COVID-19 pandemic. Now, the two benefits that companies are most likely to offer for the first time are family leave (14%) and flexible work schedules (13%).

More than 1 in 10 small businesses (12%) are considering offering in-office benefits such as snacks, and 10% plan to introduce health benefits. Businesses are also considering first-time benefits such as retirement (9%), and paid time off (9%).

About 275,000 women left the workforce in January 2021, many of them citing the challenges of child-rearing while schools and daycares are closed. Family leave and flexible work schedules are valuable employee benefits because they can help keep high-performing teammates in their role.

“The last thing you want [employees] to do is walk out the door,” said Bethany Holliday, the director of human resources for Cornerstone Insurance Group & Employer Solutions, an employee benefits and business insurance firm in St. Louis, Mo. “It costs a whole lot less to keep people happy than it does to try and find new people.”

With family leave, a new parent knows that they can keep their job while still taking time to care for a newborn. A flexible work schedule allows an employee with childcare responsibilities to schedule their remote work around virtual school hours.

Offering family leave and flexible work schedules will likely continue to be a popular compensation strategy for small businesses in 2021.

Listen to Employee Requests About Benefits

Providing benefits doesn’t have to be a guessing game. One of the simplest and strongest compensation strategies is listening and responding to employee requests.

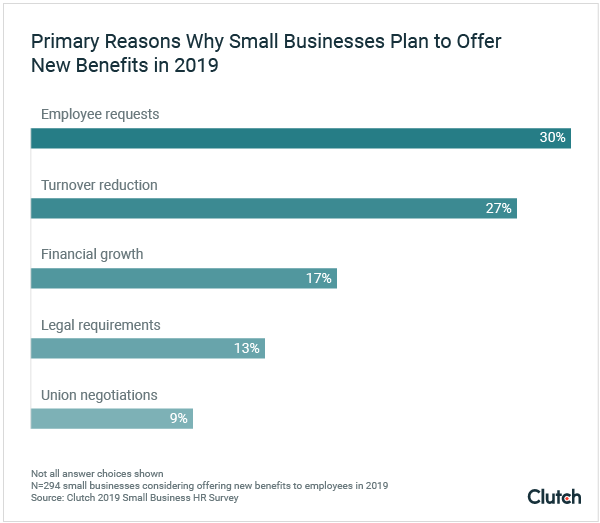

About 30% of small businesses that planned to offer new benefits in 2019 primarily did so because of employee requests, while 27% hoped to reduce employee turnover.

Meanwhile, 13% of small businesses planned to offer new benefits because of legal requirements, and only 9% as a result of union negotiations.

Showing responsiveness to employee requests regarding benefits can improve workers’ pride in their company, according to Jessica Glazer, president of MindHR, a Montreal-based staffing and benefits consulting firm.

“You don’t want to live in the cheapest house in the neighborhood,” Glazer said. “You don’t want it to be the most run down. Nobody is going to want to live there.”

Other times, companies can meet specific worker needs by listening to their requests.

For example, AlpineMaids, which offers house cleaning services, provided a fully stocked pantry for employees after many voiced that they didn’t have enough time for lunch while on the job.

“[Our employees] would come back at the end of an 8-hour day of cleaning and say, ‘Man, I didn’t have lunch. I’m really tired today,’” company founder Christopher Willatt said. “We made sure to provide that for them. We have a fridge and a pantry totally stocked all the time to make sure our guys are fed.”

Willatt listened to employees’ desire for lunch, and as a result his workers expressed gratitude.

Small businesses and HR consultants that are willing to listen to employee concerns, suggestions, and feedback when designing new fringe benefits policies have identified a valuable compensation strategy.

The business climate has changed significantly in the past 2 years.

In 2019, companies were likely to design a compensation strategy to recruit and retain talent during a hot labor market.

In 2021, small businesses are more likely to use benefits to keep their workforce healthy and productive. Companies will offer a range of benefits, including:

Some small businesses also take the approach of responding to employee requests regarding benefits.

Overall, small businesses deploy compensation strategies that fit their specific company needs and the wishes of their employees.

In 2019, Clutch surveyed 529 U.S. small business owners and managers. We defined small businesses as having limited revenue and between 1 and 500 employees, which corresponds to the Small Business Administration’s definition of small business.

Fourteen percent of respondents (14%) had 1 employee; 40% had 2 to 10 employees; 24% had 11 to 50 employees; 15% had 51 to 250 employees, and 7% had 251 to 500 employees.

More than half of survey respondents (52%) were male, and 48% were female.

Twenty-nine percent (29%) of respondents were between 18 and 34 years old; 45% were between 35 and 54, and 27% were 55 and older.

Respondents were from the South (44%), Northeast (20%), Midwest (18%), and West (18%).

In 2021, Clutch surveyed 335 owners and managers of small businesses with 500 employees or fewer.

Forty-five percent of respondents’ businesses (45%) had between 1 and 10 employees; 34% had 11 to 50 employees; 17% had 51 to 250 employees; 4% had 251 to 500 employees.

More than half (52%) of survey respondents were male, and 48% were female.

Fifty-six percent (56%) of respondents were between 18 and 34 years old; 35% were between 35 and 54, and 9% were 55 and older.

Respondents were from the South (38%), Midwest (24%), Northeast (21%), and West (17%).