Updated February 27, 2026

Finding the right payroll service for your business is a crucial decision that can impact your company's efficiency, compliance, and overall success.

Payroll service providers offer payroll management solutions and services to businesses.

As a business owner or HR professional, the process of selecting a payroll service provider can be daunting. The right partner can streamline your payroll processes, ensure compliance, and free up valuable time for strategic initiatives.

From understanding your specific business needs to evaluating key features and conducting thorough assessments, this guide is your go-to resource for making an informed decision that aligns with your organization's goals.

Browse Related Services

What is Payroll?

Payroll: Payroll services streamline the process of paying employees, calculating taxes, and managing compliance with labor regulations. Typically, payroll services include features such as automated payroll processing, tax calculations, direct deposit facilitation, wage garnishments, benefits administration, and compliance management.

Payroll services involve tracking hours worked, calculating total wage earnings, withholding deductions, and filing payroll taxes.

Each employee at a different level will receive a different amount of compensation. Payroll can also differ from one pay period to the next because of sick leave, overtime, and other variables. Payroll systems will distribute payments to employees via direct deposit or by paper paycheck.

There are four main types of payroll processing methods: weekly, bi-weekly, semi-monthly, and monthly.

Companies must record the amount the government must pay for health benefits, retirement plans, unemployment taxes, and other areas.

Payroll is typically managed by a company's financial department or even by the owner if it is a small business. Companies are increasingly outsourcing payments.

Companies outsource their payroll solutions to save time, mitigate potential mistakes, improve security measures, be more compliant with tax regulations, and more.

Payroll firms perform a variety of tasks that benefit employees.

Some of the tasks of payroll companies include:

- Collecting employee data

- Calculate compensation

- Tax management services

- Generate reports

- Prepare payroll

Payroll service providers also provide a range of services that go beyond basic payroll processing like tax filing, human resources support, benefits administration, and integration with accounting functions.

These tasks collectively contribute to the efficient management of payroll processes and help ensure that employees receive accurate and timely compensation while meeting legal and regulatory obligations.

Finding a full-service payroll service provider in your region can make communication easier and ensure that your provider is well-versed in your local regulations.

Payroll Services by Country

Payroll Services by City

5 Benefits of Payroll Services

Managing a workforce is challenging. When your company hires a payroll provider, you can be certain that your employees will be paid on payday in a timely, secure manner.

The benefits of outsourcing payroll services are numerous and can significantly impact a business's operations. Here are some key advantages:

- Saves time. Outsourcing payroll saves your business time by delegating complex and time-consuming payroll tasks to experts, freeing up resources to focus on core business activities.

- Minimizes errors. Professional payroll service providers can minimize payroll errors, ensuring accuracy and compliance with tax regulations, which can be crucial for avoiding costly penalties.

- Improves security. Outsourcing payroll can enhance the security of sensitive payroll data, as reputable service providers invest in robust data security measures to protect confidential information.

- Provides real-time reporting. A payroll management system can deliver real-time analytics on payroll data, which can be valuable for various internal departments. Real-time reporting can help businesses make data-driven decisions about their companies and find areas for improvement.

- Increases employee satisfaction. Payroll processing can be a time-consuming task for employees. Outsourcing this service reduces the burden on HR staff, leading to increased job satisfaction and employee retention while ensuring on-time payments and offering self-service options.

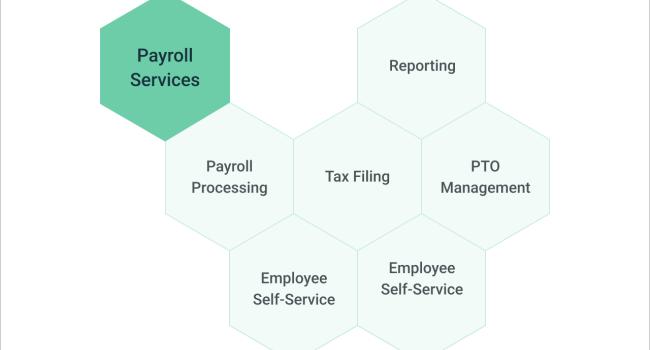

What Services Do Payroll Companies Provide?

Payroll companies provide a range of services to simplify and manage payroll processes for businesses. Here are some of the most common services that a payroll processing company will offer, the tasks involved, and the goals of each.

- Payroll Processing

- Tax Filing

- Reporting

- PTO Management

- Employee Self-Service

- Compliance Expertise

Payroll Processing

The main service a payroll company supplies is just that – payroll processing. These companies manage the entire payroll process, including calculating wages, salaries, deductions, and taxes, and ensuring timely employee payment by working with direct deposit services or other flexible payment options.

Payroll processing companies account for wage rates, shift changes, overtime, holidays, Social Security, and benefit deductions, making it easier for your internal team.

Businesses can ensure smooth and compliant payroll processing by partnering with a payroll company while optimizing operational efficiency and employee satisfaction.

Tax Filing

Some payroll companies help file taxes, handle payroll tax calculations, and make payments to ensure compliance with local, state, and federal tax regulations.

By partnering with a payroll company for tax filing, businesses can ensure accuracy, compliance, and efficiency in managing their tax responsibilities, ultimately allowing them to focus on their core business activities and strategic growth.

Reporting

Payroll providers can manage all reporting aspects in the realm of payroll - wages paid, taxes withheld, hours worked, etc. These companies can generate detailed payroll reports and analytics to help businesses track labor costs, make informed decisions, and maintain accurate financial records.

Another aspect of reporting is new hire reporting. The government asks that every company report new hires; a payroll company can do it on your behalf.

Partnering with a payroll company on reporting and analytics can harness the power of data to make informed decisions, drive operational efficiency, and ensure compliance with regulatory requirements, ultimately contributing to the overall financial health and strategic success of their clients.

PTO Management

Many payroll companies manage paid time off by tracking how many sick hours or vacation days for employees. Some of the payroll solutions out there even manage the approval process for these time-off requests.

Businesses can streamline administrative processes, ensure compliance, and promote a positive work environment using their payroll company to manage their PTO.

Employee Self-Service Support

Payroll companies can provide online platforms for employees to access pay stubs, tax forms, and manage their personal information. These companies will help employees access the platform or help with any troubleshooting.

Their specialists can answer any questions regarding these payroll systems or HR tools.

By collaborating with a payroll company for employee self-service support, businesses can enhance operational efficiency, improve the employee experience, and ensure accurate and compliant management of payroll and related tasks.

Compliance Expertise

All payroll providers should be updated on any changing tax laws and regulations to ensure their clients remain compliant while mitigating any risk of penalty. Their teams can provide their clients with advice and insight into these matters.

With the assistance of a payroll company, businesses can navigate the complexities of employment regulations more effectively, reduce legal exposure, and ensure accurate and law-abiding payroll operations.

How to Assess Payroll Services

When investing in payroll services, there are different types of metrics your team can track. Your business can track how your outsourcing support works, how your internal team relates to payroll runs and other performance aspects.

Depending on the services your payroll company is delivering, you can outline key performance indicators (KPIs) to help determine the success of your partnership as well as engagement with your employees.

Common KPIs for payroll services include:

- Time to Run Payroll: This metric evaluates the efficiency and timeliness of the payroll processing cycle. Small business owners can consider this in their choice to spend money on outsourcing or finding online payroll services that can be managed in-house.

- Training Costs: This metric measures the investment in employee training and development within the context of payroll expenses.

- Payment Accuracy Rate: This metric assesses the precision and accuracy of employee payroll disbursements. Businesses will have a sound peace of mind if this is handled by a trusted payroll partner.

- Revenue/Payroll Ratio: This metric helps understand the relationship between revenue generated and the expenses incurred for payroll.

- Overtime: This metric tracks the usage of overtime hours and the impact on labor costs and productivity.

What is a Payroll Services Team?

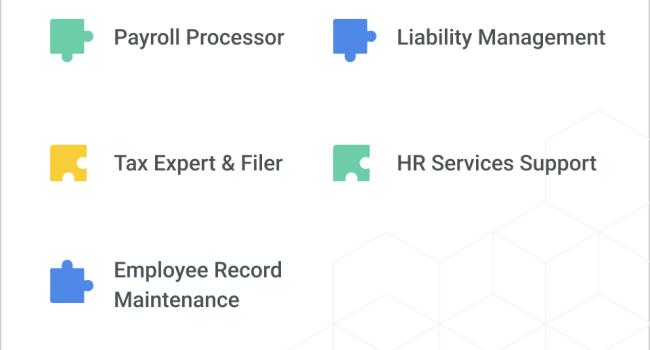

A payroll services team typically refers to a group of professionals or a dedicated department within a company that handles various aspects of payroll management. To be effective, responsibilities need to be divided up by different team members.

These are the most common roles associated with a payroll team:

Who Makes Up a Payroll Company?

- Payroll Processor: This individual is involved in all it takes to run payroll or manage payroll software. This involves accurately calculating and distributing employee payments, including wages, salaries, bonuses, and deductions.

- Tax Expert & Filer: This individual ensures all compliance with tax laws and regulations are followed. Their work also includes the timely filing of payroll taxes, bookkeeping, and other tax payment-related obligations.

- Employee Record Maintenance: This role manages and maintains employee records, including personal details, work hours, and payment history.

- Liability Management: This individual acts as the employer of record and assumes liability for certain employment-related responsibilities, especially in the case of household employees.

- HR Services Support: This role provides all-in-one human resources support, which may include benefits administration, claims management, recruiting, time tracking, and more.

What To Look For When Hiring Payroll Services

When evaluating payroll services, several factors should be considered.

Companies must ensure that a payroll service provider can accurately calculate and process payroll while following the relevant compliance. Protecting sensitive employee information and adherence to data privacy laws is also paramount for any payroll service.

Businesses should also work with flexible payroll companies. For example, some payroll companies provide employee self-service tools that enable employees to manage their own data, including pay stubs, employee benefits, and tax forms.

If you’re looking beyond payroll support in one company, finding a provider offering additional services that could benefit your internal team is important.

Along with those specifications, budget and location are also important factors that many companies consider when hiring a payroll services provider.

Criteria for Hiring a Payroll Services Company

- Expertise

- Budget

- Customer service approach

- Reputation

- Communication style

- Adaptability

- Prioritize data security

What Matters to You Most in Payroll Services?

When hiring a payroll company, there are several key factors to consider in order to make an informed decision. Most importantly, your team needs to start thinking about what matters the most when it comes to hiring a trusted payroll services provider.

At this stage, you already know your specific business needs, but it is time to narrow down how to get the best value for your money.

When interviewing potential payroll services, your business needs to assess their services, experience, and more. Questions about projects they’ve worked on, their past clients, and their ideal communication style will provide much value before onboarding begins.

Here are a few questions you should ask when interviewing payroll service providers:

10 Questions to Ask When Hiring Payroll Services

- What other financial services do you offer?

- What does your basic service model include for payroll services?

- What are typical contract lengths?

- What technologies or software do you use?

- How do you draft analytics and payroll reports?

- What is your communication approach with clients?

- What is your project management style?

- What is your workflow for dealing with multiple clients?

- Do you offer any HR solutions?

- What do you offer that the other payroll providers don’t?

After carefully vetting potential partners with the right questions, you can narrow down your top choice for payroll support. Scope out all of your objectives and team responsibilities to ensure everything is aligned before the true work begins.

Securing Your Ideal Payroll Partner

In the dynamic landscape of business operations, selecting a payroll service provider holds significant implications for an organization's efficiency, compliance, and overall success.

By leveraging the insights from this guide, your team can find the ideal payroll partner that fits all of your considerations.

Considering factors such as your specific payroll needs, the provider's range of services, pricing structure, and client support, companies can confidently navigate the process of finding the perfect payroll partner.