![How to Choose an IP Law Firm [With Checklist]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/1396ae6bad8e8579446e9c1863db83bb.png)

![How to Choose an IP Law Firm [With Checklist]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/1396ae6bad8e8579446e9c1863db83bb.png)

Updated April 10, 2025

There are various different types of business entities out there, from S-corporations and C-corporations to simpler partnerships and sole proprietorships. It's important to understand the unique aspects of each type of business entity, especially when working alone so that you know what to classify yourself as and what sorts of duties, obligations, and liabilities you may have.

Many independent entrepreneurs, freelancers, and contractors have to face one question: “What is the difference between sole proprietor vs individual?”

Many people wonder if the two terms are interchangeable, or if there are distinct legal and official differences between the two. This guide will go over all you need to know in the sole proprietor vs individual debate.

Looking for a Legal agency?

Compare our list of top Legal companies near you

A sole proprietor is an individual owner of a business. Sole proprietorships, therefore, are businesses that have one clear, distinct owner. This is in contrast to partnerships, which can have many different owners.

Sole proprietors are their own bosses, responsible for all decisions and operations of their businesses, and liable for any debts and claims against the business and the sole recipient of all revenues.

Sole proprietors don't need to register their businesses with the state. There aren't too many added complexities in handling taxes either, so setting up a sole proprietorship is considered one of the easiest ways to start a business.

Terms like "sole proprietor" and "individual entrepreneur" are often used interchangeably, and in many ways, there are many similarities between sole proprietor vs individual.

You have to be an individual to be a sole proprietor, for example.

However, even though all sole proprietors are individuals, not all individuals are sole proprietors. Why? Because not all individuals own businesses. The term "individual", from a legal perspective, simply refers to an individual person, with their own taxes, responsibilities, and liabilities.

The term can refer to people from different walks of life and in different professional situations. But the most important factor is that individuals do not always own businesses, and this is what separates them when it comes to sole proprietor vs individual.

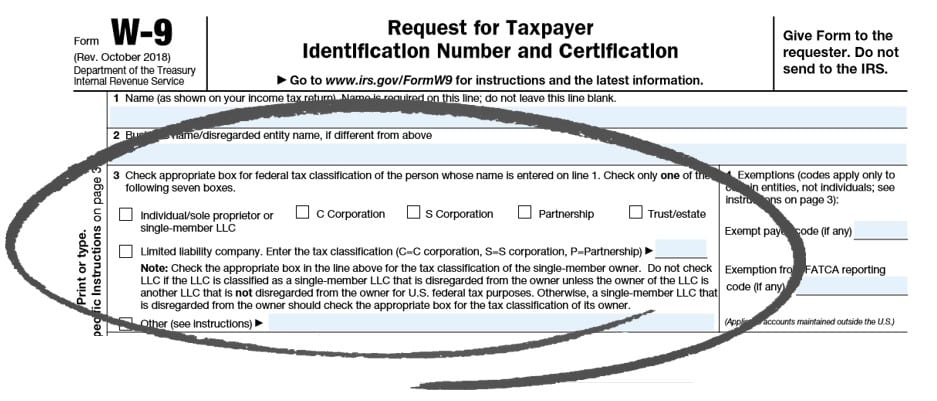

One of the significant areas in which we can differentiate between sole proprietors and individuals is how they file their taxes on a standard W-9 form.

The sole proprietor will need to enter their name on the first line, followed by the business name on Line 2. An individual, however, who isn't necessarily operating their own business, would be able to leave Line 2 blank.

Then, in Line 3, the person filling the form is asked to tick the right box corresponding to their status. Here, we can see the similarity between individuals and sole proprietors, as they have to tick the same box, labeled, "Individual/sole proprietor, or single-member LLC."

Source: W9manager

So there is a difference here between sole proprietor and individual, but it's only a subtle one.

In addition, sole proprietors are required and expected to attach a Schedule C "Profit or Loss from Business" form when filling out their taxes. In the eyes of the IRS, this is the only thing that truly distinguishes a sole proprietor from an individual.

Several vital aspects make sole proprietorship a unique form of business entity:

As we can see, there are various exciting aspects and benefits associated with a sole proprietorship. It can be a good path to follow for people who want to start their businesses and are willing to take on the responsibilities that come along with being a sole proprietor.

However, you need to prepare appropriately and assume those responsibilities to be successful and avoid any unnecessary issues.

![How to Choose an IP Law Firm [With Checklist]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/1396ae6bad8e8579446e9c1863db83bb.png)