Updated December 20, 2024

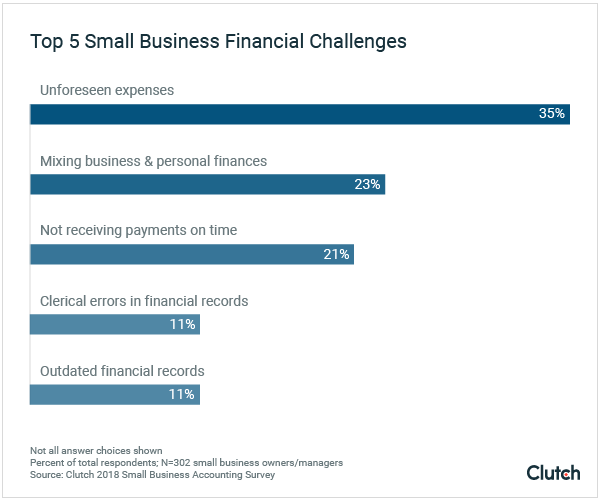

Small businesses should have an accounting strategy that helps them maximize their refund during tax season. Clutch surveyed small business owners and managers and found that small businesses should place special consideration in selecting the right accounting software and weighing the benefits of in-house and outsourced accounting teams.

It’s tax season, and successful small businesses must work to receive as favorable a refund as possible. Using outdated or improper accounting processes, however, may cause small businesses to pay more than necessary to the IRS.

A small business should keep in mind a number of tips when designing an accounting strategy. These tips include:

Looking for a Accounting agency?

Compare our list of top Accounting companies near you

Clutch surveyed over 302 small business owners or managers in 2018 and 335 small business owners or managers in 2021. We sought to learn how small businesses manage their accounting strategy and what benefits they draw from their decisions.

Small businesses can use this report to create a strong and effective accounting strategy.

Running a small business is hard enough without the stress of confusing business and personal transactions.

Yet, over one-quarter of small businesses say they do not have a separate bank account for their business.

Established businesses are more likely to have separate bank accounts. Nearly 80% of small business owners of 5 years or more say they have separate bank accounts, compared to 68% of small business owners of 1-2 years or less.

Some small business owners find ways to keep finances separate, despite keeping only one bank account.

“My business and personal bank account are the same,” said Stacy Caprio, founder of Accelerated Growth Marketing, a website investing company. “I pay my bills using a separate personal and business credit card, so I don't run into any issues.”

Caprio hasn’t felt a need to keep separate bank accounts: “I don't feel the need to separate them since I spend and keep track of spend using credit cards. It's nice to have the bank account cash all in one place because it's what I use to pay all my bills at the end of each month. I like knowing how much is in it overall.”

Yet, this strategy doesn’t work for every small business. In fact, nearly one-quarter of small businesses say they’ve encountered challenges with mixing business and personal finances in the past year.

Having separate bank accounts from the start can protect your small business from future challenges.

"Comingling of funds can make it virtually impossible to separate business transactions from your personal life," said Rhett Molitor, co-founder of Basis 365 Accounting, a cloud-based accounting service. "That will raise red flags for anyone relying on your financials (e.g. IRS, bringing in a business partner, trying to sell the business)."

Separating personal and business bank accounts prevents future confusion, especially as your business grows.

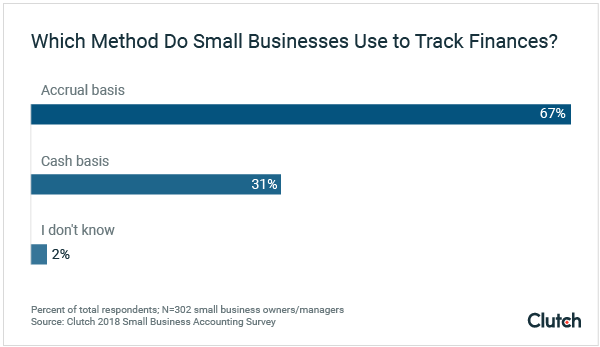

Small businesses have two different options for tracking their finances: the accrual basis method and the cash basis method. While some experts consider the accrual basis a better method, it’s important for small businesses to keep an eye on both.

The majority of small businesses (67%) use the accrual basis method.

What is the difference between the accrual basis and cash basis methods of small business accounting?

Danielle Klassen, public relations manager at Bench Accounting, an online bookkeeping service, explains the difference between the two:

For example, under the accrual basis, if you receive a bill on July 31, but don’t pay it until August 1, the bill would be recorded in your July expenses since that’s when it was received.

Oppositely, under the cash basis, you would record the bill in your August expenses because that’s when the money actually left your bank account.

Either method can work for your business based on your specific financial needs.

“The cash method is best if you have a lot of transactions and deal directly with customers. Meanwhile, the accrual method is best if you deal with large businesses and don't get paid quickly.” Klassen said.

While the accrual basis can work well for large businesses, it does have cons, such as limiting business owners’ understanding of cash flow.

“The downside is that accrual accounting doesn’t provide any awareness of cash flow; a business can appear to be very profitable, while in reality, it has empty bank accounts,” Klassen said. “Accrual basis accounting without careful monitoring of cash flow can have potentially devastating consequences.”

“Accrual basis accounting without careful monitoring of cash flow can have potentially devastating consequences.”

Smart small businesses keep track of both their earnings and cash flow.

“They need to look at an accrual basis to learn margins, see how their finances look, and be able to plan forward,” said Wanda Medina, managing partner at Maventri, a full-service digital firm providing accounting, marketing, and administrative support services. “The cash flow projections are extremely important to figure out when they’re going to need cash.”

Stay on top of your small business’s finances by using both the accrual basis and cash basis method – and ensure you get a complete picture of your money.

Selecting an accounting software isn’t that different from choosing a plumber, real estate agent, or lawyer: The right decision reaps benefits; the wrong one may leave you with a service provider that is useless and costly.

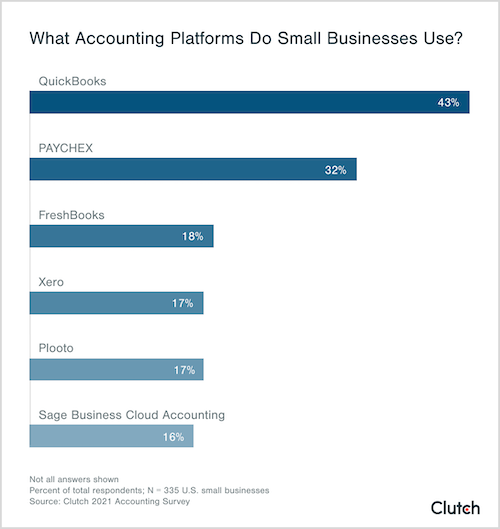

Currently, businesses use a range of accounting software.

Small businesses are most likely to use QuickBooks (43%).

Other popular accounting software includes PAYCHEX (32%), FreshBooks (18%), Xero (17%), Plooto (17%), and Sage Business Cloud Accounting (16%).

Experts say that small businesses consider user-friendliness and integration when deciding what accounting software to use.

Travis Blanchard, the founder of Splash Bytes, a website dedicated to fishing and boating, uses Zoho Books for his company’s accounting needs.

Blanchard said that Zoho is user-friendly because it is designed for users without substantial accounting experience. Zoho also offers integration with more than 40 apps, so Blanchard did not have to alter his company’s workflow.

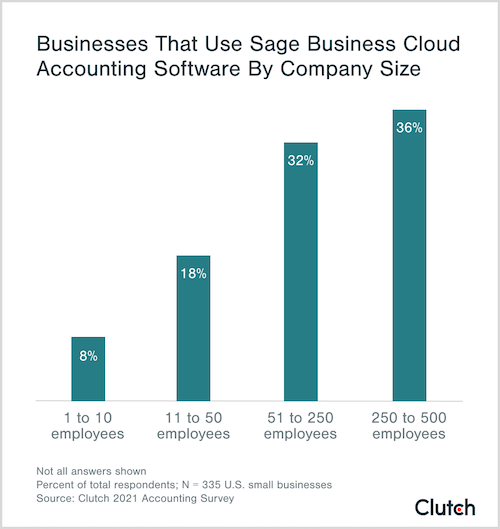

As businesses add employees, they are more likely to use Sage Business Cloud Accounting.

Only 7% of small businesses with 1 to 10 employees use Sage Business Cloud Accounting.

In comparison, more than one-third of businesses (36%) with more than 250 employees use Sage Business Cloud Accounting.

Neal Taparia, co-founder of Solitaired, an online solitaire website, decided to switch from QuickBooks to Sage Business Cloud Accounting after receiving recommendations from other entrepreneurs.

“The fact that Sage was directed towards small and medium-sized businesses made me curious about its benefits,” Taparia said. “Sage has been incredibly stable, and there are no issues with file sizes or limitations as to the number of users.”

In comparison to QuickBooks, Taparia found Sage better able to handle the demands of a growing business.

Small businesses must consider factors such as company size as they choose accounting software.

Business processes can be done in-house or outsourced. Before contracting a service provider to handle accounting, small businesses should consider the benefits in-house accountants provide.

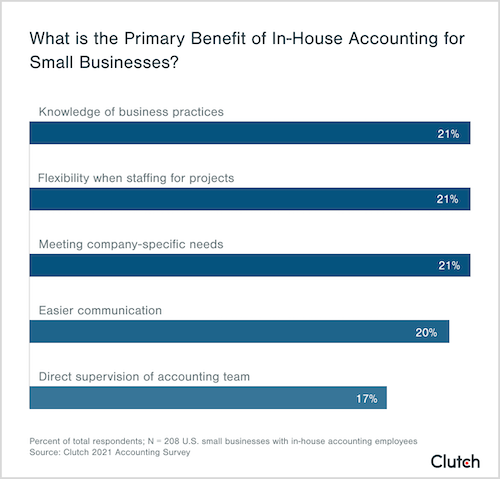

Small businesses say there are a variety of benefits of having in-house accounting services.

Nearly one-quarter of small businesses that practice in-house accounting say the biggest benefit is knowledge of business practices (21%).

Small businesses also mention flexibility when staffing (21%), meeting company-specific needs (21%), easier communication (20%), and the ability to directly supervise the accounting team (17%) as a primary benefit of in-house accounting.

Arbab Muneeb, outreach consultant at Physicians Thrive, a financial and retirement planning service for doctors, says there are 3 notable benefits in-house accountants provide small businesses:

These three benefits are on business’s minds when they choose to keep accounting in-house.

“With our own accountant, we are able to be very specific about the tasks that need to be done and the process we prefer,” said Arthur Linuma, president of ISBX, a web and mobile application development company. “We handle lots of sensitive information, so we’d rather rely on an accountant within our organization.”

"We handle lots of sensitive information, so we’d rather rely on an accountant within our organization."

Linuma believes that his in-house accounting team provides his business personalized services and confidentiality.

Overall, small businesses should bear in mind the benefits in-house accounting provides.

As companies grow, needs change.

Small businesses should consider outsourcing their accounting services.

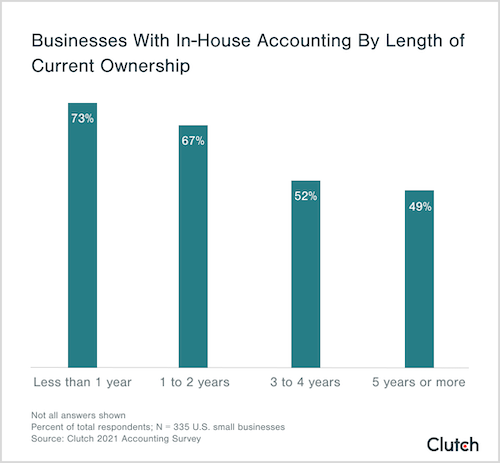

Nearly three-quarters of small businesses (73%) that have had the same owner or manager for less than one year have in-house accountants.

In comparison, two-thirds of small businesses (67%) that have had the same management for 1 to 2 years have in-house accountants. Only about half of small businesses (52%) with the same management for 3 to 4 years have in-house accountants, and 49% of small businesses under the same management for 5 years or more have in-house accountants.

Why are small business owners and managers more likely to outsource accounting as their business matures?

Yvonne Chavez, founder and chief executive of Painting Kits, a online painting materials service, says small businesses that outsource accounting are likely motivated by 3 factors:

“Outsourcing offers a unique opportunity to obtain accounting assistance from skilled professionals without incurring the additional costs of hiring in-house personnel,” Chavez said.

"Outsourcing offers a unique opportunity to obtain accounting assistance from skilled professionals without incurring the additional costs of hiring in-house personnel."

Overall, small businesses should consider the expertise and cost savings that outsourcing can provide.

Properly managing money is central to the success of a small business.

Although you may be confident in your small business’s accounting capabilities, it is important to consistently reevaluate your company’s needs.

The 5 accounting tips every small business should remember are:

Typically, small businesses that follow these accounting tips are well-positioned to claim significant tax refunds and benefits.

Clutch surveyed 302 small business owners or managers who are involved or very involved in their business’s financial decisions.

Fifty-eight percent (58%) are female and 42% are male.

Sixty percent (60%) of respondents have owned or managed a small business for 5 years or more; 17% for 3-4 years; 13% for 1-2 years; 10% for less than 1 year.

In 2021, Clutch surveyed 335 owners and managers of small businesses with 500 employees or fewer.

Forty-five percent of respondents’ businesses (45%) had between 1 and 10 employees; 34% had 11 to 50 employees; 17% had 51 to 250 employees; 4% had 251 to 500 employees.

More than half (52%) of survey respondents were male, and 48% were female.

Fifty-six percent (56%) of respondents were between 18 and 34 years old; 35% were between 35 and 54, and 9% were 55 and older.

Respondents were from the South (38%), Midwest (24%), Northeast (21%), and West (17%).

![How to Create a Budget for Accounting Services [With Template]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/7dce8a5e1339227e397cf68f6f555f92.png)