![How to Choose an IP Law Firm [With Checklist]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/1396ae6bad8e8579446e9c1863db83bb.png)

![How to Choose an IP Law Firm [With Checklist]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/1396ae6bad8e8579446e9c1863db83bb.png)

Updated April 11, 2025

Whether you’re selling a car or buying cattle, this guide outlines everything you need to know on how to write a bill of sale.

A bill of sale is a legal document that acts as a proof of purchase or proof of payment when someone sells or trades an asset. While a simple receipt could be considered a bill of sale, it usually refers to the transaction of a very valuable asset. For example, a motor vehicle bill of sale is required in most states if someone sells their car.

A bill of sale certifies the sale by recording the transfer of ownership between a seller and the new owner and protects both parties in case a disagreement regarding the asset arises in the future.

Looking for a Legal agency?

Compare our list of top Legal companies near you

As such, it frees the seller from any liabilities while providing proof of ownership for the buyer. Buyers can then use the bill of sale to obtain a certificate of title if needed or register their purchase.

Check out top law firms in your area by filtering by location, services offered, and your budget.

For businesses, a bill of sale is helpful for tax purposes, but is absolutely necessary if you’re selling:

As a rule, companies should create a bill of sale whenever the law requires a proof of purchase. Of course, this varies from state to state, so if you’re unsure whether or not you need to create a bill of sale, you should check your local laws.

In many places, such as New York, the department of motor vehicles (DMV) requires a bill of sale and title to prove ownership of a car. However, in the state of California, the DMV only needs the bill of sale if the owner’s name isn’t included on the title.

Absolute Bill of Sale: An absolute bill of sale is when the asset is being sold as is and the seller has no responsibility once a sale is complete.

Conditional Bill of Sale: A conditional bill of sale outlines criteria that must be completed in order for the sale to be complete. For example, if the buyer borrows money from a lender to purchase the item, they will only retain the asset if they make their payments.

Quitclaim Bill of Sale: A quitclaim bill of sale is used to transfer ownership without a warranty of any kind. Like an absolute bill of sale, it proves the transaction occurred and the buyer owns the property, but the seller offers no guarantees. Usually, this is used to sell to give property to close friends and family.

Bill of Sale with Warranty: This type of bill of sale provides additional protection for the buyer

A bill of sale includes information about the item being sold as well as information about the seller and new owner.

Here are a few items that should be included in a bill of sale regardless of the type of asset that is being sold or the state in which it’s located:

Bill of Sale Checklist

Additional Resources

While anyone can write a bill of sale, and even a handwritten bill of sale is binding, it’s still a legally binding contract. Here are a few resources to help you write your bill of sale:

This template for a motor vehicle bill of sale identifies the information that must be included in a bill of sale.

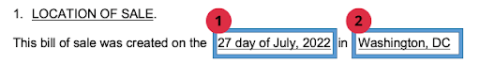

Section 1 simply provides information about when the sale occurred and where.

Key:

1. Bill of Sale Date: the date the bill of sale is signed

2. Location of Sale: the county and location where the transaction occurs.

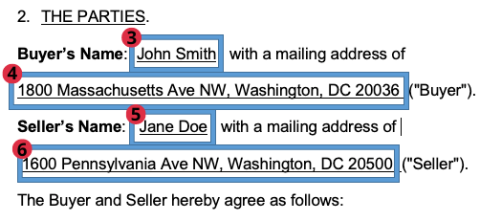

Section 2 identifies the parties involved in the transaction and provides additional information about the buyer and seller.

Key:

3. Buyer’s name: the full legal name of the person paying for the vehicle.

4. Buyer’s address: the address where the buyer lives.

5. Seller’s name: the full legal name of the owner of the vehicle.

6. Seller’s address: the address where the buyer lives.

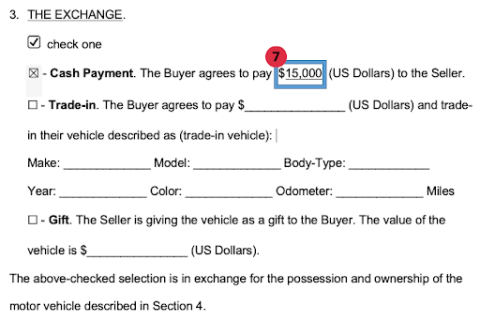

Section 3 outlines the type of transaction that is occurring. The involved parties should first identify whether it is a cash payment, trade-in vehicle, or a gift by marking the associated check box. In this example, the vehicle is being sold for a price, making it a cash transaction.

Key:

7. Cash payment: the amount exchanged for the vehicle.

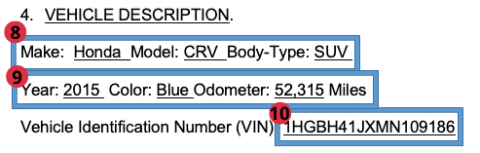

The vehicle description is necessary to identify the vehicle that is being transferred from the owner to the buyer.

Key:

8. Vehicle of Sale: Includes the make, model, and body type of the vehicle for sale.

9. Additional Vehicle Information: To provide a full description of the vehicle, include the year, color, and mileage on the car.

10. VIN: The vehicle identification number (VIN) is located in the lower driver side area of the windshield, near the door jam, or on the title of the car. This information is required by the DMV for inspections.

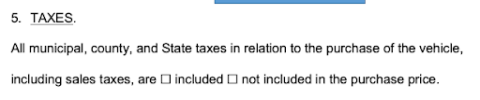

State and local taxes apply where the vehicle is sold. To make sure you’re complying with local laws, the bill of sale needs to outline whether or not the sales tax is reflected in the purchase price. When filling out this section, simply check the box that accurately reflects the purchase.

The buyer and seller conditions outline the parameters of the sale. In this transaction, the seller is offering the vehicle as-is. This section should be edited to reflect any additional conditions the parties agree upon. For example, they should edit this section if there is a warranty on the vehicle.

Both the buyer and seller need to sign and date the bill of sale to show they agree on the terms of the sale and finalize the transaction.

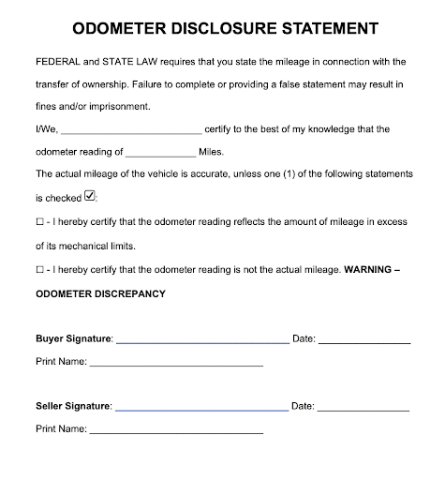

The Truth of Mileage Act (TIMA) is “a federal law that requires the seller of a vehicle to verify the mileage of the vehicle at the time of sale.”

The odometer disclosure statement includes this information. The buyer then must verify the mileage of the vehicle and sign the agreement to acknowledge the mileage.

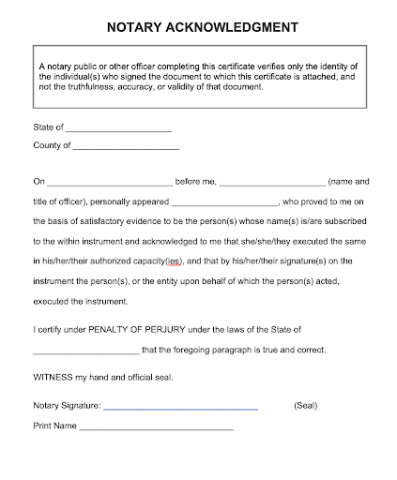

A notary is a public official that acts as a witness and prevents fraud. When dealing with a bill of sale, a notary confirms the identity of both the buyer and seller. While most states do not require that a bill of sale be notarized, a few do, including:

If you live in any of these states, you will need to find a notary to complete the bill of sale.

Find a notary near you here.

Additional resource: Download the complete bill of sale template here.

Additional Reading

![How to Choose an IP Law Firm [With Checklist]](https://img.shgstatic.com/clutch-static-prod/image/resize/715x400/s3fs-public/article/1396ae6bad8e8579446e9c1863db83bb.png)