Updated July 22, 2025

Finding the right balance between the wholesale and DTC approach can be tricky; however, real-world experience shows that EDI and other integrations matter a lot but can be compensated with a proper selection of 3PL providers. It also pays off to start with inventory management and have it endorsed by tech, so that the channels on both B2B and DTC side can reinforce each other, e.g. during peak seasons, as well as with additional data they provide. This article discusses how balancing DTC and wholesale can level up your operations.

For many e-commerce brands, choosing between direct-to-consumer (DTC) and wholesale is no longer a simple decision.

Since the digital nomads and the digital natives came of age, this (initially, at least) spelled good news for everyone since it felt like you could simply market your products independently, with full control over everything, and sell them via e-commerce piece by piece. DTC companies continue to grow, reaching around $44.7 billion in the U.S. But by 2023, many businesses now have to opt for a hybrid approach.

Looking for a Logistics & Supply Chain Consulting agency?

Compare our list of top Logistics & Supply Chain Consulting companies near you

However, over time, with the proliferation of e-commerce, the space became cluttered, causing the need to balance between DTC and wholesale approaches.

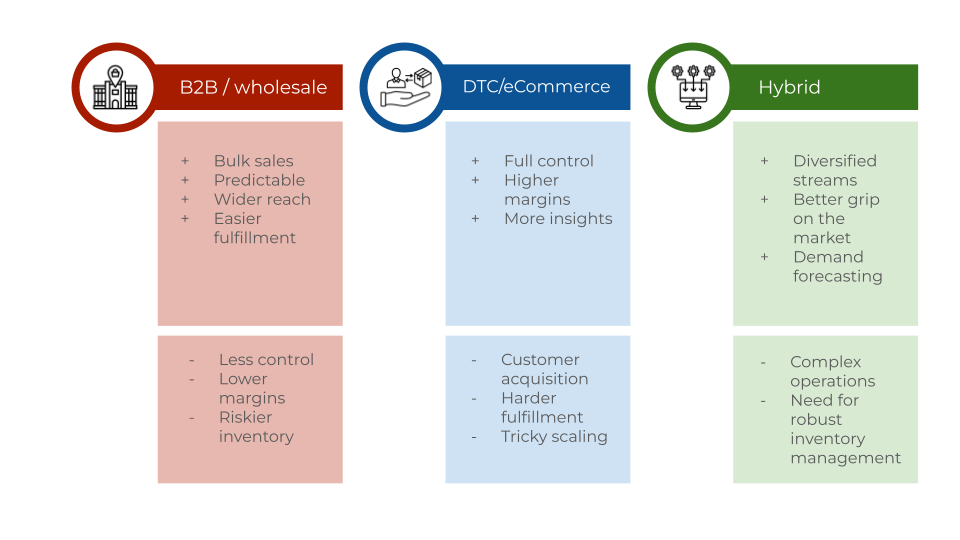

DTC offers better margins and direct customer relationships, but rising customer acquisition costs, complex logistics, and inventory challenges make it increasingly difficult to scale profitably.

Meanwhile, wholesale provides stability, volume, and broader market reach but often limits control over branding, pricing, and the overall customer experience. As a result, many businesses are adopting a hybrid model—blending the strengths of both approaches

Even so, balancing DTC and B2B requires strategic inventory management, fulfillment optimization, and seamless data integration. In this article, we explore how brands successfully navigate this shift and the key strategies driving their success.

It’s not just out of dire straits—a major driver is scalability. As awesome as DTC sounds to a marketer, the brand manager will typically gasp at the costs of customer acquisition, especially fulfillment. However, going fully wholesale is like sacrificing some of your freedom as a brand for the sake of predictability.

Today’s landscape brands that try to balance the two approaches formulate their own hybrid model. There are pioneers like Levi Strauss, who’ve seen a 6.7% increase in wholesale revenue and a 19% rise in DTC sales, largely thanks to a balanced approach between the two.

With all the benefits of DTC or B2B taken separately, in terms of business value, the safest bet is to go with a hybrid model. The reason is that its inherent risks are really just challenges that can be solved through technology, like finding a way to connect B2B platforms and inventory management systems.

One of the common grievances about the traditional wholesale approach was the lack of data. The very same digital revolution that spawned DTC e-commerce, though, has birthed B2B digital tools that allow brands to scale and retain the benefits of DTC.

Shopify is probably the best example with their B2B platform allowing a unified storefront for wholesale and DTC. This move alone actually eliminates many of the anxieties.

Now, the “unified storefront” essentially means both DTC customers and wholesale buyers are served from a single website. This reduces operational complexity simply because you don’t need to maintain two platforms and think of how to transfer data between them. Plus, there are features like customer-specific catalogs and pricing models, which means the brand is now given the possibility to operate where it could not efficiently do so before.

As of now, Shopify is truly a big deal, with 700 million customers, and over 2 million merchants. 117 out of North America’s top 2,000 online retailers rely on Shopify – simply because they manage to unite DTC-style flexibility with wholesale efficiency.

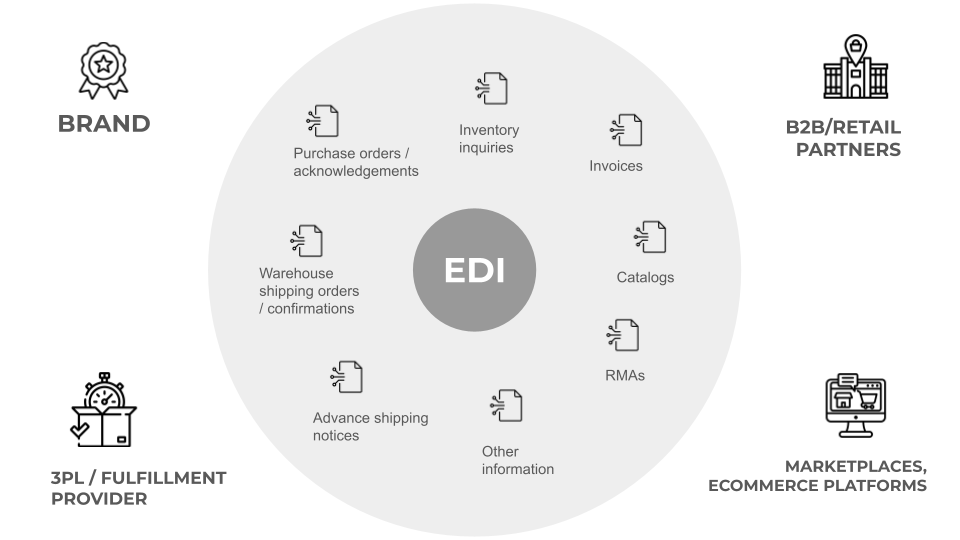

The software developer community, even though their own marketers promote the idea that application programming interfaces (API) are better than electronic data interchange (EDI), still recognizes the benefits of the latter. It’s true for B2B transactions when it comes to exchanging documents like purchase orders, invoices, and shipping notices.

EDI-powered sales are here to stay, even as they are past the hectic rise stage: yes, they rose only 8.3% YoY in 2021, which is dwarfed by e-commerce platforms, but that’s just an indicator that the technology has matured and is safely beyond the potential bubble stage. We still see EDI accounting for $8.38 trillion in electronic sales.

That is due to several factors, the prominent one being SPS Commerce, which helps suppliers, distributors, and retailers automate transactions. The main takeaway is, of course, automated order processing, which translates into faster fulfillment.

Plus, there’s the immense inertia from the large retail chains (think Walmart, Tesco, Costco, and the likes) – the likes of these are likely to require EDI use, and that’s where SPS Commerce (plus equivalents) helps businesses meet the requirements.

Some other possibilities include the ability to update inventory, but in practice, this requires know-how that will more or less equate to the effort of building another system. In our experience as a fulfillment partner, we’ve had to establish a more idiosyncratic approach to helping clients manage inventory.

Inventory management is one of the main and most obvious challenges to a hybrid approach. By nature, DTC orders are smaller but happen more frequently, while B2B transactions have longer lead times but ensure bulk purchasing all at once. Managing both is crucial to keep up with the hybrid method.

What matters here is to keep inventory tracking as close to the real-time variant as possible (and making it 100% real-time is also possible). The key is centralization, with the additional need to integrate whatever system is in charge with e-commerce platforms, warehousing systems, and retail partner networks.

Another solution would be to build that system as a connecting link between them all – either variant would allow not just the monitoring of stock levels but also implementation of demand forecasting tools on top of the aggregated data.

Several strategies such as the following help the process:

This is, of course, by no means an exhaustive list, and a lot of companies have their own inventory management know-hows.

The real question is how to keep the best practices in touch with the current reality of the business model – which can change more rapidly than the business can react. So being aware of the possible shifts is already an asset in itself, and one that can be readily furnished by the more versatile types of 3PLs who deal with diverse businesses routinely.

Of course, inventory management is just one piece of the puzzle; we’ve seen companies with optimal logistics networks but struggled with marketing and pricing strategies and companies that only needed automation to make things work.

There is no universal way to do things that would be perfect for everyone, but there are a number of success cases we think are indicative of the right direction.

For example, there’s StitchFix, which started as a DTC subscription model. As its popularity grew, it found its way into wholesale.

Logistically, that translated into using regional warehouses, allocating inventory (aka “splitting the waters”), and finally implementing flexible warehousing contracts to provide a buffer for peak seasons. That ultimately worked.

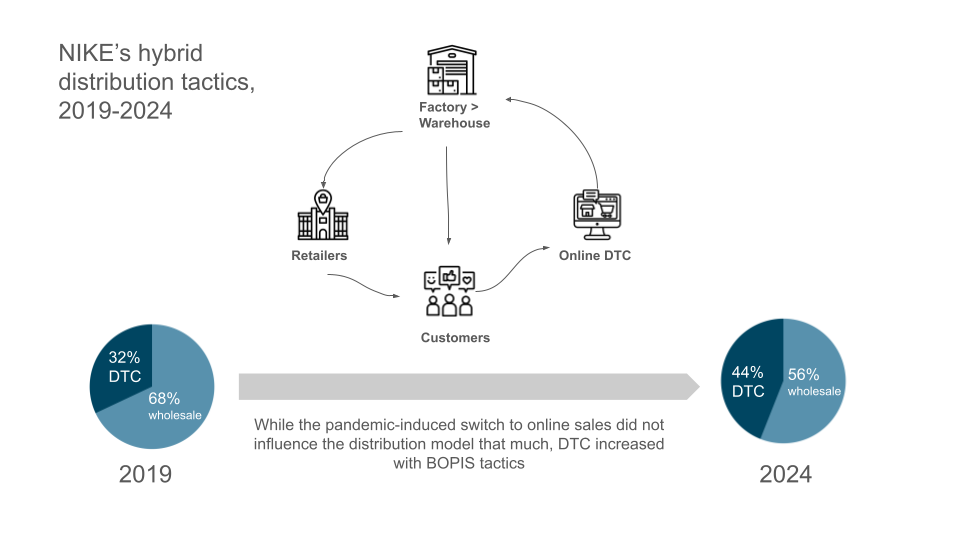

Nike is also an epitome of the hybrid approach, but in a different way — it has a global network of warehouses and distribution centers. Their expansive network functions as fulfillment hubs for online orders, enabling the Buy Online, Pick Up In-Store (BOPIS) model, which is essentially the crossing between DTC and wholesale in terms of inventory management.

There’s also the Glossier case, which started as a DTC-only beauty brand but then drove into wholesale territory on Sephora’s back.

What they did seems to be outsourcing bulk fulfillment to 3PL vendors while also separating the inventory pools for retailers vs. individual online clients. This, in turn, gives them enough real-time data on sales to pull off demand predictions.

After all, any successful strategy that combines B2B and DTC will ultimately rest on the B2B methods since the e-commerce levers are always somewhat in the lead, and wholesale management needs to keep up.

The key words here are integrating, automating, and finally getting hold of your data.

Overall, the union of B2B and DTC methods is already happening, and we can predict it will be complete around 2027 when the corresponding software types will become available to every business.

Currently, the soundest strategy is to rely on 3PLs most frequently for tech enablement, and generally, 3PLs are the most receptive stakeholders when it comes to the digitalization of logistics.

The future role of fulfillment providers in this marriage between B2B and DTC remains to be seen, but as of now, it boils down to the simple principle of either developing the tech in-house or using some from third-party providers and taking on the task of integrating it all for a truly unified ecosystem that can then be built upon.

![How to Build a Contract Manufacturing Budget [With Template]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/999da9705b21428571a626d80e3b0a70.jpg)